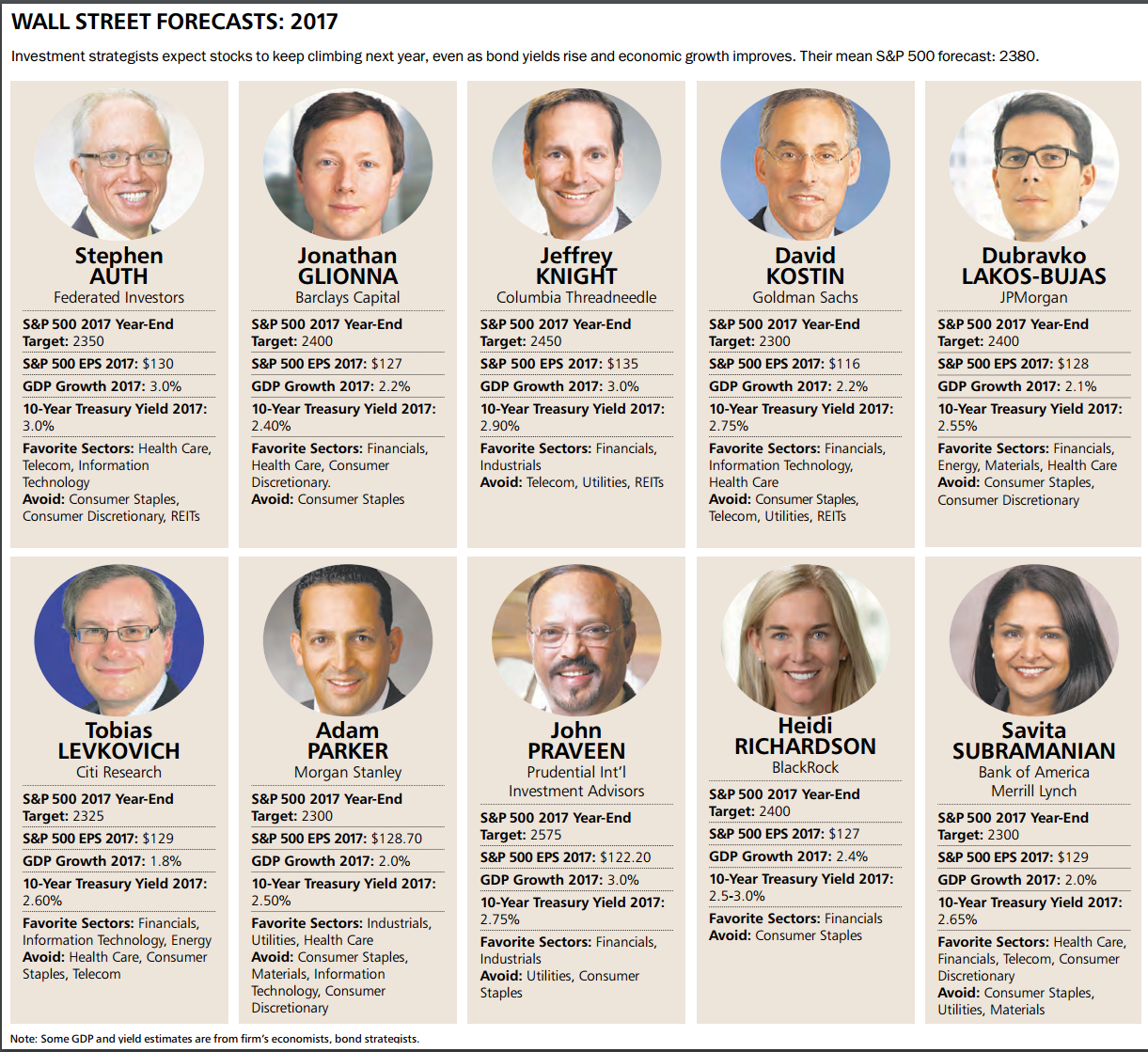

Over this past weekend, Barron’s Magazine published its big story the “2017 Market Outlook.” Here is what was interesting, after 8-years of a bull market advance not one of the forecasters had a “bearish” outlook. In fact, as the article concludes:

“If all goes smoothly, our experts’ forecasts might even prove too tepid. The old bull isn’t ready to call it quits yet.”

If that isn’t enough to get you all “giddy” for the holiday season, I am not sure what is?

I have written over the last couple of weeks the markets would likely advance heading into the end of the year as portfolio rebalancing, window dressing and performance chasing all collide to give a lift to stocks. However, as we will examine, there is sufficient evidence the markets may have run too far, too quickly.

Signs Of Exuberance

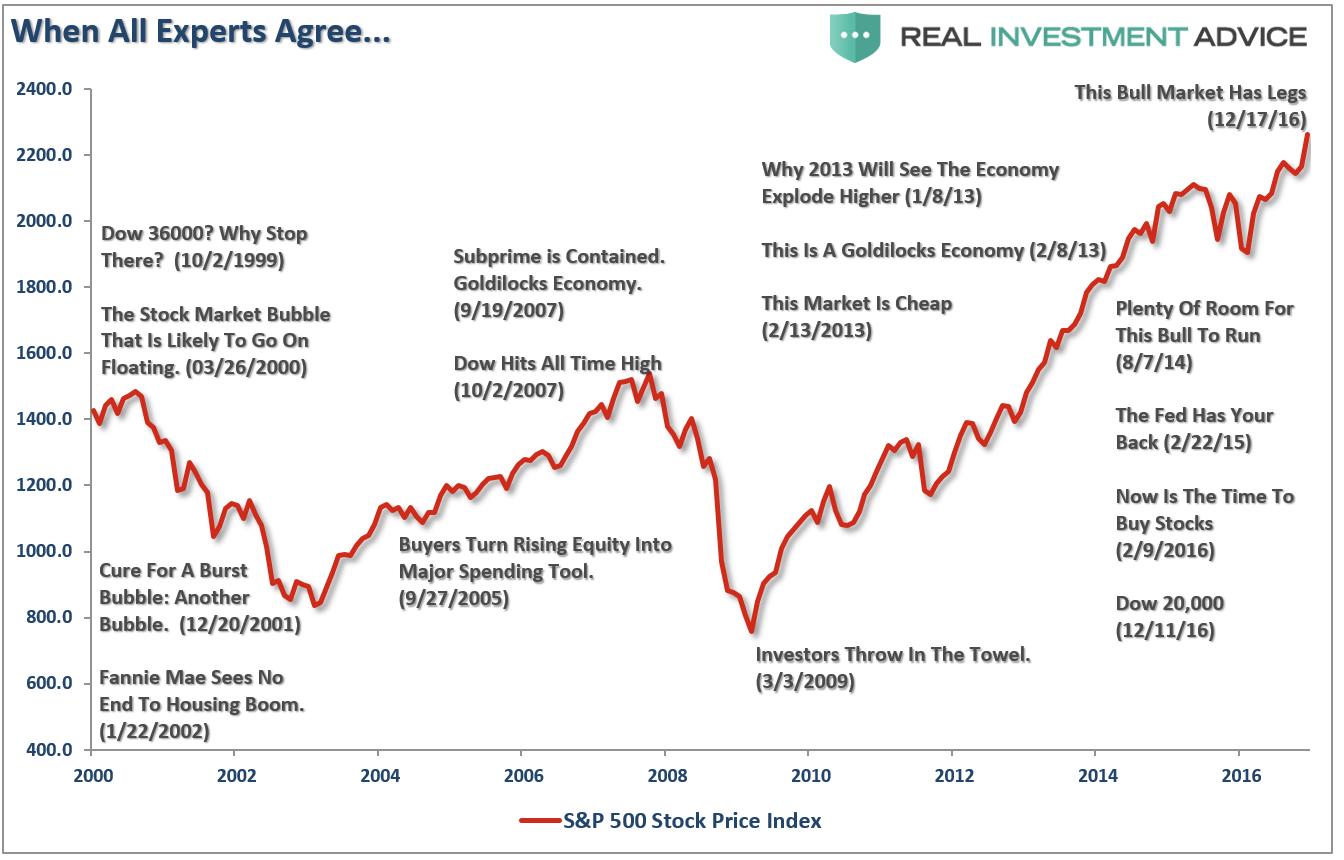

It really isn’t surprising the majority of Wall Street analysts are bullish as prices have advanced improving their performance numbers for the year. Of course, since it is rising asset prices which drives their business – being “bullish” is good for business. (Telling investors to move to cash doesn’t create inflow for their firms or funds.) However, as investors, it is extremes in both “psychology” and “behaviors” that tend to give us the best indications as to future outcomes.

The legendary Bob Farrell had two rules specifically relating to today’s topic.

The first was Rule #9:

“When all the experts and forecasts agree – something else is going to happen.”

Or, as Sam Stovall, the investment strategist for Standard & Poor’s once stated:

“If everybody’s optimistic, who is left to buy? If everybody’s pessimistic, who’s left to sell?”

While psychologically it may seem as though the markets will rise indefinitely, the reality is they don’t. The reason is excesses are built when everyone is on the same side of the trade.

While there is ALWAYS both a buyer and seller to every transaction – it is at WHAT PRICE that matters. Ultimately, when a shift in sentiment occurs, the reversion is exacerbated by the stampede going in the opposite direction as a “vacuum” at current prices forms.

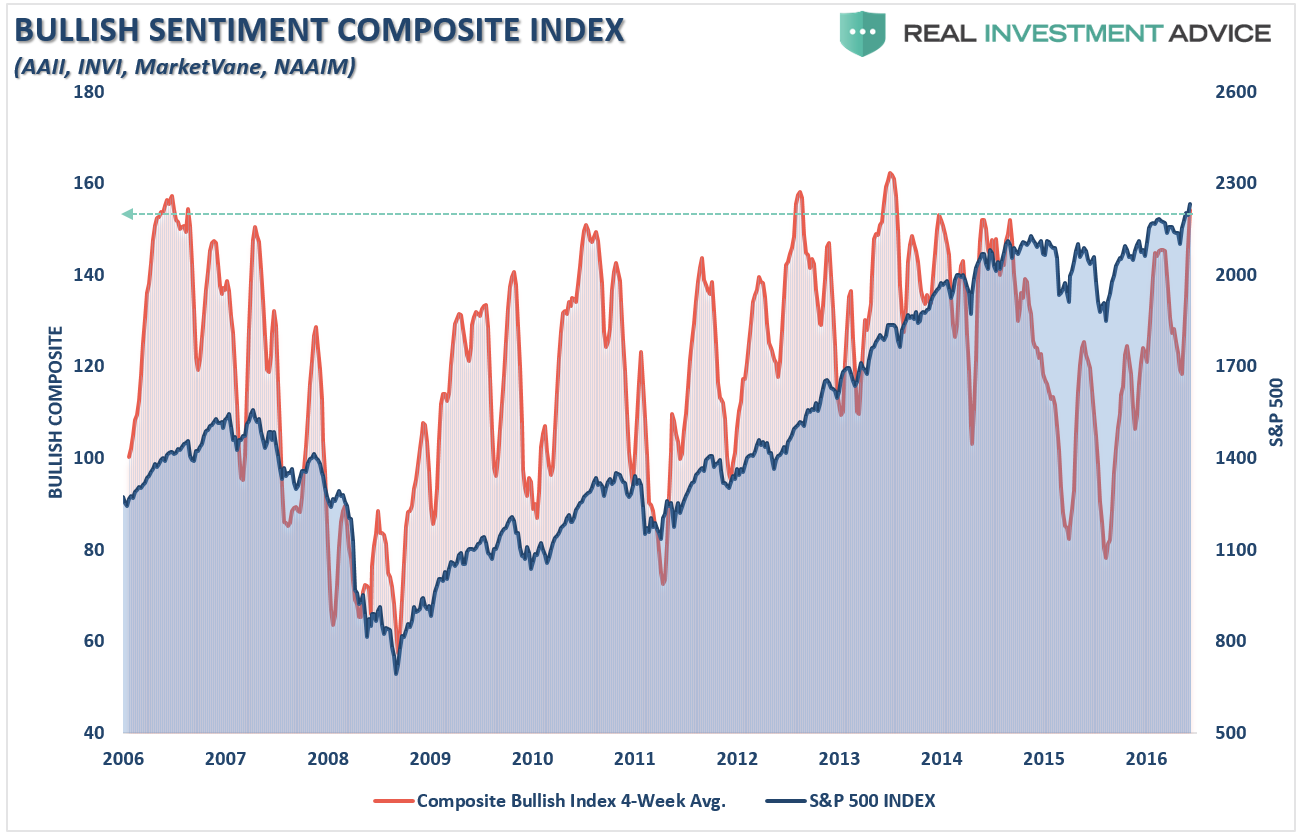

Currently, we are seeing a lot of exuberance being built into the markets as shown by the composite indicator of both individual and professional investors.

Furthermore, as noted by Randy Frederick at Charles Schwab:

“It is a little scary to see such optimism. But at the same time, when I look out between now and the end of the year, I’m having a difficult time finding anything that’s probably going to derail this market outside of a black-swan event.

The only thing I’m worried about is that it seems like nobody is worried about anything right now.”

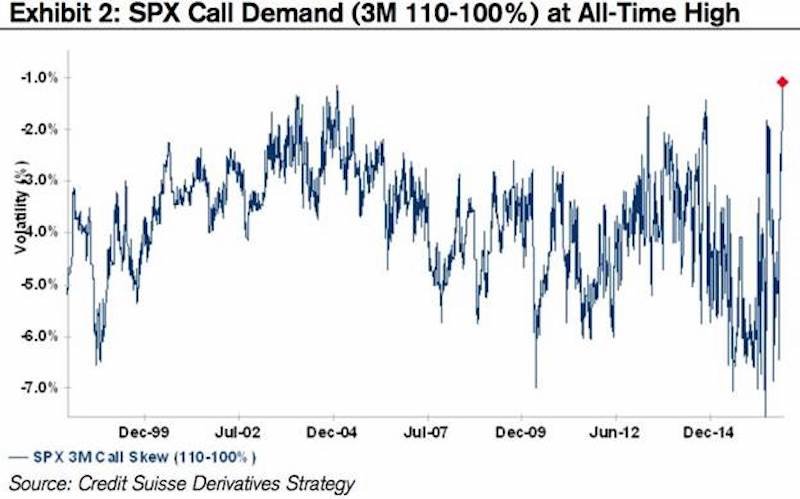

With virtually all equity put/call ratios in bullish territory there is literally no one hedging against a potential market decline.

Then there is this:

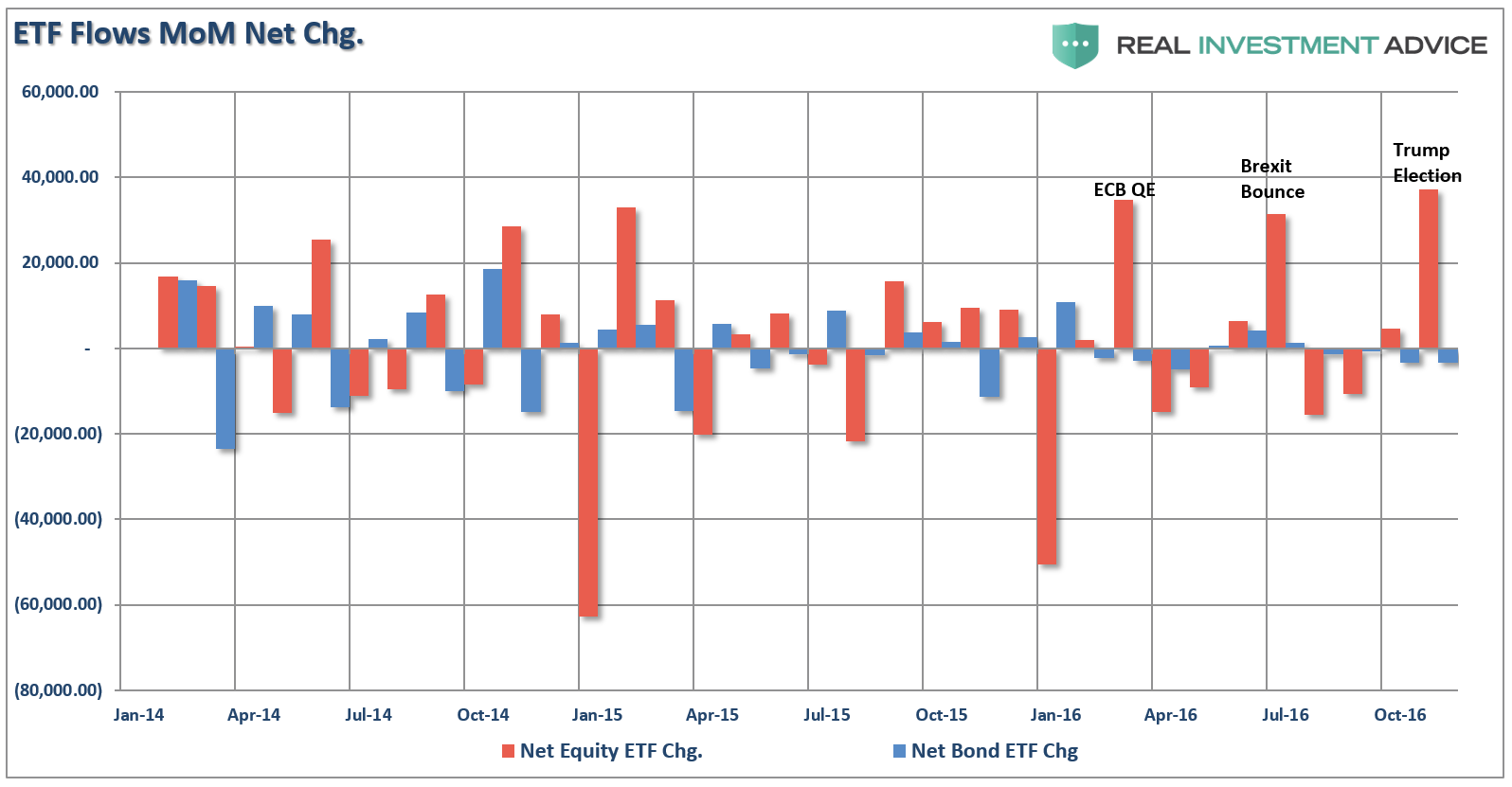

“The stampede into U.S. equity ETFs since the election has been nothing short of breathtaking,” said David Santschi, chief executive officer at TrimTabs. “The inflow since Election Day is equal to one and a half times the inflow of $61.5 billion in all of last year. One has to wonder who’s left to buy.”

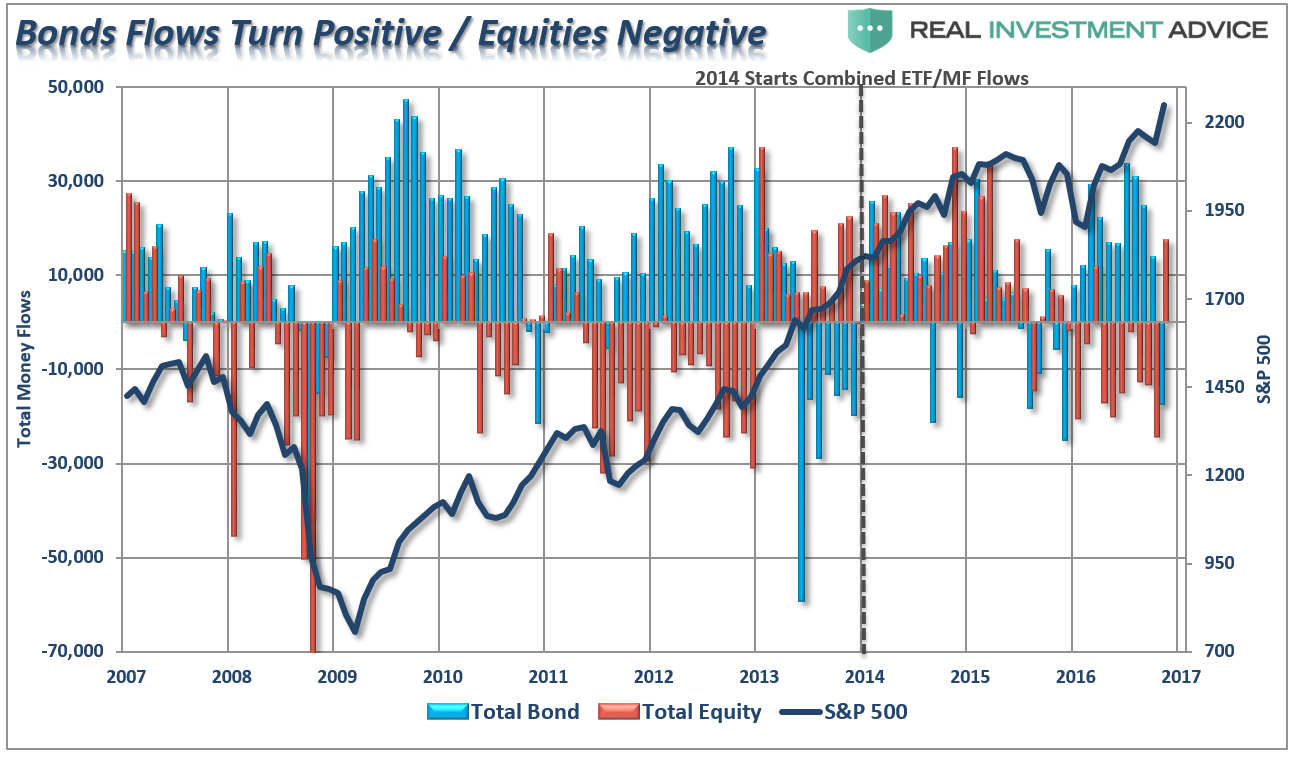

It is even more evident when combining both ETF and Mutual Fund flows and comparing those to the overall market.

In other words, all the “kids are in the pool” which is typical near short- to intermediate-term peaks in the market.

Snap-Back

Psychological exuberance is a by-product of the extension of prices. As prices rise, investors “betting” on the market become more emboldened in their choice. It is this self-reinforcing cycle as prices rise which push individuals into taking on increasing levels of “risk” in order to “chase the market.”

It is this push higher in prices, as noted by Bob Farrell’s Rule #2 that is most important:

“Excesses in one direction will lead to an opposite excess in the other direction.”

Markets that overshoot on the upside also overshoot on the downside, kind of like a pendulum. The further it swings to one side, the further it rebounds to the other side.

On a longer term basis markets adhere to Newton’s 3rd law of motion:

“For every action, there is an equal and opposite reaction.”

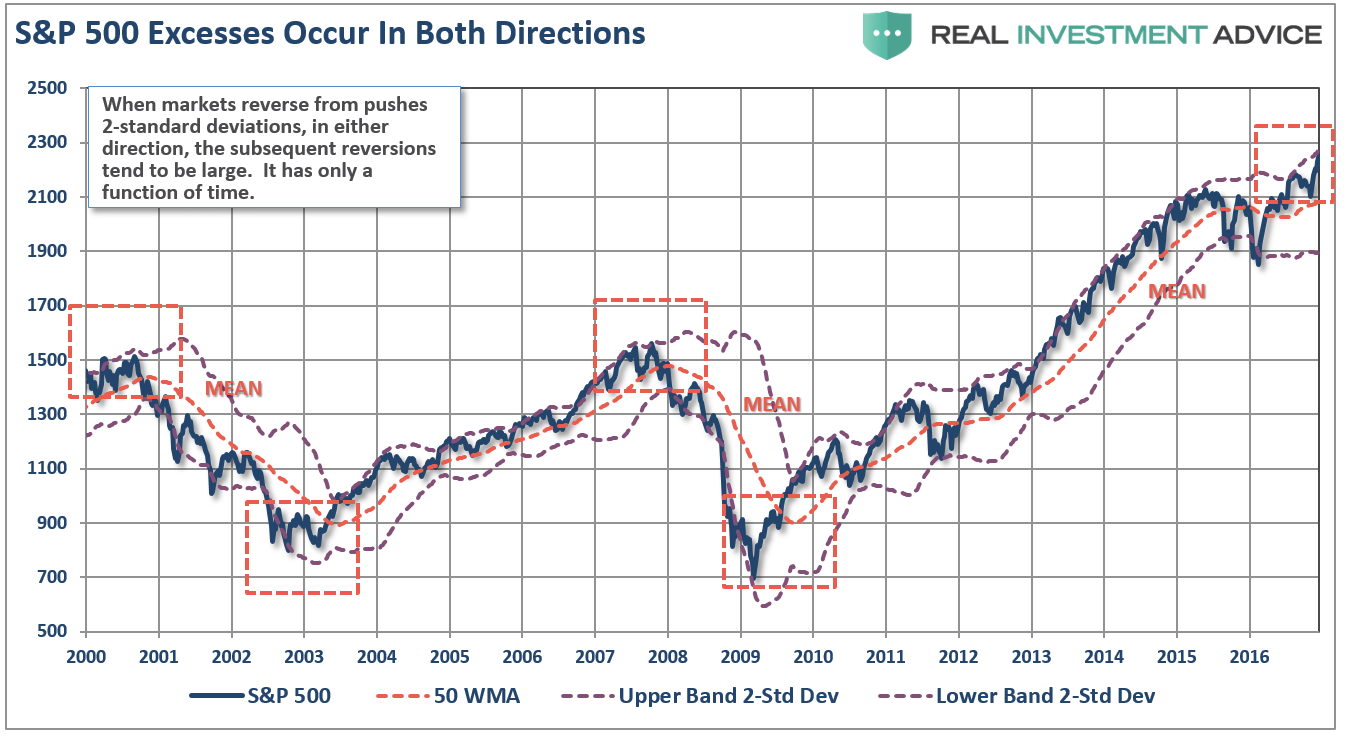

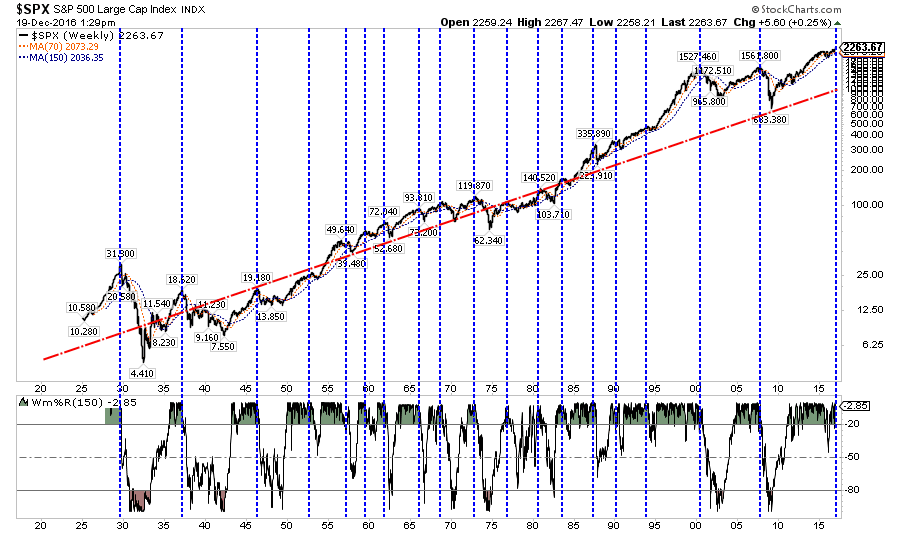

The first chart, of the S&P 500, shows that cyclical markets reach extremes when they are more than 2-standard deviations above, or below, their respective 50-wk moving average. While markets can trend higher in the near-term, there is ALWAYS a point where prices revert to the 50-week moving average or beyond.

The second chart shows price reversions of the S&P 500 on a long term basis. Notice that when prices have historically reached extremes – the reversion in price is just as extreme. This current extension above the long-term historical mean will likely end just as badly as they always have in the past.

As Bob Farrell also states:

“There are no new eras – excesses are never permanent.”

There will always be some “new thing” that elicits speculative interest. These “new things” throughout history, like the “Siren’s Song,” has led many investors to their demise. In fact, over the last 500 years, we have seen speculative bubbles involving everything from Tulip Bulbs to Railways, Real Estate to Technology, Emerging Markets (5 times) to Automobiles and Commodities.

It always starts the same, and ends with the utterings of “This time it is different”

Being a contrarian can be quite difficult at times as bullishness abounds. However, it is also the secret to limiting losses and achieving long-term investment success. As Howard Marks once stated:

“Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combine to make it difficult; including natural herd tendencies and the pain imposed by being out of step, since momentum invariably makes pro-cyclical actions look correct for a while. (That’s why it’s essential to remember that ‘being too far ahead of your time is indistinguishable from being wrong.’)

Given the uncertain nature of the future, and thus the difficulty of being confident your position is the right one – especially as price moves against you – it’s challenging to be a lonely contrarian.”

Yet, it is being a contrarian that allows investors to “buy low and sell high.” Furthermore, it is what allows individuals to truly garner a real advantage over long-term investment time horizons.

Don’t mistake these views thinking I am “bearish” and am therefore “out of the market.” I assure you that I am not. As I have often stated, as a money manager I must navigate the markets to the best of my ability otherwise I suffer “career risk.”

However, as I always tell new prospects with whom I am going to work:

“While there will indeed be years I underperform the market as they rise, I would much rather have the conversation about how to improve performance next year versus how I am going to recover a large loss of your capital this year.”

Currently, there is an elevated risk of principal loss over the next couple of months.

This isn’t bullish, or bearish, it is “just what it is.”

In the meantime, enjoy your holidays and Merry Christmas.