Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Summary

Brexit could be one of those random events that causes a recession.

Ten years later, we still have no prosecutions for anything related to the financial crisis.

The markets did nothing today.

So -- what exactly causes a recession? Here's how it actually works: the economy is humming along. People are spending money, business is hiring, and trade is flourishing. Everyone is happy. Then, something upsets the applecart. Sometimes it's oil prices; sometimes it's a really nasty financial shock (2008 anyone?). Other times it's the Federal Reserve "taking away the punchbowl" (kind of like when your parents arrived home early during your party). But, there's a big, ugly nasty shock that's the economic equivalent of throwing a giant boulder into a calm and tranquil pool, sending ripples and waves God knows where. That's what could be developing between the UK and EU regarding Brexit. Teresa May has come up with a "Chequers Plan" that is basically EU light. Under this proposed arrangement, the UK will have a common market like the one Norway has with the EU. And, UK courts will take their lead from EU rulings on the trade in goods -- which isn't going to go over well with conservatives. They're so thrilled with this plan that they're thinking about ousting her. Of course, it's not like they have any idea that's better. As of now, the UK is hurtling towards its Brexit date like a bug flying towards the windshield of a car going 100 MPH in the opposite direction. That, ladies and gentlemen, will create one hell of an economic shock.

I've been seeing a number of 2008 financial crisis articles. So, let me add this one point: why in the name of God were there no criminal prosecutions? I've seen the central theory that doing so would have destabilized the financial system to an unwanted degree, especially at a time when it was very fragile. I call BS on that. You can't tell me that in the mortgage market there wasn't full knowledge of the problems all the way up the corporate food chain. And that's before we look at the rating agencies who stamped AAA on grade A crap. The fact that no one did a frog walk will go down in history as one of the greatest acts of criminal justice malfeasance of all time.

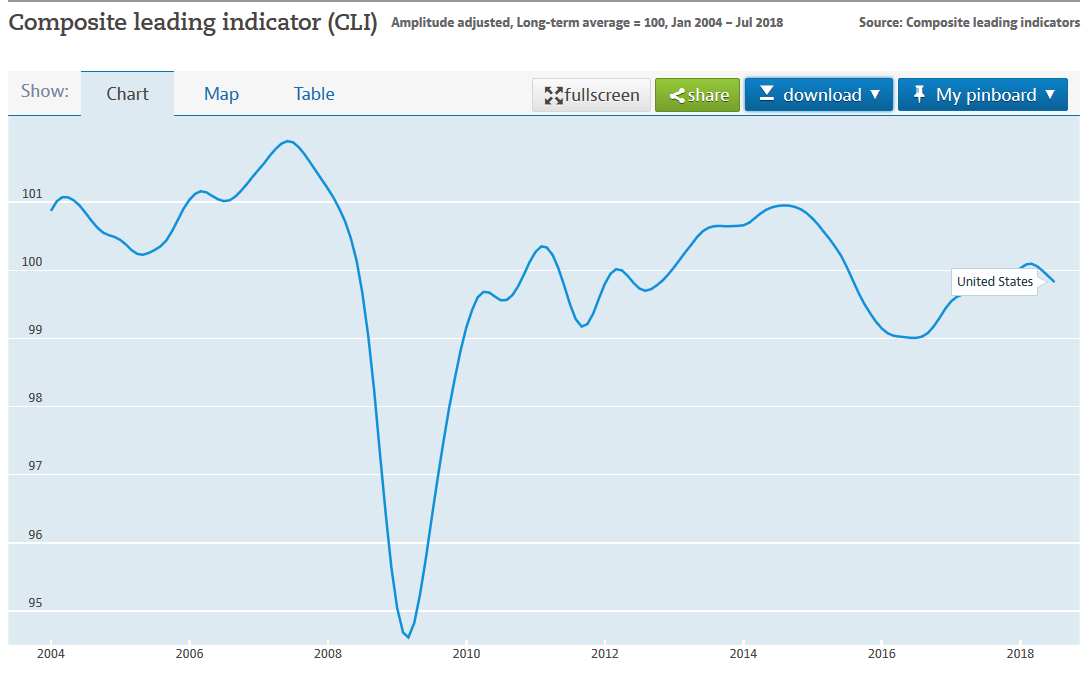

So far, 3Q GDP looks pretty good. The Atlanta Fed is predicting 3.8%. This is way above the Blue Chip consensus -- which is also contained on the Atlanta Fed's table. But the Atlanta Fed's prediction for 2QGDP was pretty good. The NY Fed's prediction is a bit lower, clocking in at 2.23%. However, in an interesting little twist, the OECD's leading indicator for the US is down:

This stands in contrast to the Conference Board's numbers, which was up .6% in the latest report. And I'd be remiss if I didn't shamelessly promote my own Turning Points analysis, which sees no recession in the next 6-12 months.

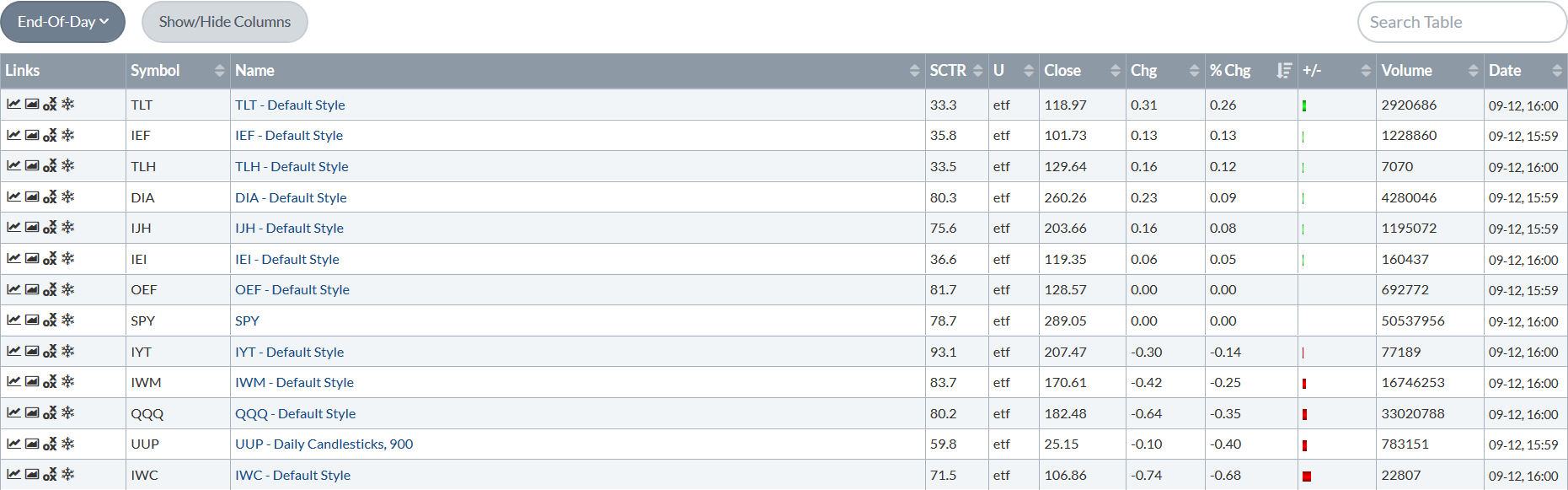

Turning to the markets, this was literally a nothing day:

Today's market is brought to you by the words, bupkiss, zilch, and nada. Just nothing happening.

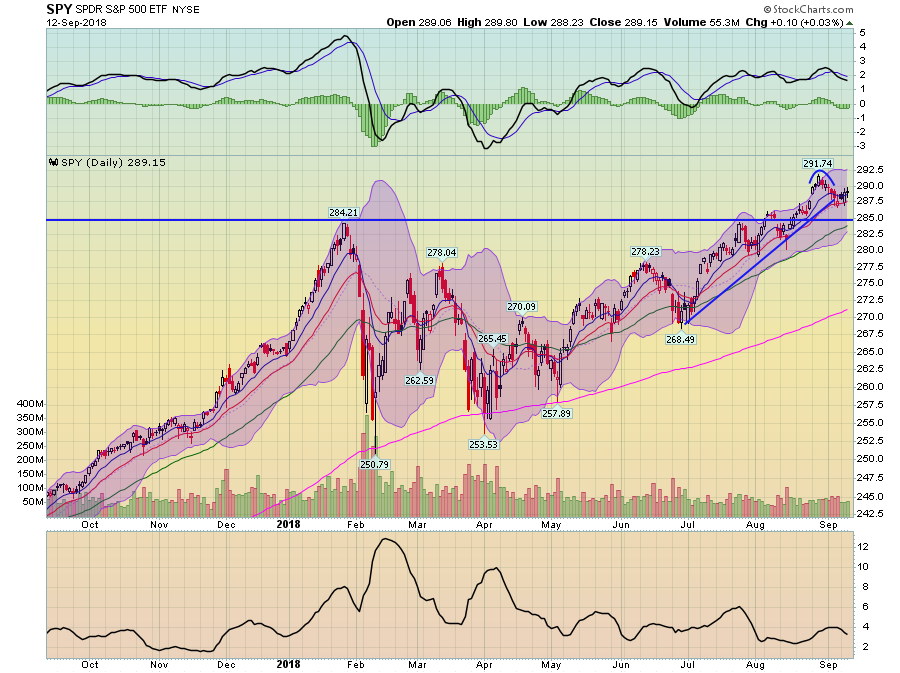

Which means we're still left with this:

Prices broke technical support a few days ago. But instead of moving lower to the highs of late January (284.21), they moved a touch higher. But all of the candles are really small and the volume is non-committal at best. The 2-week chart really captures this well:

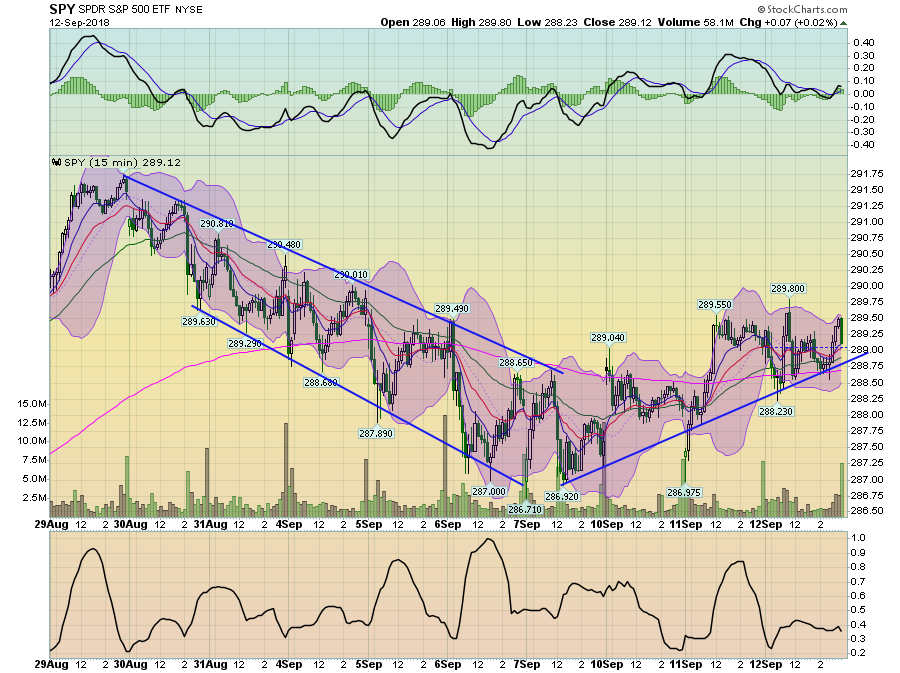

Prices moved lower in a channel pattern between late August to mid-September. Notice how prices moved lower and then moved higher in a very disciplined way. For the last few days, prices have been moving higher. But there's a whole lot of nothing in that chart. It's just as likely to describe the price action as meandering as anything else.

Right now, we're waiting for something to spark a move in one direction of the other. We just don't know what that is.

Disclosure:I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.