In yesterday’s post on the tools companies use to “manipulate” earnings, I referenced a tweet I received discussing the markets next move to 2400.

“Of course, the issue ultimately comes down to valuations. At a price of 2400, based on current earnings per share of $86.92, the market would be trading at the second highest level of valuations in history with a P/E of 27.61.

@LanceRoberts @JLyonsFundMgmt what about 129-133$ forward earnings est?

— Paolo Riccelli (@paolo_riccelli) October 2, 2016

Let’s assume for a moment the $133 EPS estimate was accurate. This would put the forward P/E ratio at just 18x earnings – still well above the long-term historical average P/E of 15.

However, in Paolo’s attempt to justify the bullish meme, the forward earnings estimate is no longer $133/share but, according to S&P, just $122.15 through the end of 2017. IF we assume those estimates are correct, now the forward P/E rises to 19.64x earnings. Certainly not cheap.“

While yesterday’s post was based primarily on the current fundamental underpinnings of the market, which Central Bank interventions have led investors to completely ignore, I wanted to examine this idea of a “2400 moonshot” from a technical perspective as well.

However, before we get to projections, let’s update our current position given the market action yesterday.

Market Review & Update

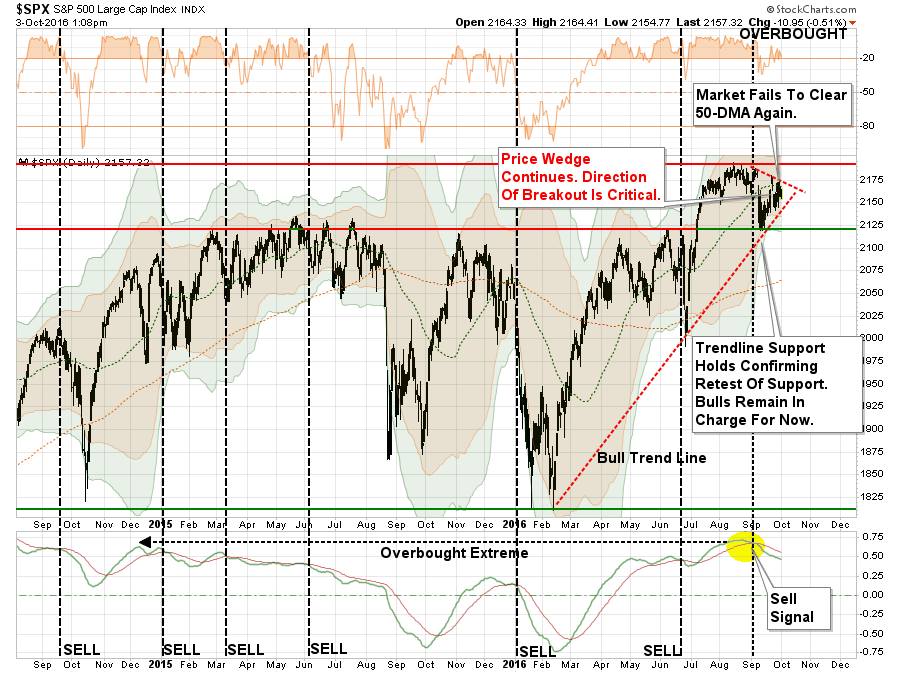

On Saturday, I discussed the addition of a trading position to portfolios given the ongoing defense of the upward trending bullish trend line.

“The GOOD news is the market has continued to hold support along the bullish trend line which goes back to the February lows. This continued defense of bullish support has been consistent enough to allow us to add a small trading position of an equal weight S&P 500 index ETF to portfolios. Importantly, this is a trading position only currently with a stop set at the bullish trend line support.

The BAD news continues to outweigh the good, unfortunately. As shown in the chart above, the market was unable to close above the 50-dma keeping that level of resistance intact. Furthermore, the intra-day rally failed at both the average of the previous trading range and the downtrend resistance line from the August highs.”

In other words, I will NOT be surprised to be stopped out of the recent addition of a trading position to portfolios. That is part of portfolio management. However, the bullish trend line remains intact and a break above the “price wedge” would suggest a sharper move higher. This makes the addition of a trading position viable with a very close stop at the current trend line.

But therein lies the question of the day. If the market is able to break above the current resistance levels, the technical trends suggest a move to 2400 is indeed viable. However, while is not discussed by the mainstream media, because it would be considered “bearish,” is a break to the downside could be equally as painful.

But for today, let’s analyze the potential for an upside breakout.

2400 Or Bust

The current belief is that over the next couple of quarters the earnings and economic backdrop will begin to improve providing the catalyst for an upside move in the markets. It is also the becoming a realization that interest rates aren’t going to rise anytime soon, something I have been saying for the last two years. Therefore, “accommodative policy” remains supportive of higher prices for now.

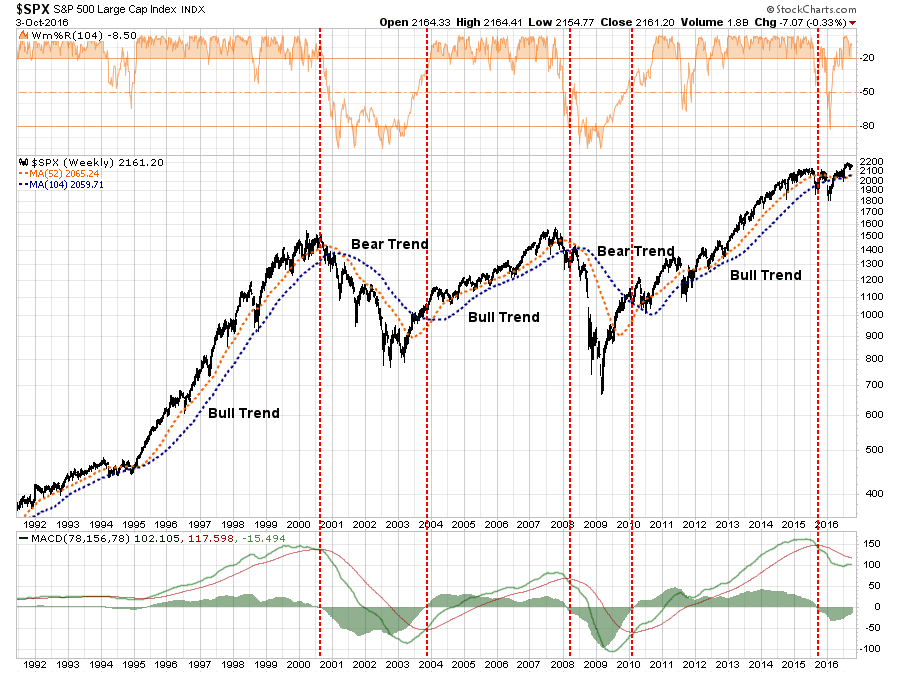

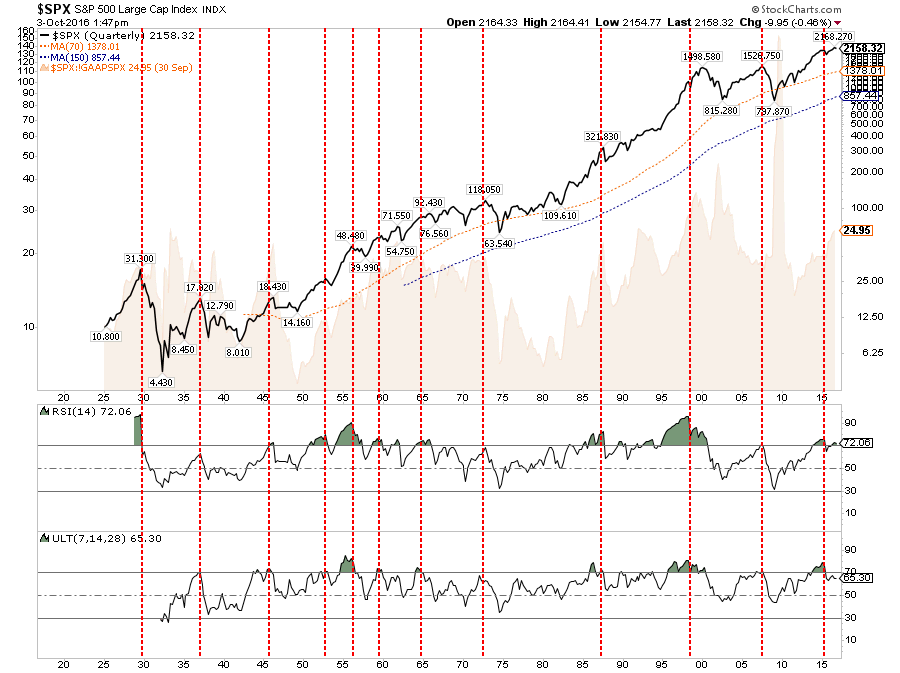

However, it should be noted that despite the monetary backdrop supporting the idea of higher prices in the short-term, longer-term “sell signals” only witnessed during major market topping processes currently remain as shown below.

There has never been an era previously where global Central Banks have stood at the ready to rush to aid to support asset prices at even the slightest hint of a “correction.” It is a logical conclusion that at some point there will be a dislocation which even Central Bank interventions will not be able to cure. It would likely be wise not to be present when that occurs.

But that is a story for another day.

For now, Central Bankers “rule the world” and their word alone has been enough to push markets higher despite repeated failed forecasts of stronger economic growth. But it is this repeated failure that keeps the “bulls” alive, as each failure by Central Banks to achieve their monetary policy goals simply means leaving accommodative monetary policy in place. Of course, no one has asked the question what happens when they actually do succeed in raising rates?

The market currently remains above the running bullish trend line which has been the rally point for Central Banks to intervene with either actual monetary interventions or promises to do more. Despite concerns of global disruption due to the “Brexit,” or the next potential bank failure with Deutsche Bank (DE:DBKGn), nothing has been able to shake the markets as investor complacency remains elevated.

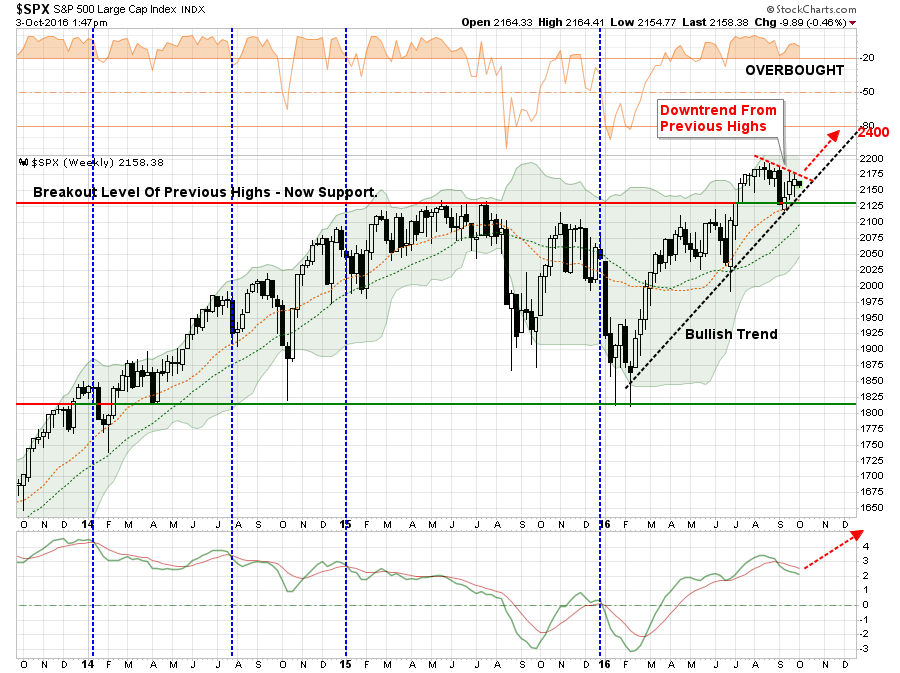

As shown below, the current price action continues to consolidate in a very tight range which will resolve itself in very short order. A breakout to the upside will clear the markets for a further advance. However, while the technicals suggest a move to 2400, it is quite possible it could be much less. Notice in the bottom section of the chart below. Turning the current “sell signal” back into a “buy signal” at such a high level does not give the markets a tremendous amount of runway.

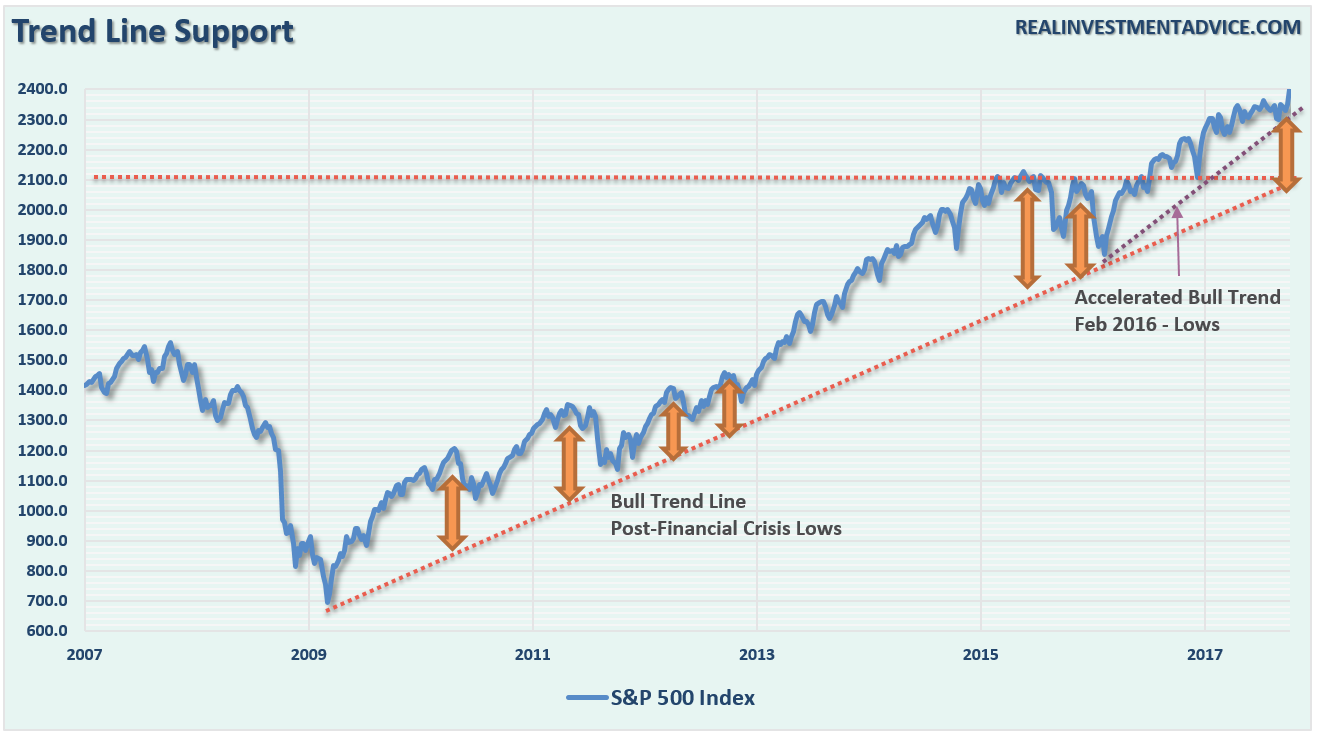

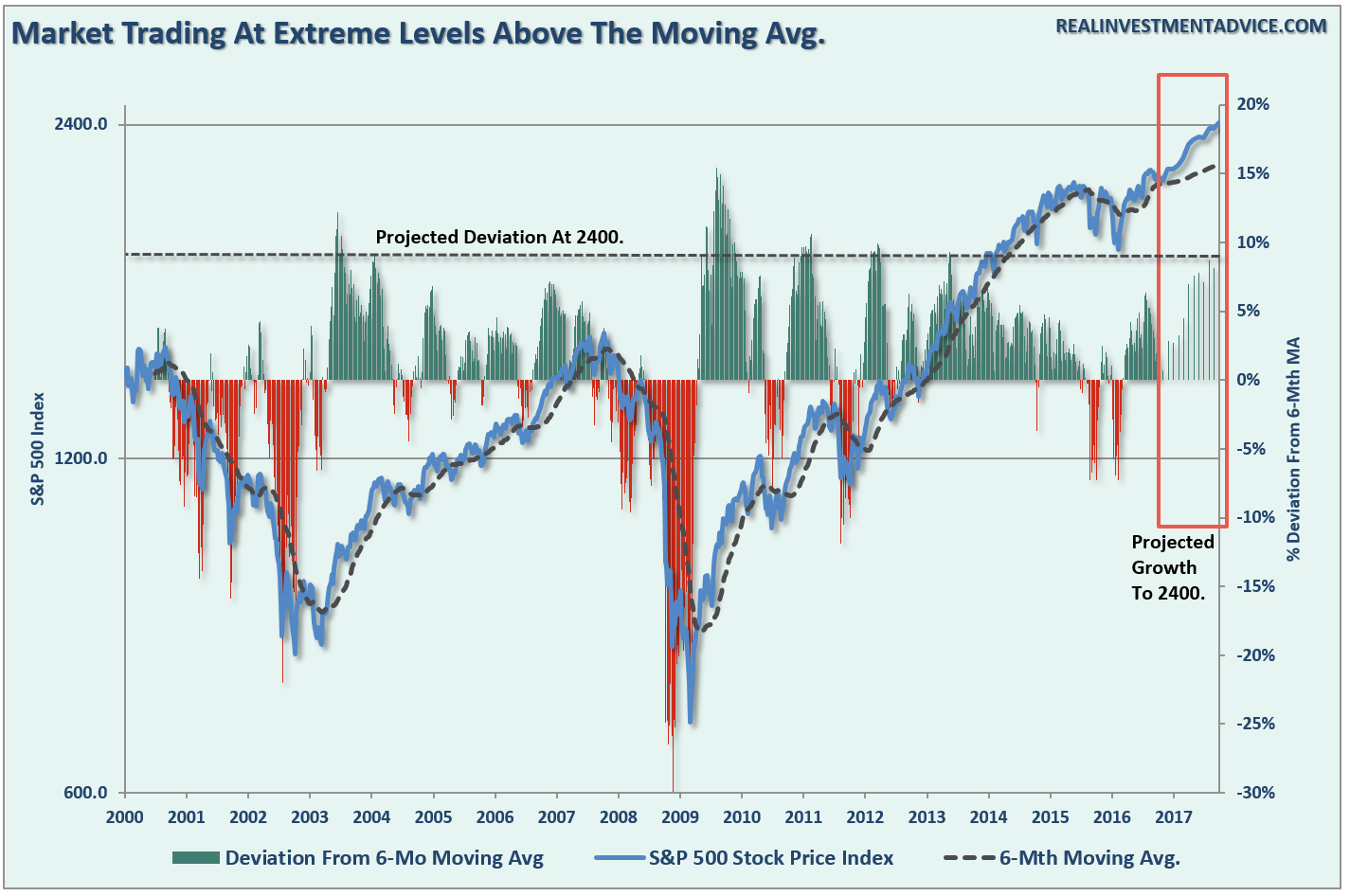

There is also the issue of deviations above the long-term trend line. Trend lines and moving averages are like “gravity.” Prices can only deviate so far from their underlying trends before eventually “reverting to the mean.” However, as we saw in 2013-14, given enough liquidity prices can remain deviated far longer than would normally be expected. (I have extrapolated move to 2400 using weekly price data from the S&P 500.)

A move to 2400 would once again stretch the limits of deviation from the long-term trend line likely leading to a rather nasty reversion shortly thereafter.

We can see the deviation a little more clearly in the analysis below. Once again, the data in the orange box is an extrapolated price advance using historical market data. The dashed black line is the 6-month moving average (because #BlackLinesMatter) and the bar chart is the deviation of the markets from price average.

Historically speaking deviations of such an extreme rarely last long. As discussed above, while it is conceivable that a breakout of the current consolidation pattern could lead to a sharp price advance, it would likely be the last stage of the bull market advance before the next sizable correction.

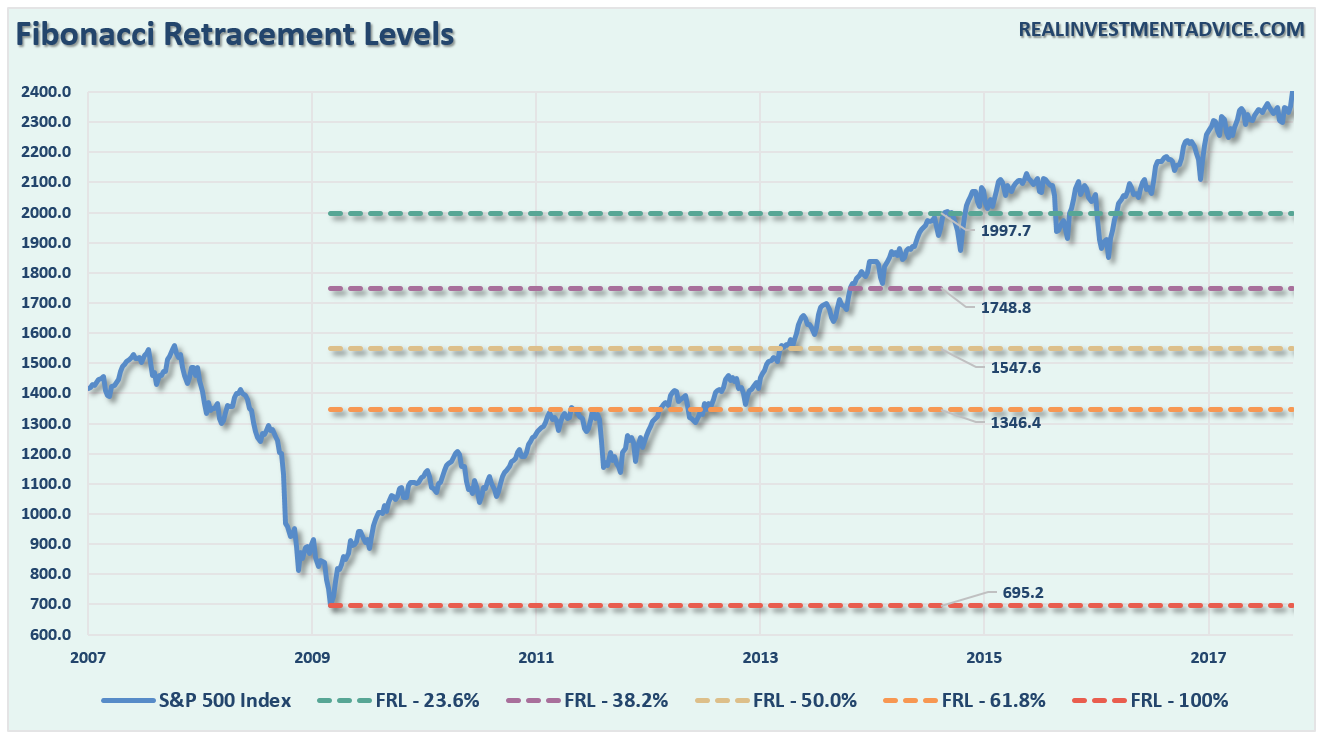

So, how big of a correction would we be talking about? The chart below, once again extrapolated to 2400, shows the mathematical retracement levels based on the Fibonacci sequence. The most likely correction would be back to 2000-ish which would officially enter “bear market” territory of 23.6%. However, most corrections, historically speaking, generally approach the 38.2% correction level. Such a correction would be consistent with a normal recessionary decline and bear market.

Of course, given the length and duration of the current bull-market with extremely weak fundamental underpinnings, leverage, and over-valuations, a 50% correction back towards the 1300 level is certainly NOT out of the question. Let’s not even discuss what would happen if go beyond that, but suffice it to say it wouldn’t be good.

One-Way Trip

The reality is that a breakout and advance to 2400 is actually quite possible given the confluence of Central Bank actions, increased leverage and the embedded belief “There Is No Alternative (TINA).” It would be quite naive to suggest otherwise.

Given the technical dynamics of the market going back to the 1920’s, it would be equally naive to suggest that “This Time Is Different (TTID)” and this bull market has entered a new “bull phase.” (The red lines denote levels that have marked previous bull market peaks.)

Of course, as has always been the case, in the short-term it may seem like the current advance will never end.

It will.

And when it does the media will ask first “why no saw it coming.” Then they will ask “why YOU didn’t see it coming when it so obvious.”

In the end, being right or wrong has no effect on the media as they are not managing money nor or they held responsible for consistently poor advice. However, being right or wrong has a very big effect on you.

Yes, a move to 2400 is viable, but there must be a sharp improvement in the underlying fundamental and economic backdrop. Right now, there is little evidence of that in the making. Either that, or a return to some form of QE by the Fed which would be a likely accommodation to offset a recessionary pull. In either case, it will likely be a one-way trip and it should be realized that such a move would be consistent with the final stages of a market melt-up.

Of course, as Wile E. Coyote always discovers as he careens off the edge of the cliff, “gravity is a bitch.”