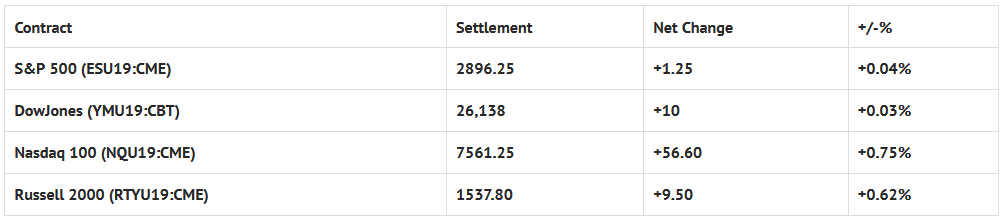

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed higher: Shanghai Comp +0.09%, Hang Seng +1.00%, Nikkei -0.72%

- In Europe 13 out of 13 markets are trading higher: CAC +1.56%, DAX +1.41%, FTSE +0.97%

- Fair Value: S&P +4.92, NASDAQ +28.83, Dow +15.27

- Total Volume: 1.64 million ESU & 11.4k SPU traded in the pit

*As of 7:00 a.m. CST

Today’s Economic Calendar:

Today’s economic calendar includes the 8-Week Bill Settlement, FOMC Meeting Begins, Housing Starts 8:30 AM ET, and Redbook 8:55 AM ET.

S&P 500 Futures: Buy #NQ / Sell #ES

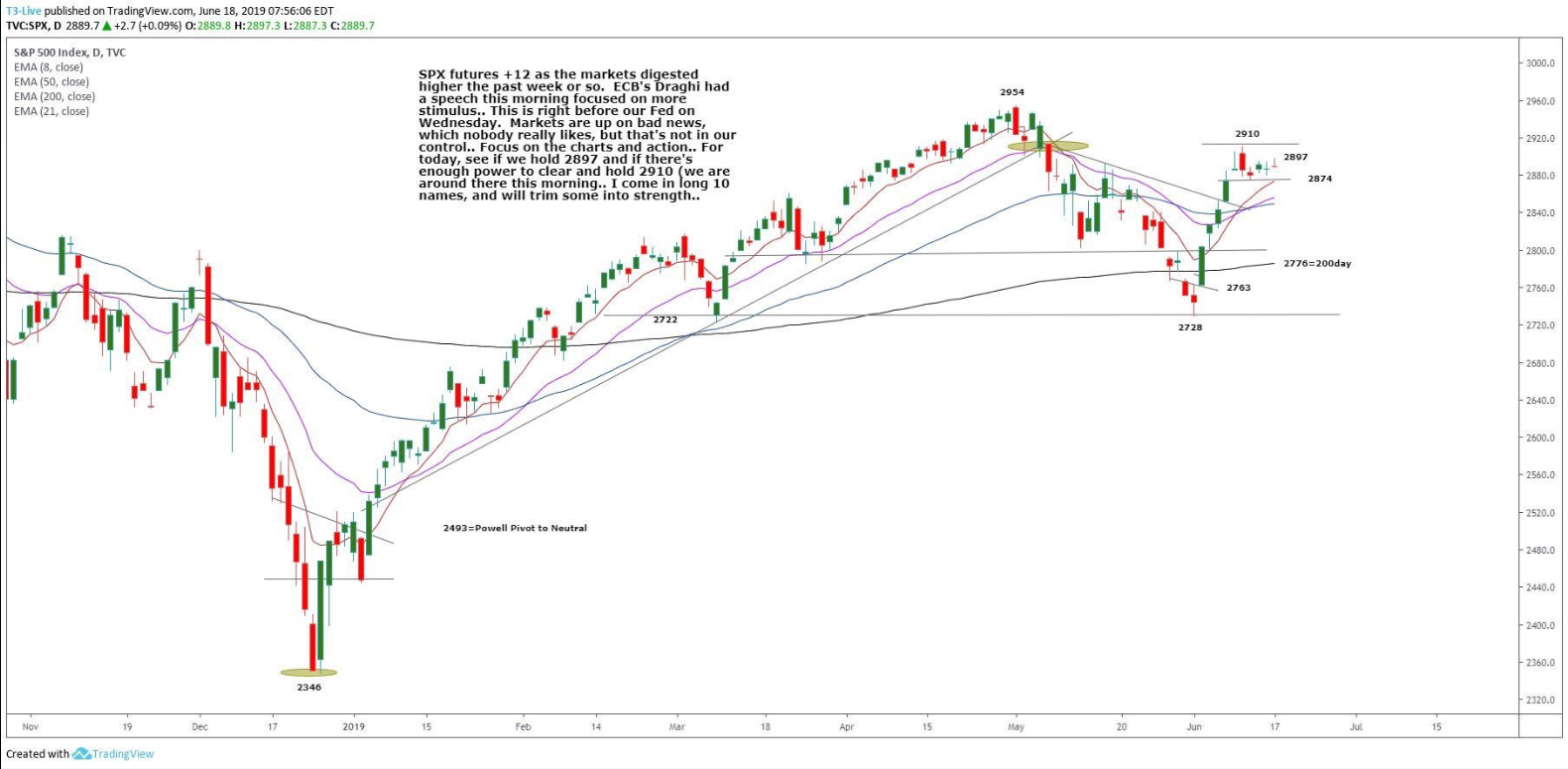

Chart courtesy of Scott Redler @RedDogT3 – $spx futures +12 as Draghi fans the stimulus flames. See how the markets treat 2910 as it’s smart to manage your positions.

After trading up to 2904.75 during Sunday nights Globex session, the S&P 500 futures pulled back to open Monday’s regular trading hours at 2895.50. The first move after the 8:30 CT bell was to take out the overnight low at 2893.75, and print a new low at 2892.00, before turning around and heading higher.

By 10:00, the ESU had failed to take out the Globex high, and double topped at 2902.75. From there, the futures did some back and fill down to 2895.50, and then went on to trade sideways in a 6 handle range for the rest of the day.

Going into the close, when the MiM reveal showed $264 million to sell, the ES was trading at 2895.75. It then printed 2894.75 on the 3:00 cash close, and 2896.75 on the 3:15 futures close, up xx handles on the day.

There is always, and I mean always, some type of rotation going on, and yesterday it was the Nasdaq leading the rest of the markets higher. After nearly 1 billion has gone into recent IPO’s, the S&P seems to be reenergized, but it also is only one bad headline away from the next drop.