- SPX monitoring purposes; Long SPX on 6/18/20 at 3115.34.

- Gold monitoring purposes GOLD: Sold GDX on 6/11/20 at 32.83=gain; long GDX on 6/8/20 at 32.79.

- Long-Term Trend SPX monitoring purposes: Short SPX 5/13/20 at 2820

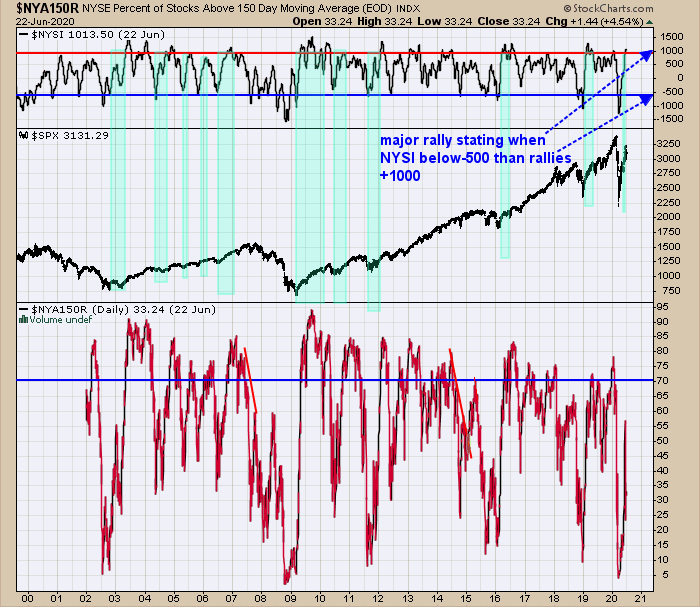

This chart shows the occasions on which the McClellan Summation index, an indicator of market breadth, on US stocks reached oversold levels below -500 and than rallied to +1000. This surge of +1500 points in the index has been a bullish longer term sign. The light blue area shows when these parameters where met (including the current one from the March low). There can be a 50% retracement in the market, but its unlikely the March 23 low will be tested. July (third weakest month of the year) is one of the weaker months of the year and if there is going to be a 50% retracement, July could be a candidate. For very short term, the June 8 high could be tested.

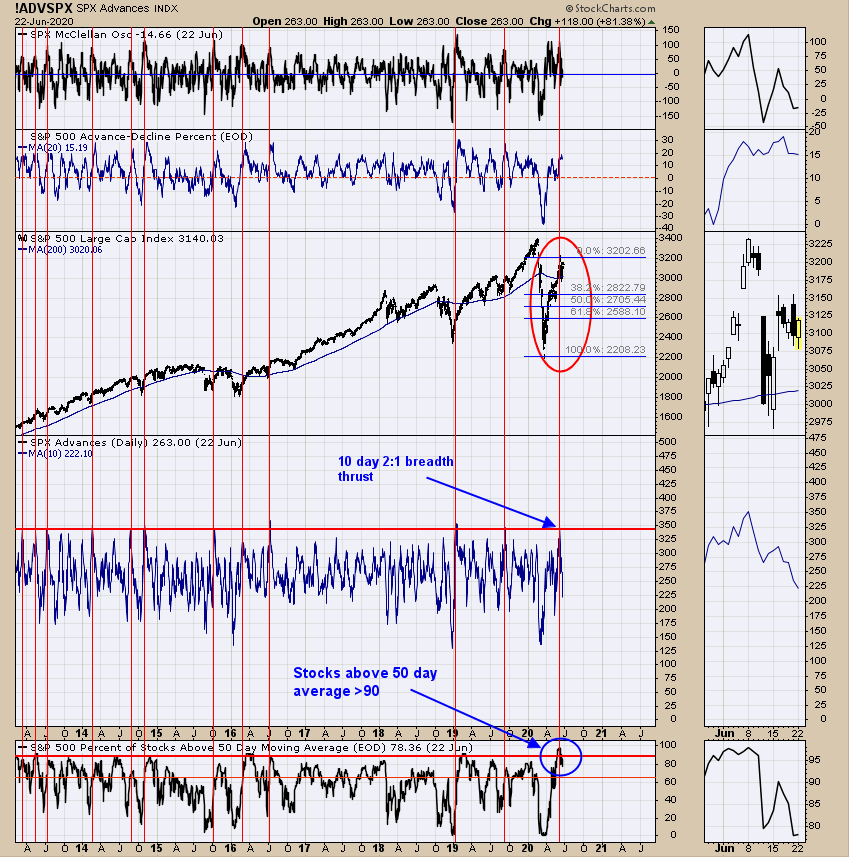

Near the June 8 high, the percentage of stocks stocks trading above their 50DMA topped 90% and 10-day average 2/1 breadth-thrusts were triggered. This combination never materialised at the final high. The market can consolidate in the short term, but should see another rally that may break to a new high in the coming months.

Gold vs gold miners

It is common around the July 4 holiday for markets to reverse. If a market rallies into the July 4 holiday, then that period may mark a short-term high and if the market declines into the period, a low could form. We are thinking the July 4 period for gold mining stocks (NYSE:GDX) could be a low. GDX has traded sideways-to down over the last 30 days and this consolation may continue into the July 4 time-frame. The middle window above is the ratio of GDX to the gold price itself (NYSE:GLD). We are closely watching the GDX/GLD ratio and comparing that to GDX. When the GDX/GLD ratio is stronger than GDX, this is usually bullish for GDX and vice versa. Recently, the rally in GDX has been stronger than the rally in the GDX/GLD ratio, resulting in a bearish sign in the short term. We are looking for the next setup and watching for GDX/GLD ratio to outperform GDX to trigger the next setup. We are being patient for now.