With the earnings season getting into the groove, forecasts of a negative earnings growth remains the primary concern though the actual results are not as dreary as the initial forecasts. The pace of the growth is improving despite the presumption of a negative earnings growth.

As per the recent Earnings Trend, total S&P 500 earnings are expected to decline by 3.4% on the back of 0.5% lower revenues. Additionally, growth estimates of third-quarter 2016 are starting to lean into the negative as well. However, we anticipate a change in the last quarter of the year with expectations of growth in earnings to pick up and get even better going forward into fiscal 2017.

Telecom Stocks in Focus

The U.S. telecommunications industry is expected to observe reasonable growth through 2016. This industry has lately emerged as an intensely contested space where the key catalysts to success are technical superiority, the quality of services and scalability. Despite fierce competition, an uninterrupted advancement in telecom technologies has aided the telecom operators and equipment manufacturers to adopt newer business models in order to improve revenues.

Let us look at some of the stocks related to the telecom sector that are due to report their earnings on Jul 28.

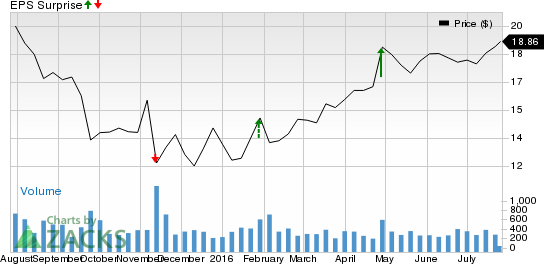

A10 Networks, Inc. (NYSE:ATEN) provides software based application networking solutions. The company carries a Zacks Rank #3 (Hold) and an Earnings ESP of 0.00%. According to our quantitative model, a company needs the right combination of two key ingredients – a positive Earnings ESP and a Zacks Rank #3 or better – to increase the odds of an earnings surprise., A10 Networks doesn’t conclusively show that it is likely to beat the Zacks Consensus Estimate this quarter.

Clearfield, Inc. (NASDAQ:CLFD) designs and manufactures fiber management platform. Clearfield has a combination of Zacks Rank #3 and an Earnings ESP of 0.00%. Although Zacks Rank #3 increases the predictive power of ESP, we need a positive Earnings ESP to be confident of an earnings beat.

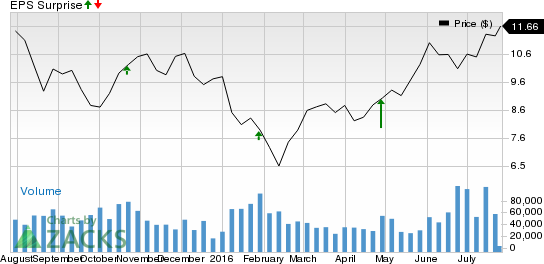

Cypress Semiconductor Corporation (NASDAQ:CY) designs, develops, manufactures and markets a broad line of high-performance digital and mixed-signal integrated circuits. The stock has a Zacks Rank #4 (Sell) has an Earnings ESP of 0.00%. Note that we caution against stocks with a Zacks Rank #4 or 5 (Sell-rated stocks) going into the earnings announcement.

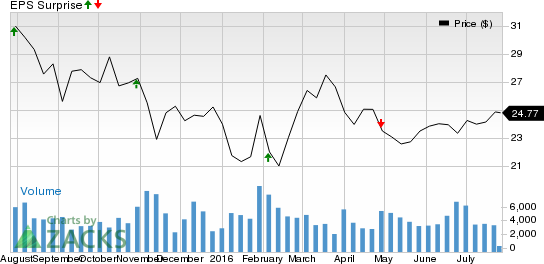

NeuStar, Inc. (NYSE:NSR) is a provider of essential clearinghouse services to the North American communications industry and Internet service providers around the world. NeuStar has a combination of Zacks Rank #3 and an Earnings ESP of 0.00% which doesn’t make us confident of an earnings beat this quarter.

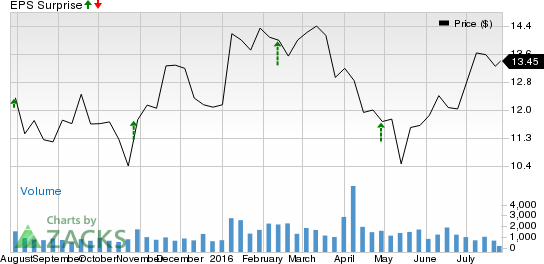

Vocera Communications Inc. (NYSE:VCRA) provides mobile communication solutions focused on addressing critical communication challenges that hospitals face. The stock has the combination of Zacks Rank #3 and an Earnings ESP of 14.29%, making us confident of an earnings beat this quarter.

CYPRESS SEMICON (CY): Free Stock Analysis Report

A10 NETWORKS (ATEN): Free Stock Analysis Report

CLEARFIELD INC (CLFD): Free Stock Analysis Report

VOCERA COMM INC (VCRA): Free Stock Analysis Report

NEUSTAR INC -A (NSR): Free Stock Analysis Report

Original post

Zacks Investment Research