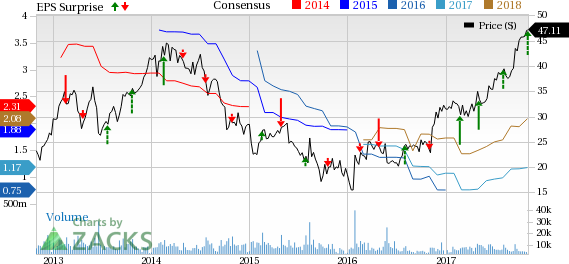

Terex Corporation’s (NYSE:TEX) third-quarter 2017 adjusted earnings surged a whopping 194% year over year to 50 cents per share. Earnings also beat the Zacks Consensus Estimate of 36 cents per share by a wide margin of 39%. All the three segments increased sales, improved operating margin and grew backlog which led to the overall improved performance in the quarter.

Including one-time items, Terex posted earnings of 63 cents per share in the quarter compared to 31 cents reported in the year-ago quarter.

Operational Update

Revenues in the quarter improved 5% year over year to $1,111 million from $1,056 million recorded in the prior-year quarter. Revenues beat the Zacks Consensus Estimate of $1,034 million.

Cost of goods sold increased 2.3% to $892 million from $873 million in the prior-year quarter. Gross profit surged 19% year over year to $219 million. Gross margin expanded 230 basis points (bps) to 19.7%.

Terex Corporation Price, Consensus and EPS Surprise

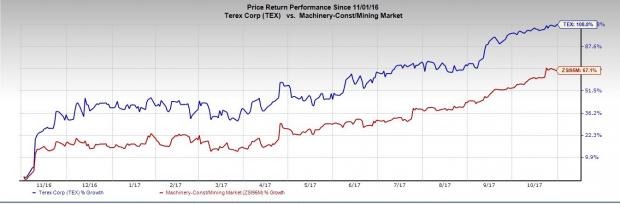

The company continues to implement its strategy to focus and simplify the company, and build capabilities in key commercial and operational areas. Its on-going efforts to expand capabilities in sales execution and account management through Commercial Excellence initiative reflects the company’s growing bookings and backlog. Consequently, Terex has, soared 108.8% in the past year, outperforming 67.1% growth recorded by the industry.

Terex currently carries a Zacks Rank #2 (Buy).

Other Stocks to Consider

Other top-ranked stocks worth considering in the same sector are Lakeland Industries, Inc. (NASDAQ:LAKE) , China National Materials Company Limited (OTC:CASDY) and Caterpillar Inc. (NYSE:CAT) . All three stocks flaunt a Zacks Rank of 1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Lakeland Industries has an expected long-term earnings growth rate of 10%.

China National Materials has an expected long-term earnings growth rate of 20%.

Caterpillar has an expected long-term earnings growth rate of 9.5%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Terex Corporation (TEX): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Lakeland Industries, Inc. (LAKE): Free Stock Analysis Report

China National Materials Group Corp. (CASDY): Free Stock Analysis Report

Original post