Much like stock markets around the world, the U.S. dollar continued to climb yesterday, further to a vote of confidence in the U.S. economy from several members of the Federal Reserve and the encouraging tone struck by President Trump. The absence of details regarding tax cuts and bank deregulation in the new president’s speech Tuesday night failed to dampen markets’ spirits. The Dow Jones Industrial Average gained more than 300 points to break through the 21,000 level, another major threshold reached in record time.

As expected yesterday, the Bank of Canada (BoC) kept its key rate unchanged. The tone of the short statement that accompanied the decision was cautious regarding the outlook for the Canadian economy despite recent encouraging data. In short, the BoC underscored the challenges exporters face, the issue of low wage growth and hinted that no rate hikes were on the horizon. The Canadian dollar naturally weakened in the wake of this announcement.

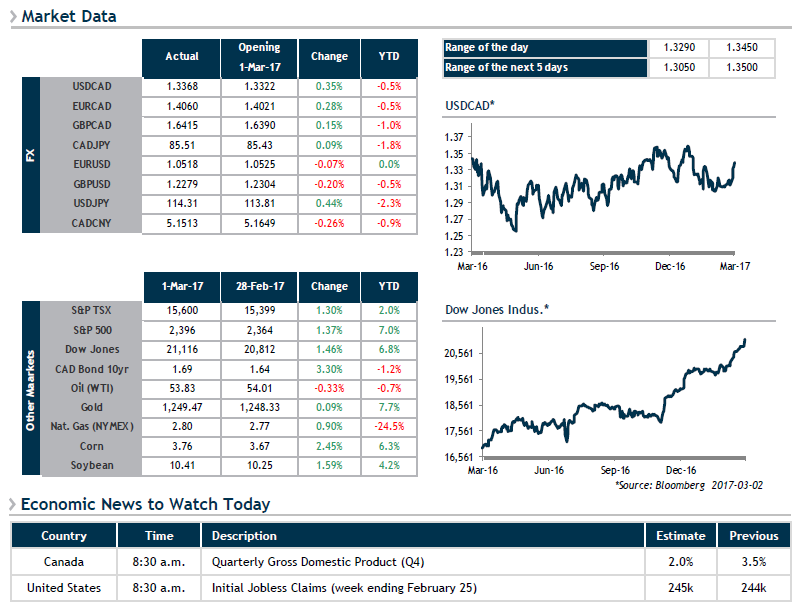

This morning, we’ll be keeping an eye on Canadian GDP figures for the fourth quarter. An increase above 2% could halt the loonie’s ongoing slide since the beginning of the week.