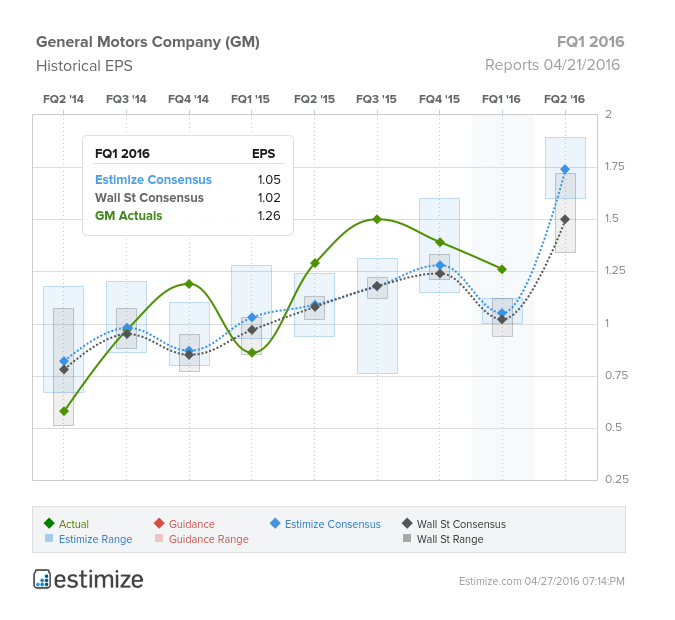

If you were skeptical that the automotive industry could maintain its comeback, General Motors Company (NYSE:GM)’s Q1 earnings should alleviate those concerns. This morning, GM reported better than expected first quarter results that topped both earnings and revenue estimates. The automaker posted earnings per share of $1.26 on revenue of 37.30 billion in sales. This easily topped the Estimize consensus by 19 cents and revenue by $1.75 billion. The crowd had been more bullish on GM than Wall Street, and was correct in doing so, but neither party had predicted such a big beat.

The quarter featured gains in key reporting segments, including domestic and international markets. GM continues to regain its position in the U.S. primarily driven by robust sales growth in higher margin SUV’s and trucks. The strong quarter also reflected improvements in its struggling European division, which broke even after posting a $200 million loss a year earlier. Overall, net revenue was $2.9 billion higher, on constant currency basis, than the first quarter of 2015.

Following its report, GM raised its full year EPS guidance range as high as $5.75, which is higher than the Wall Street Consensus forecast to start the year. At the very least, the strong momentum should carry into second quarter earnings. Early estimates from the crowd have Q2 earnings per share reaching $1.74 on just over $39.13 billion in sales.

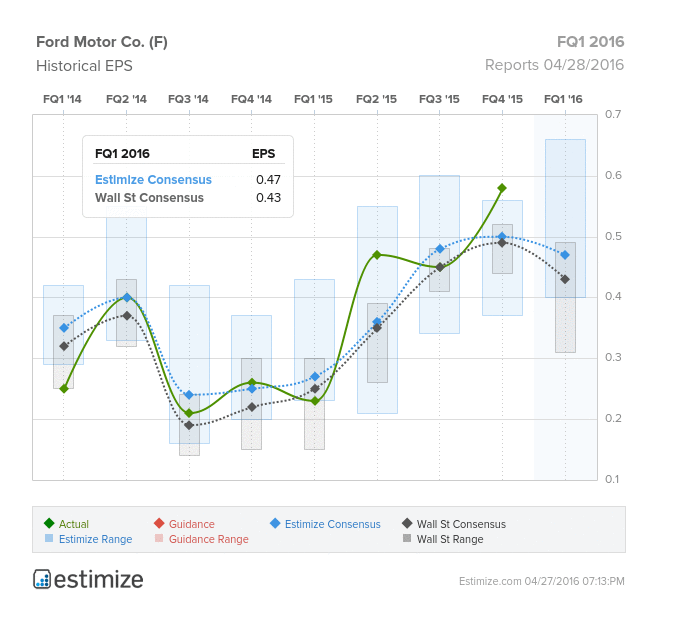

General Motors strong quarter sets a favorable tone for Ford’s earnings call next week. Ford Motor Company (NYSE:F), like GM, has benefited from muted oil prices and booming demand for gas guzzling vehicles. Analysts are expecting earnings per share of $0.47 on $36.41 billion in revenue, according to the crowdsourced data. Compared to a year earlier, earnings are predicted to rise 104% on a 7% increase in sales.

Looking forward, the automotive industry is emerging as one of the market’s safer bets. Last year auto sales topped a 15-year-old record with auto stock amongst the strongest performers in the S&P 500. Companies like General Motors and Ford should continue to benefit from this trend as conditions continue to favor the automotive industry. Auto sales across the industry have already increased 3% this year, despite softer than expected sales in March.

How do you think these names will report this week?