Major markets temporarily halted their runaway tear overnight. I say temporarily because for all the headlines that have been written today, all I see is price hitting a major resistance level and experiencing a rejection at first touch.

“CNY Trade Balance (210B v 339B expected)”

The major fundamental theme from yesterday was the miss in the Chinese trade balance number. It not so much renewed global growth concerns as they’ve always been lingering, but at least brought them back to the fore. Seasonality can be blamed here to some extent, so markets at least have an excuse if they want to take it.

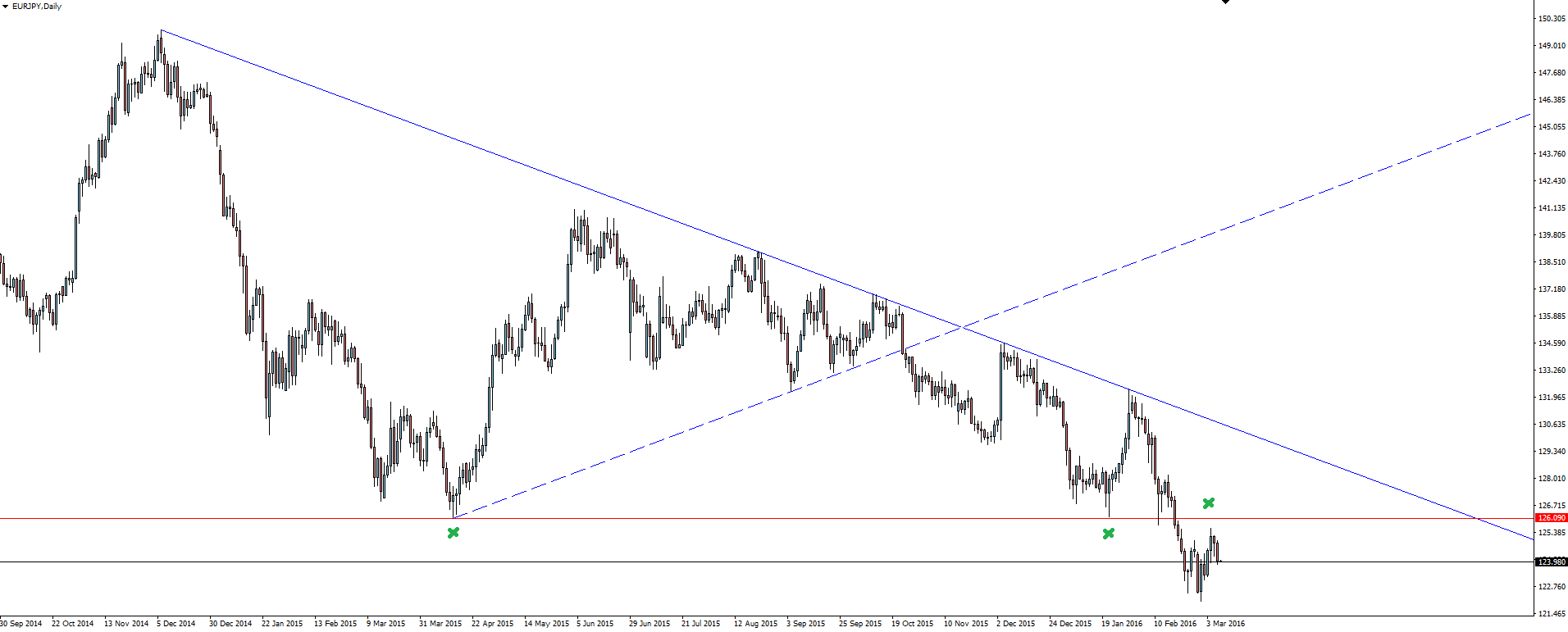

As expected during times of uncertainty, the best performing currency overnight was the Japanese yen. Turning to the charts, we’ve gone for EUR/JPY:

EUR/JPY Daily:

We went the EUR/JPY rather than USD/JPY just for the fact that the turn down in the pair coincides with a push up into resistance. This is definitely a nice, obvious level to use in your trading.

Speaking of levels to use in your trading…

———-

Chart of the Day:

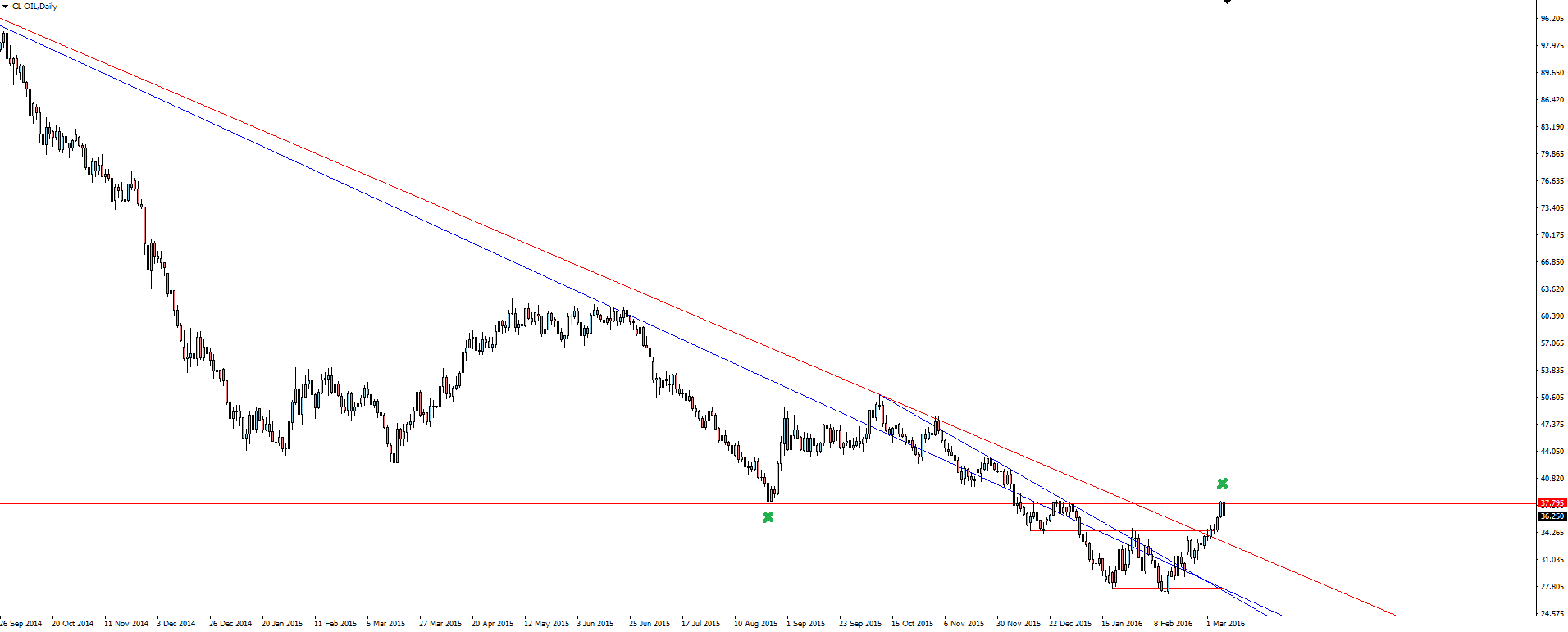

CHART UPDATE from yesterday’s Extraordinary European Expectations blog:

Oil Daily:

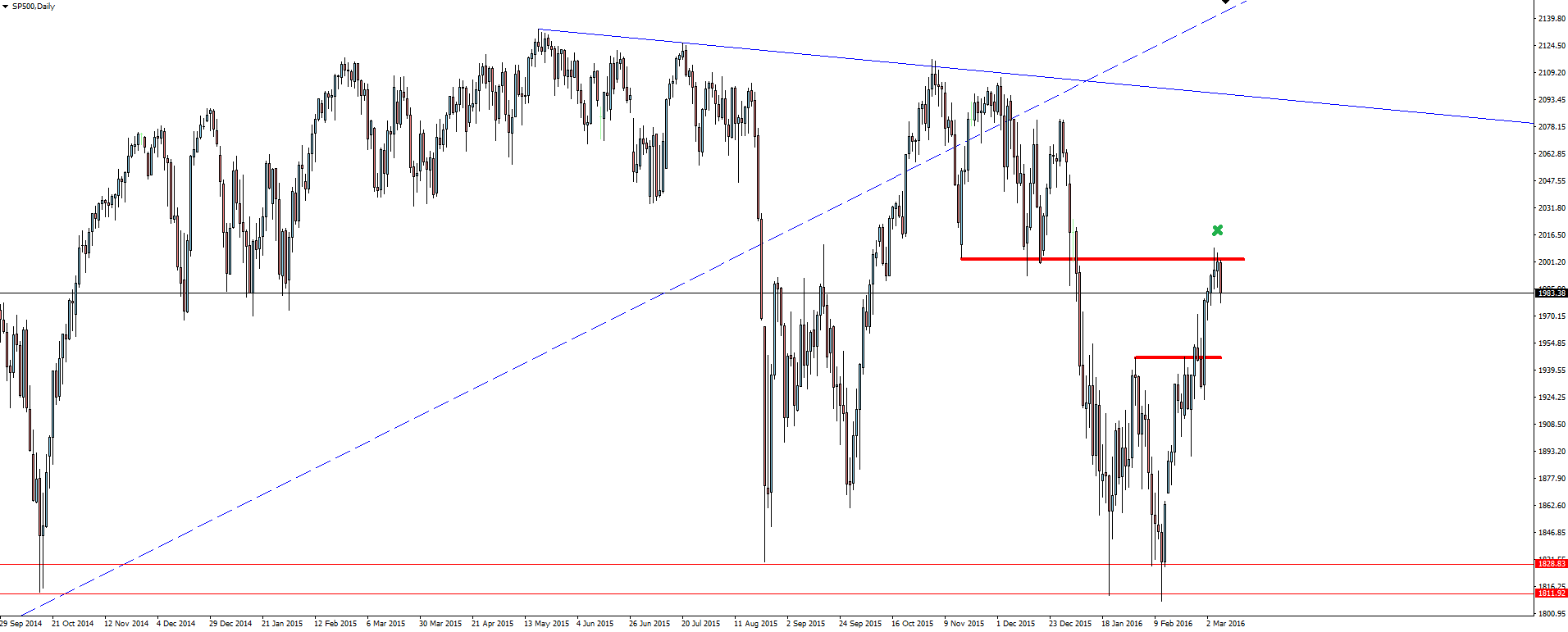

S&P 500 Daily:

In yesterday’s daily market update blog, we talked about both the recently correlated oil and US stock charts both sitting at resistance.

Both markets completed perfect technical rejections off clear resistance levels. If you’re managing your risk around major levels correctly, you will always be okay.

On the Calendar Wednesday:

AUD Westpac Consumer Sentiment

AUD Home Loans m/m

GBP Manufacturing Production m/m

CAD BOC Rate Statement

CAD Overnight Rate

USD Crude Oil Inventories

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Vantage FX Pty Ltd does not contain a record of our Desktop or MT4 WebTrader prices or solicitation to trade Indices. All opinions, news, research, prices or other information is provided as general news and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the actions of the reader. We always aim for maximum accuracy and timeliness, and Vantage FX on the MT4 platform, shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.