Summary

- The US grew at a healthy rate in 2Q.

- The markets sold off on Friday.

- The US-EU trade spat is off for now... hopefully.

So - the trade wars are over, right? The correct answer is sort of. The EU and the US agreed to agree at a later date. There's nothing wrong with this approach; at the bare minimum, it gets the parties to stop adding tariffs to the mix. This decreases cross-Atlantic tension that's been more than apparent for the last 6-12 months. The tough part is the EU and US have laid out some very ambitious goals like lowering all tariffs to 0%. Politically, that's not going to happen. We also have NAFTA and China tensions to worry about, so all is not perfect yet. But this is a start.

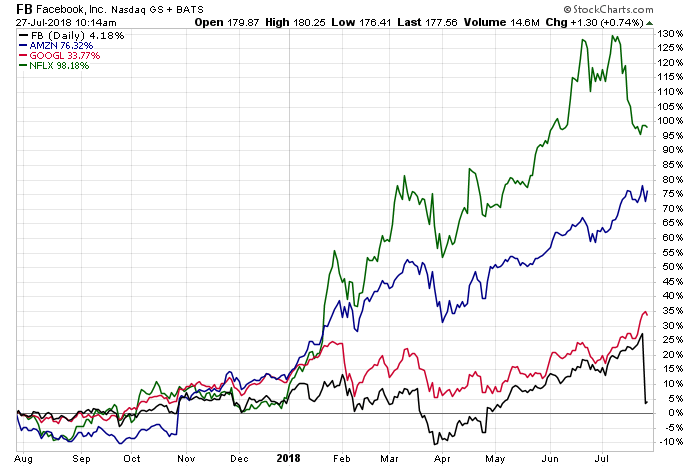

This market has been driven in large part by the outperformance of the FANG stocks: Facebook (NASDAQ:FB), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX), and Google (NASDAQ:GOOGL). All is not perfect with our four-member group. From the NY Times:

It had become an article of investor faith on Wall Street and in Silicon Valley: Quarter after quarter, year after year, the world's biggest technology companies would keep raking in new users and ever-higher revenue. And with that, their share prices would continue to march upward, sloughing off any stumbles.

This week, that myth was shattered. And investors responded Thursday by hammering the stock of Facebook, one of the world's most valuable companies. Shares of the social media giant fell 19 percent, wiping out roughly $120 billion of shareholder wealth, among the largest one-day destruction of market value that a company has ever suffered.

This shouldn't come as a surprise, if for no other reason than the old maxim that nothing lasts forever. Here's a comparison chart of all four companies for the last year to provide some context:

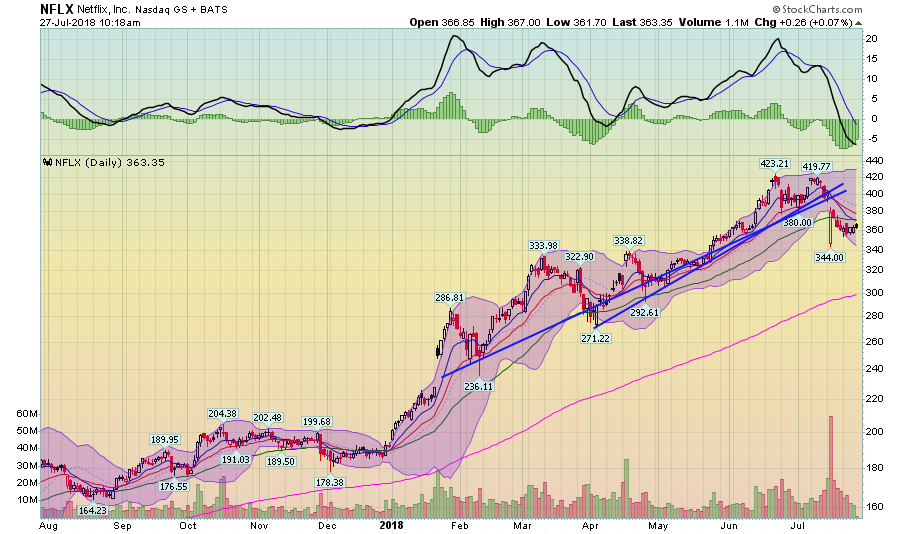

Facebook's sharp drop is more than apparent. Netflix is certainly not immune to problems, however. It lost about 14% over the last month while breaking an uptrend on its daily chart:

Google and Amazon are still in an uptrend, which certainly helps. But the mighty FANG stocks are not so mighty anymore.

Finally, not only did the US grow at a solid rate in the 2Q18, but also the Atlanta Fed's Nowcast proved to be pretty accurate, calling for a 3.8% growth rate. The Blue Chip consensus from the report was fairly accurate. The NY Fed's model was a bit further off, arguing for a 2.78% rate. It's still a bit early for 3Q guestimates.

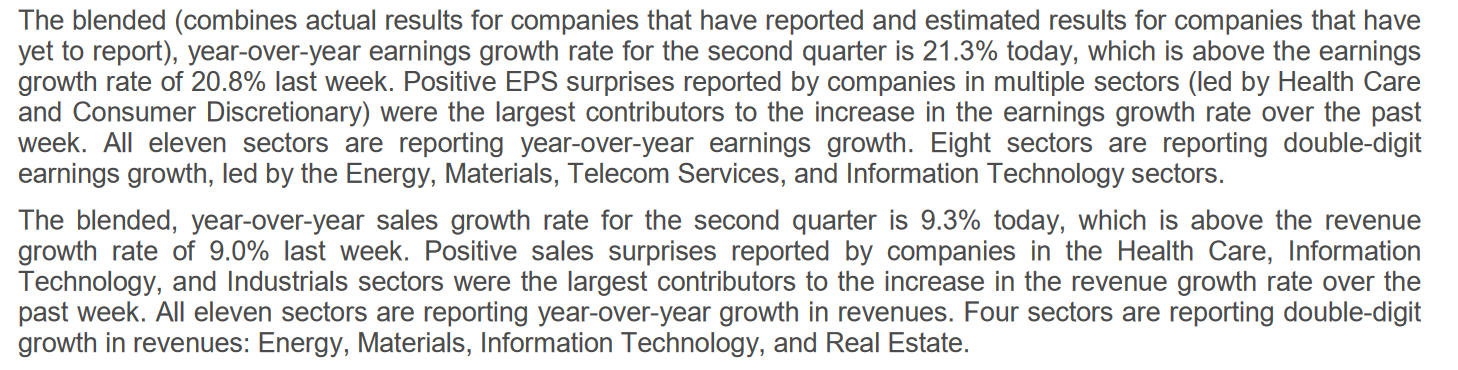

Earnings season is well underway. The results have been strong:

Between the solid economic performance and earnings growth, there is plenty to support the market.

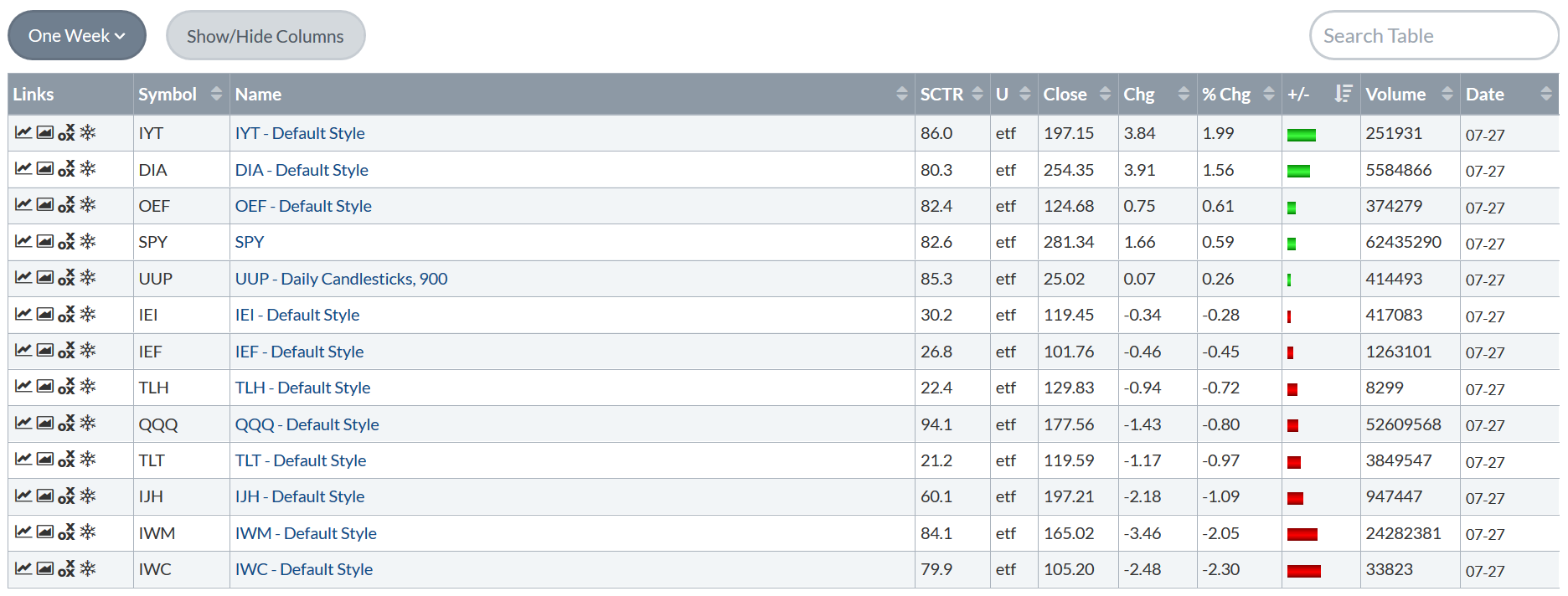

And speaking of the market, let's now look at how various indexes performed:

This was an interesting week. First off, the transports were the big winner. Then, we have the indexes that are composed of larger companies - the iShares S&P 100 (NYSE:OEF) and SPYs. These are followed by three ETFs from the Treasury market and finally by mid caps and small caps.

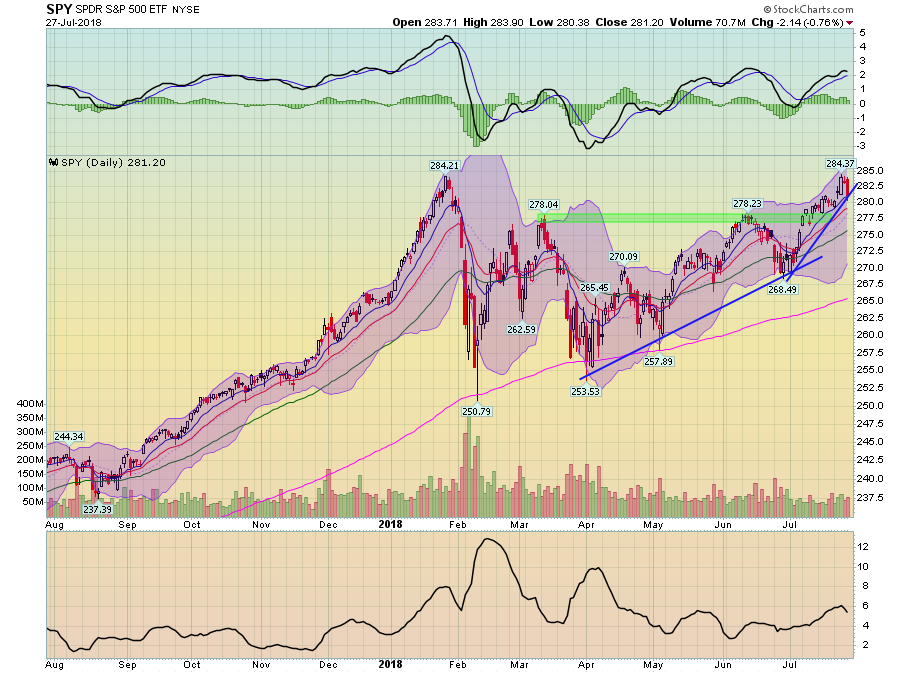

Let's turn to the daily charts, starting with the SPDR S&P 500 (NYSE:SPY):

Overall, this is still a bullish chart. Momentum is rising; prices are still in an uptrend, using the EMAs for technical support. So why was there a big sell-off on Friday? The most common explanation that I've seen is that weak tech earnings brought the bears out. But I have a better one: strong growth means more Fed hikes are in the cards.

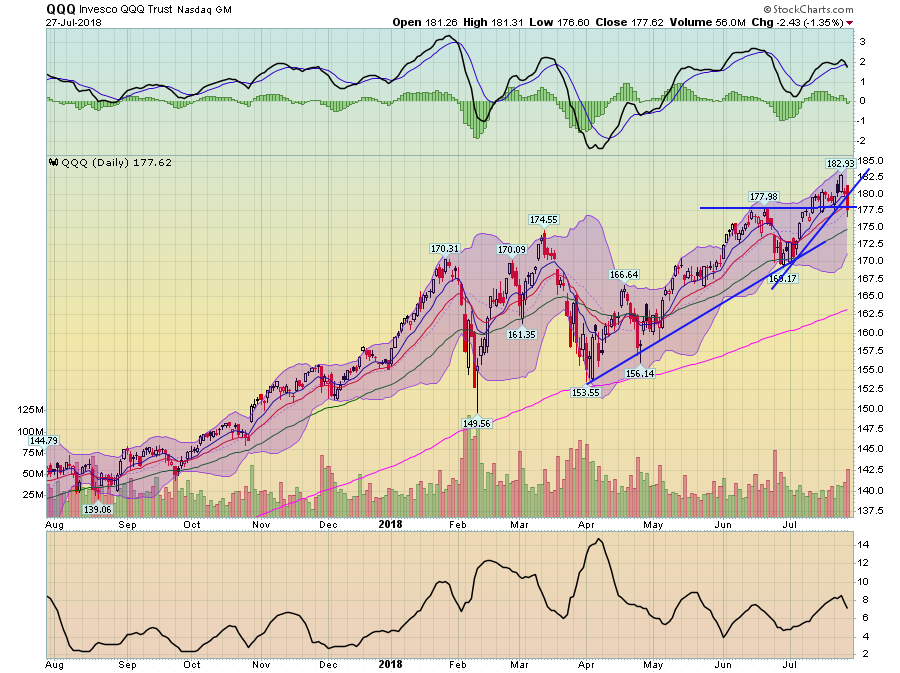

We see a sharper drop in the PowerShares QQQ Trust Series 1 (NASDAQ:QQQ):

Here, prices not only broke a short-term uptrend on higher volume but we also see a sell signal coming from the MACD.

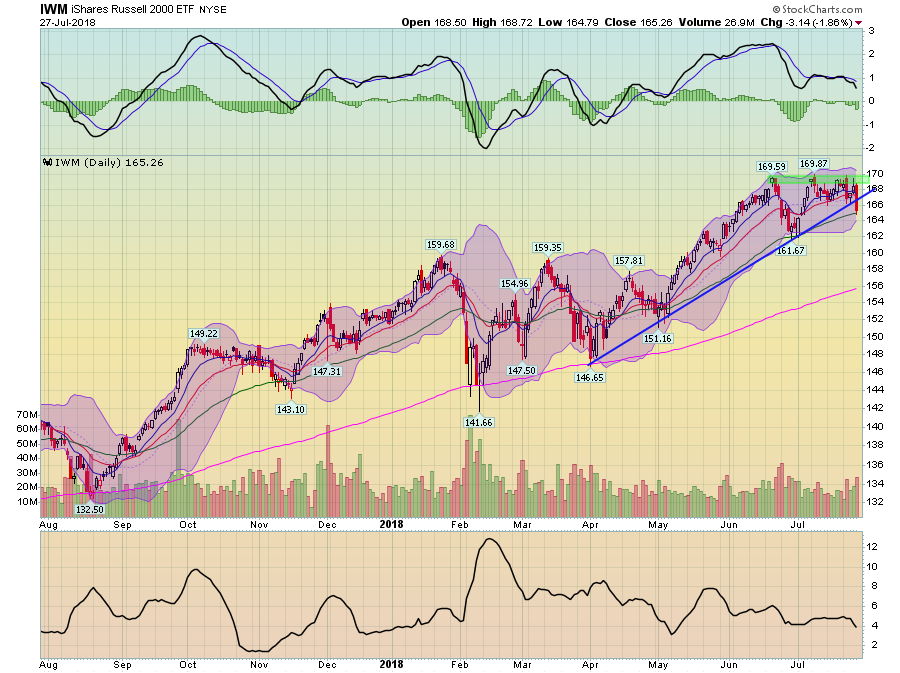

And finally, there are the iShares Russell 2000 (NYSE:IWM):

Here there's a weaker technical picture (MACD crossover) along with prices breaking an uptrend.

Friday's price action sets up a really interesting potential dynamic. Next week, the Fed has its next meeting. We already know it intends to keep raising rates. But what if the Fed implies that the pace of increases will, well, increase?

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.