Technically Speaking For June 11: The Rally Is Sputtering

Summary

- Anti-trust is making a comeback.

- Inflation expectations are low.

- The daily charts don't support the bulls.

Anti-trust is making a comeback. From today's NY Times (emphasis added):

The Justice Department is examining complaints against Google (NASDAQ:GOOGL) and Apple (NASDAQ:AAPL), while the F.T.C. will handle antitrust issues related to Facebook (NASDAQ:FB) and Amazon (NASDAQ:AMZN). Last week, the House Judiciary subcommittee on antitrust also announced plans for an investigation into whether the tech companies stifled competition and hurt consumers. The first hearing is scheduled for Tuesday.

Combine that with a clear pro-enforcement tilt from leading Democratic contenders and a President who is suspicious of big tech, and you have the beginnings of a recipe to seriously challenge Google, Amazon, and their brethren. These companies have gotten the message; they are increasing political contributions and hiring lobbyists to blunt this assault. Investors should remember that tech represents over 20% of the SPY and 40% of the QQQ; the markets would have an extremely difficult time advancing without these companies.

There's good news on the demographic front. From Calculated Risk:

By the year 2020, 8 of the top 10 cohorts will be under 40 (the Boomers will be fading away), and by 2030 the top 11 cohorts will be the youngest 11 cohorts (the reason I included 11 cohorts).

Potential GDP is population growth plus productivity growth. In addition, a younger population increases the amount of productive capacity in the economy. In the long run, this is an incredibly important - and positive - development.

Inflation expectations are low. From the NY Fed:

The May survey shows median inflation expectations declined by 0.1 percentage point at both the one- and three-year horizons, to 2.5 percent and 2.6 percent, respectively, again marking their lowest readings since late 2017. The declines were broad-based across income and age groups. Home price change expectations remained subdued at their recent low level of 3.0 percent. Households were generally less positive about their current and future financial situation, even though their average expectations for earnings growth and finding a job improved.

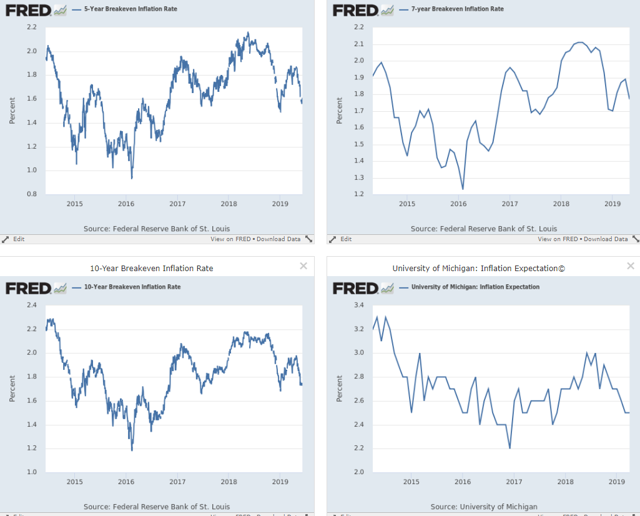

Measures from the bond market are even lower:

The top two panels show the 5-year (left) and 7-year (right) break-even inflation rate, defined as the difference between the Treasury and its corresponding TIP security. The bottom left panel shows the 10-year rate. All three are at low levels. The lower right panel shows the University of Michigan's inflation expectation, which is also declining. Inflation expectations are a key component comprising interest rates.

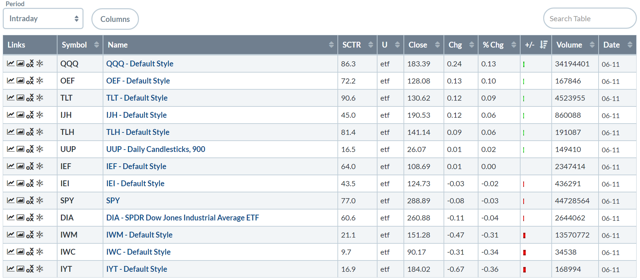

Let's turn to today's performance table:

Today's performance was disappointing. The QQQ was up marginally, but so was the entire Treasury market complex. Most of the equity indexes were down with the micro and small-caps leading the market lower. While the losses weren't that large, they were still off.

And the charts are less than encouraging for the bulls.

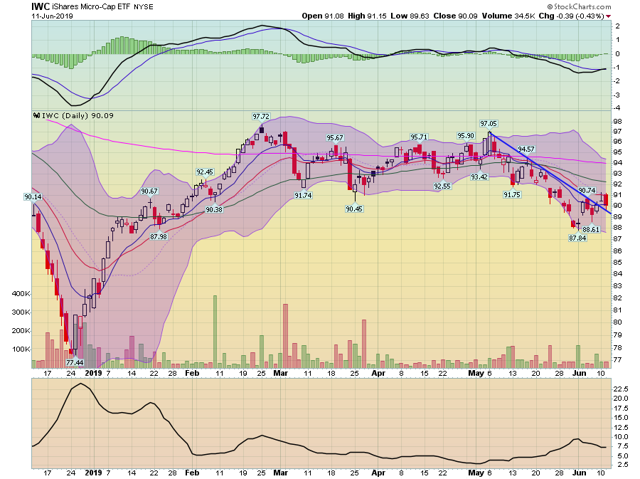

This chart should most concern the bulls. Although the micro-caps have broken through resistance, they have struggled to gain any upside traction. Today, they started at the 20-day EMA and moved lower.

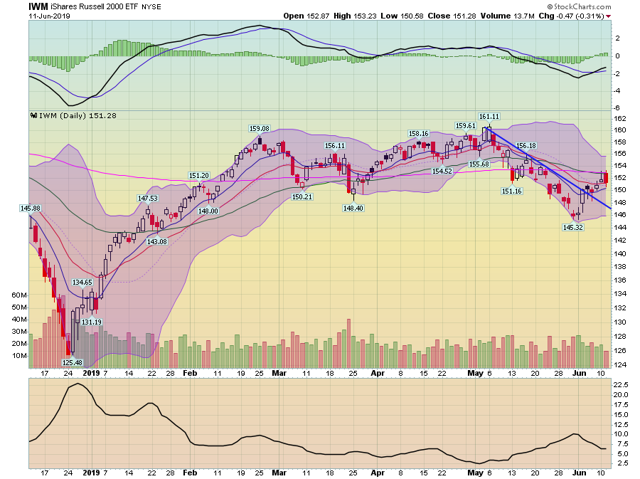

Small-caps have performed better; they've gained a bit since breaking through resistance. But volume is declining during the rally, indicating less enthusiasm for the upside equity trade. And today, prices hit the 200-day EMA and moved lower.

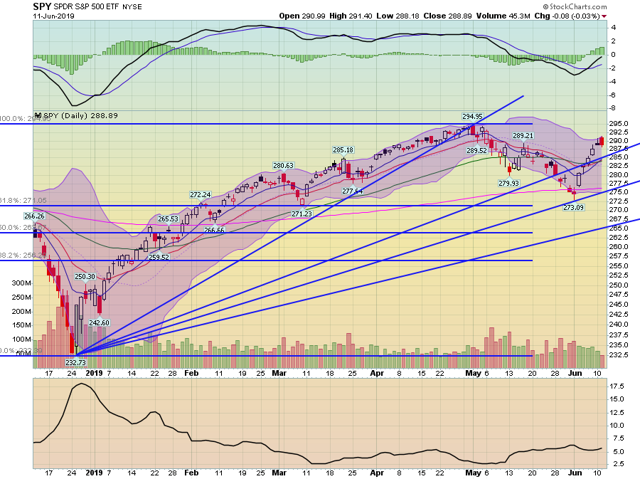

While the SPYs have gained, they, like the IWMs, have seen declining volume.

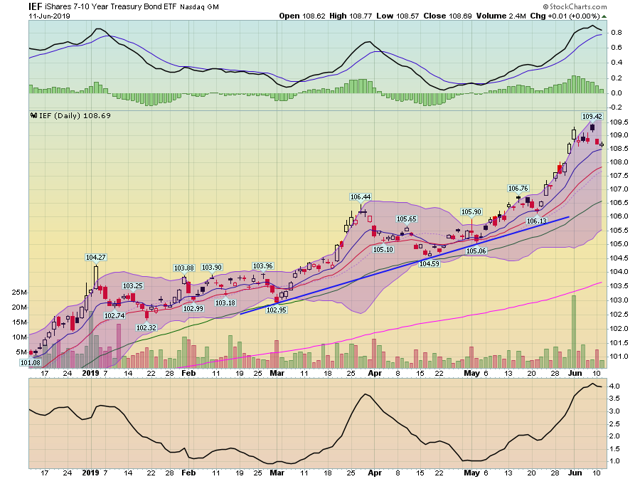

And topping it off is the IEF, which is consolidating gains at high levels.

The markets continue to have the same problems: a Treasury complex that is rallying and small-caps that are underperforming large-caps. Until that changes, this rally is less than impressive.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.