Summary: Technically Speaking For March 5

- The latest ISM non-manufacturing report showed a strong rebound from the previous report's decline.

- The RBA kept Australian interest rates at 1.5%; they noted increased downside risks to the global economy.

- We're seeing the daily charts of the major indexes do a slow-motion rollover.

The latest ISM non-manufacturing report was very bullish. The headline number increased 3 points to 59.7. The sub-categories numbers were especially encouraging. Production rose 5 to 64.7; new orders added 7.5 to 65.2; new exports advanced 4.5 to 55. The anecdotal comments contained some concerns about the tariffs. One comment was especially interesting (emphasis added):

However, we do believe it will be a short-lived issue. In the long term, tariffs will force our suppliers to source elsewhere, which will levy more competition from manufacturers in other low- or non-tariffed countries and even in the U.S. Ultimately, the tariffs will force an improvement to the overall supply chain and better mitigate supply risk in our industry. (Management of Companies & Support Services)

This makes sense from a microeconomic perspective. An increase in costs should lead market participants to locate lower-sourced goods (if they exist).

The Reserve Bank of Australia kept short-term rates at 1.5%. Because Australia is more export-dependent, they are a bit more aware of and sensitive to international developments. Here is how the bank described the international economic environment:

The global economy grew above trend in 2018, although it slowed in the second half of the year. The slower pace of growth has continued into 2019. The outlook for the global economy remains reasonable, although downside risks have increased. The trade tensions remain a source of uncertainty. In China, the authorities have taken further steps to ease financing conditions, partly in response to slower growth in the economy. Globally, headline inflation rates have moved lower following the earlier decline in oil prices, although core inflation has picked up in a number of economies. In most advanced economies, unemployment rates are low and wages growth has picked up.

This paragraph simply confirms what others have already said.

The latest flash Markit economics PMI data was mixed. On the plus side, the Japanese service index rose .7 to 52.3 while the composite was down .2 to 50.7. Japan's service sector experienced strong order growth while the manufacturing order book declined. The Chinese service index was down from 53.6 to 51.1. Manufacturing was fractionally higher. The EU composite was up .9 to 51.9; the service sector increased from 51.2 to 52.8. New orders for the manufacturing sector declined the most in six years while the service sector production was up modestly.

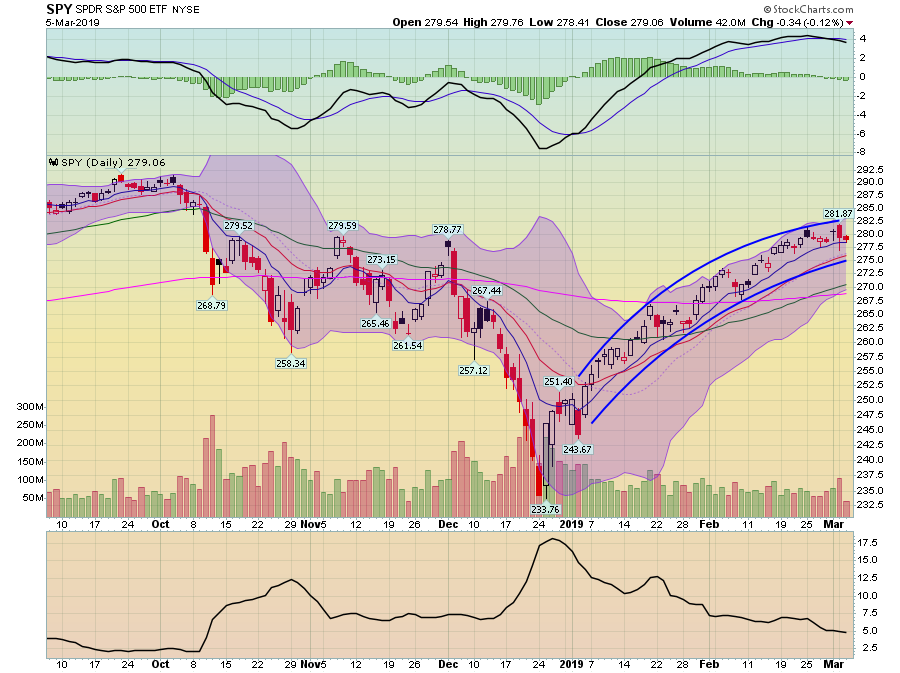

Once again, the markets moved very little today. The Nasdaq and SPY (NYSE:SPY) were both near unchanged while the transports dropped .76. The IWM was down .43.

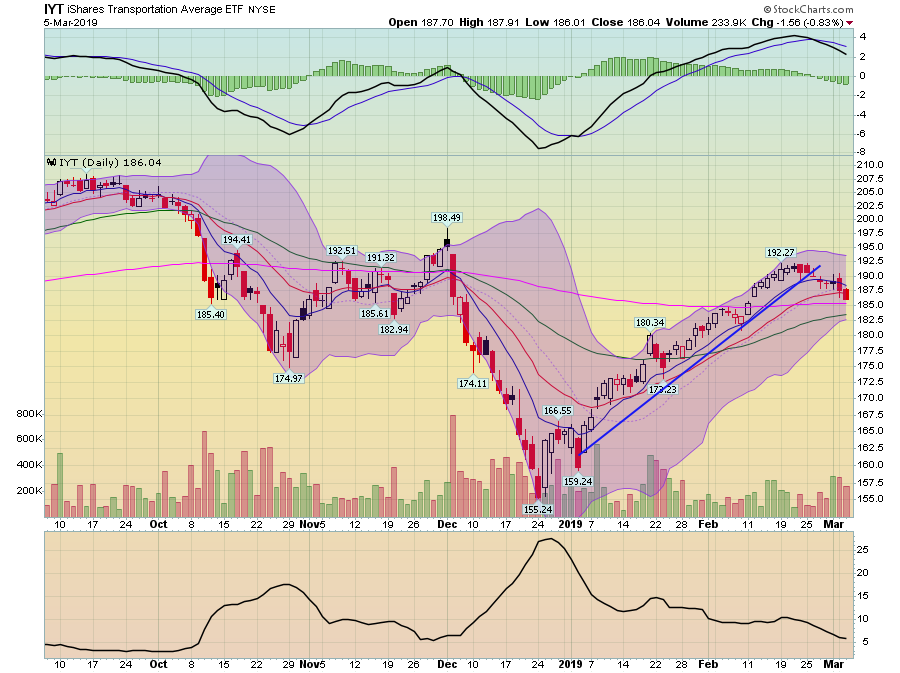

The market has had a very difficult time moving higher over the last few weeks. But if you look at the daily charts, it's looking more and more like the major indexes are rolling over. Let's start with the transports:

The IYT broke its trend a little over a week ago and has been moving modestly lower since. Prices have moved through the 10 and 20-day EMA and look to be targeting the 200-day EMA for technical support. The MACD has given a sell signal.

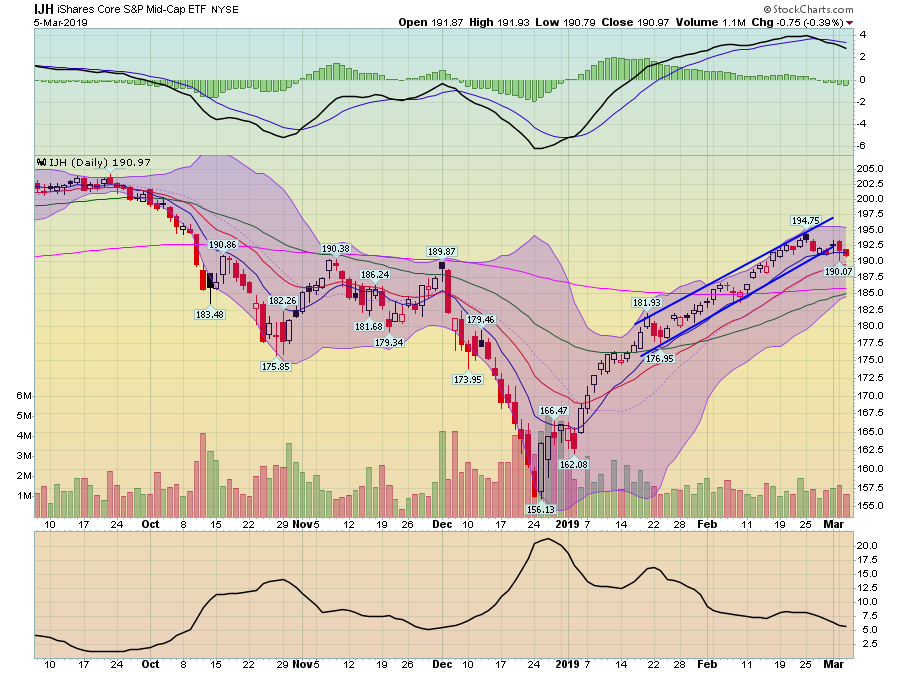

The mid-caps are right at the 10-day EMA but have also broken their trend. Its MACD has also given a sell signal.

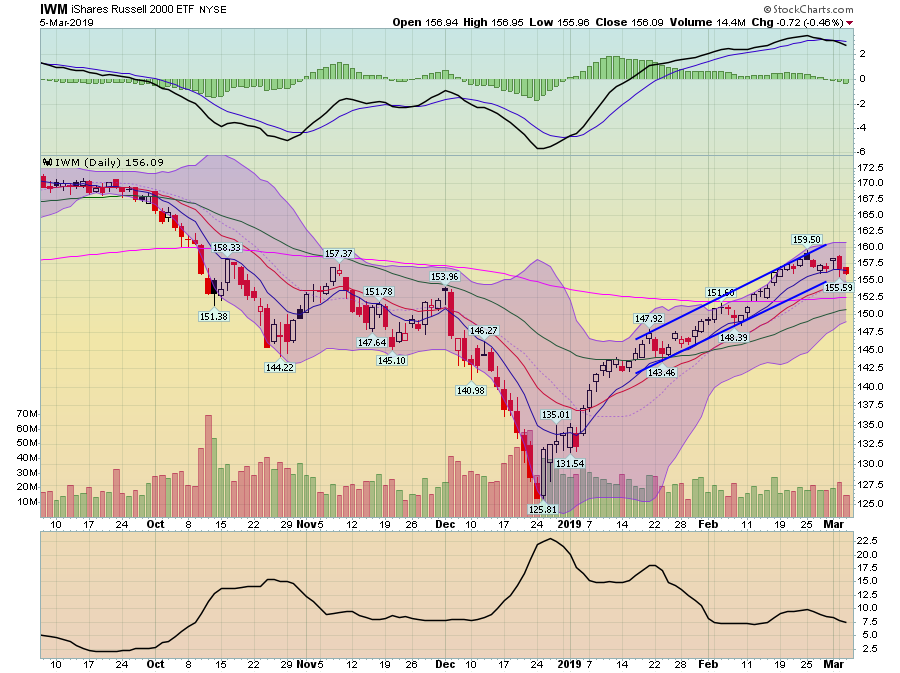

The IWM is still above its short-term trend line but has been moving sideways for a little over a week. Prices are at the 10-day EMA; the MACD has given a sell signal.

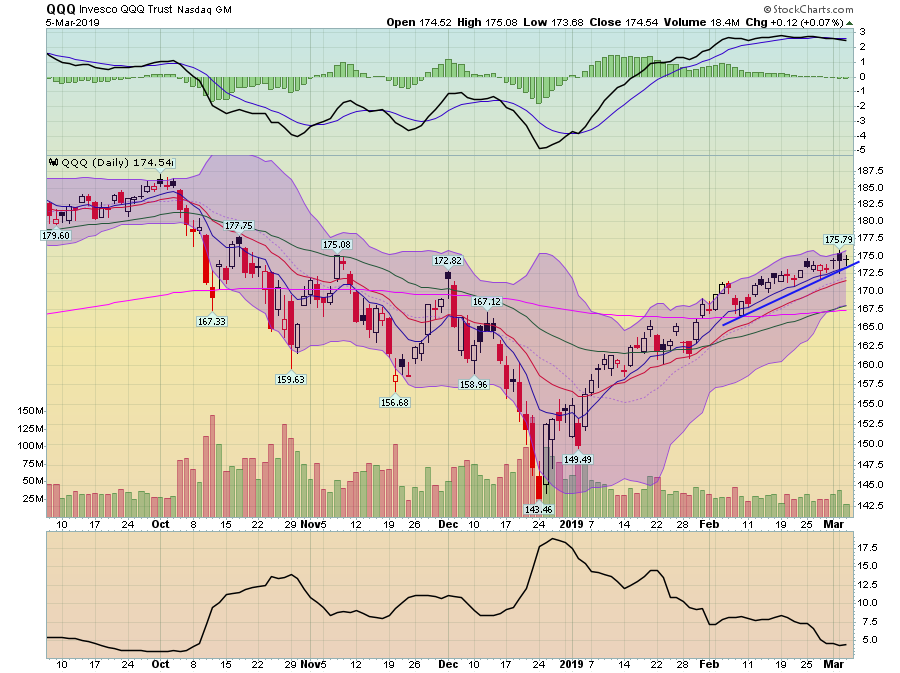

The Nasdaq is still in an uptrend but its MACD is borderline sell.

The SPY looks to be forming a long parabola. Its MACD has also given a sell signal.

The leading indexes (the transports) and the riskier averages (the mid and small caps) have broken trend. None are moving significantly lower. Instead, they are more drifting. The major indexes are still in uptrends but with declining momentum. At best, it's looking as though the markets will be moving sideways for the time being.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.