Summary

- Budgetary shenanigans are increasing uncertainty at time when we really need stability.

- The BEA released the last estimate of 3Q GDP.

- The markets continue to move lower.

I'll be celebrating the holidays on Monday and Tuesday and will resume writing on Wednesday.

Markets don't like uncertainty, yet that's what we've had for the last few weeks regarding the government shutdown. At a time when the possibility of economic shocks caused by trade issues, Brexit, and rising interest rates are increasing, we now have an entirely avoidable work stoppage that will decrease the amount of money flowing into the economy. That's not a good development -- especially when the 3Q18 GDP predictions are pointing towards slower growth.

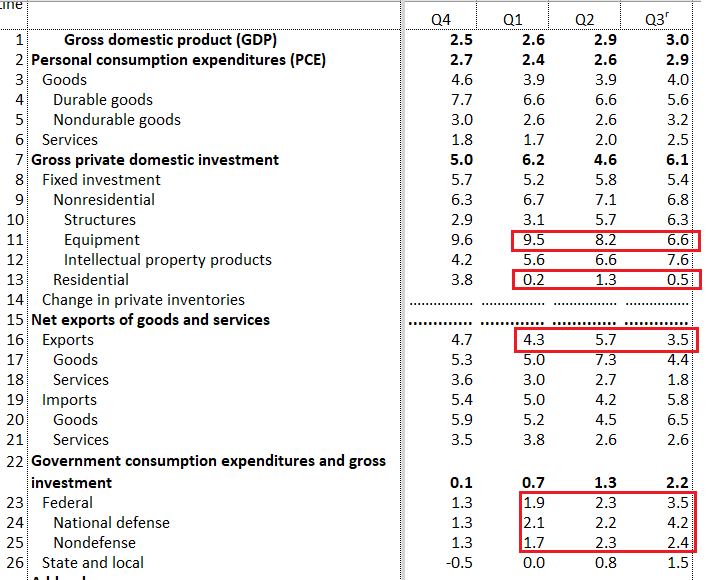

The BEA released their last estimate of 3Q GDP (below are Y/Y percentage change numbers):

I've outlined in red a few key details. While investment in equipment is still at solid levels, it is decreasing. Businesses have implemented previously agreed to plans, but they're probably delaying future spending. Residential investment remains weak. There was a fairly large export bump in the 2Q, as businesses got orders out in anticipation of tariffs. Orders decreased in the 3Q probably because they were pulled forward into the second. Finally, notice the nice increase in government spending -- especially the 4.2% Y/Y increase in defense spending. Remember that long-ago the Pentagon spread spending out across the country to gain leverage over Congress, which means an increase in spending hits the entire country.

Tim Duy on the Fed [emphasis added]:

So how do we get there? The starting point to that conversation is recognizing that the Fed more likely than not made an error by boosting rates this month. Growth is slowing and inflation remains low while downside uncertainty is on the rise. While the Fed resists reacting to financial markets, the reality is that the downdraft in equities has gone on long enough to warrant additional caution. There is also plenty to worry about on the international side of the equation, from China to Brexit. And finally, policy uncertainty only increases with each passing day of the Trump administration.

The Fed is a big fan of models and most likely based their latest decision on them, but there's plenty of information out there supporting a pause. As I noted in this week's bond market review, the Beige Book report -- which is based on anecdotal information -- contained a number of comments about a slowing economy. Corporate bond yields are rising, short-term funding costs are increasing, housing and auto sales are slowing, and the yield curve is flattening. And, as Duy notes, there is plenty to worry about internationally as well. The Fed really should turn away from their computers and back towards the real-world data over the next few months.

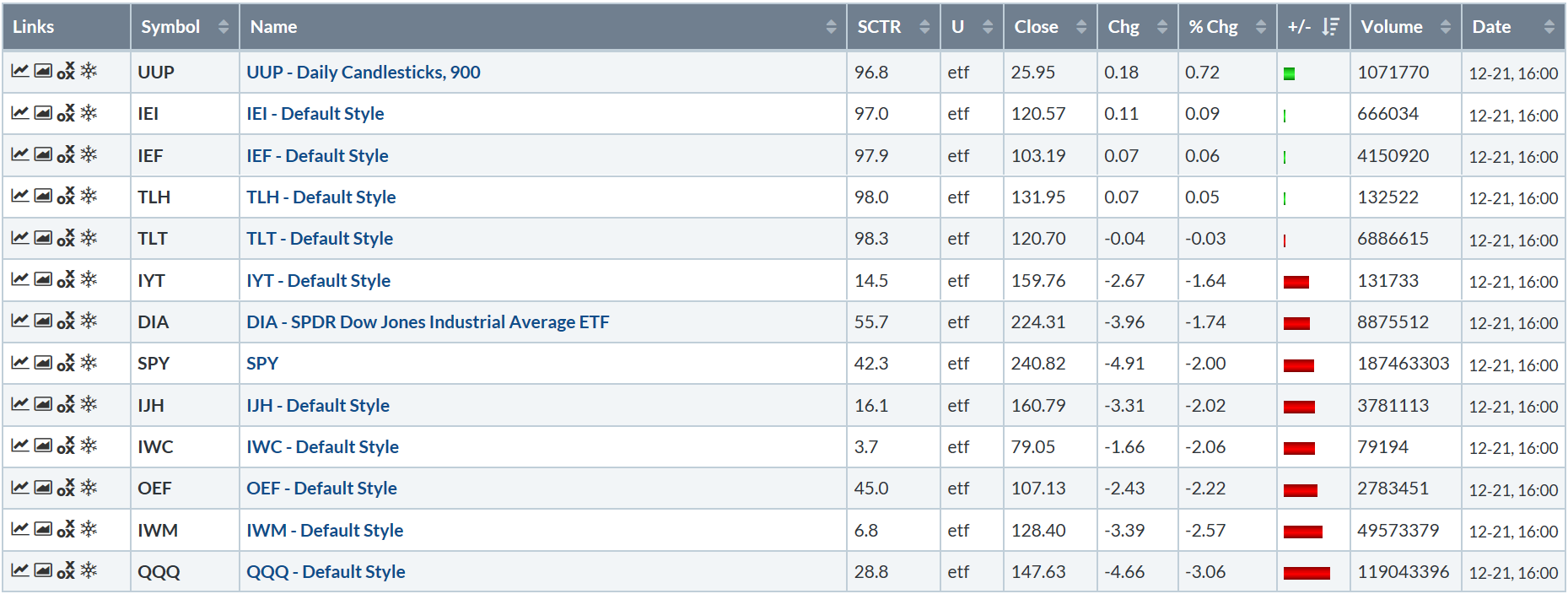

Let's turn to today's performance table:

Despite the trading day starting out well, it ended badly with all the major markets down - again. The NASDAQ led the way, again, followed by the (NYSE:IWM) and (NYSE:OEF). The "best" performer was the Transportation average, and it was down over 1.5%. This is not the way we wanted to enter the holiday season.

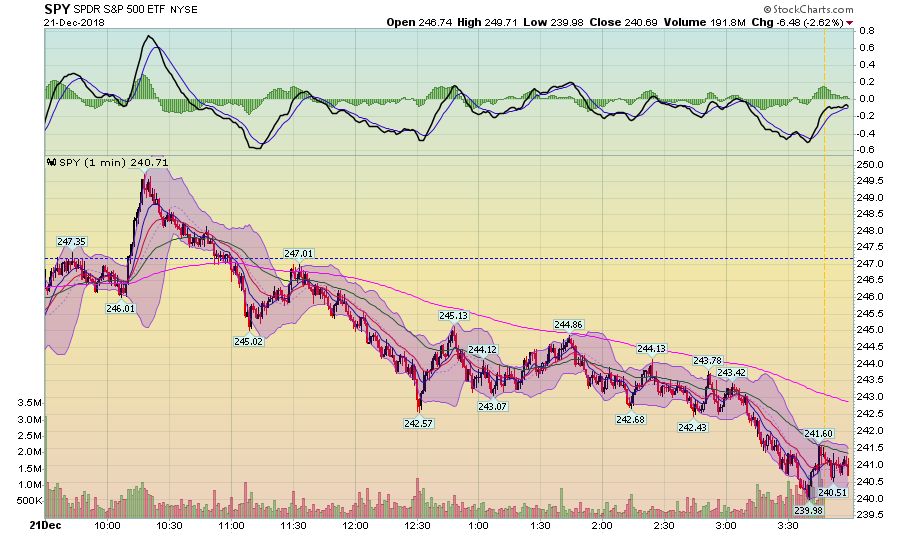

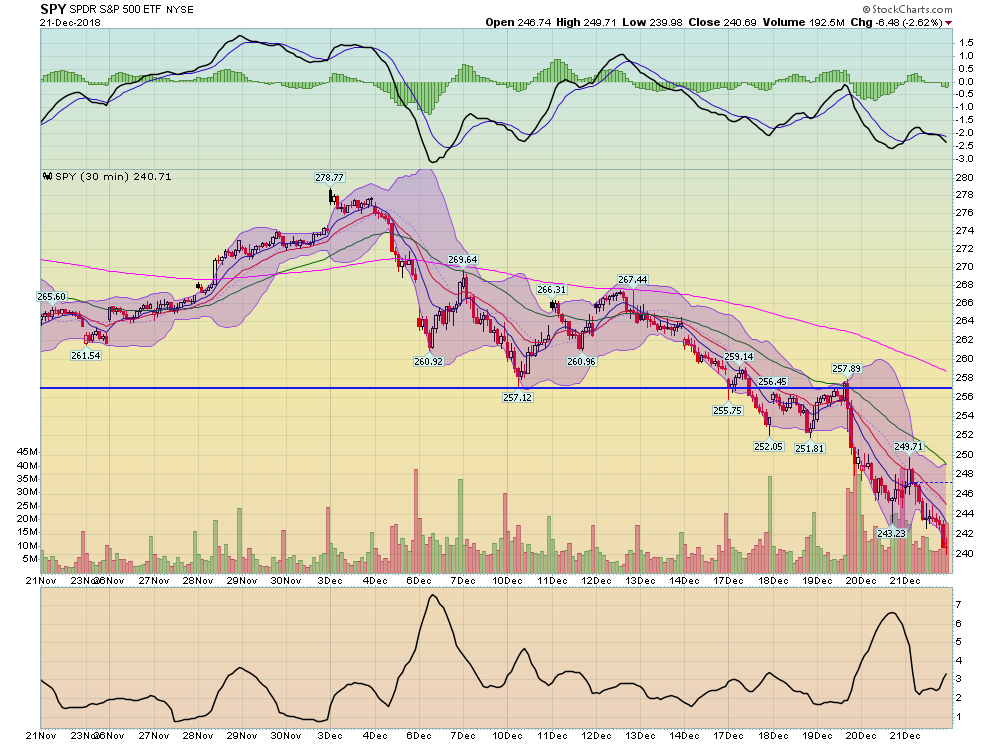

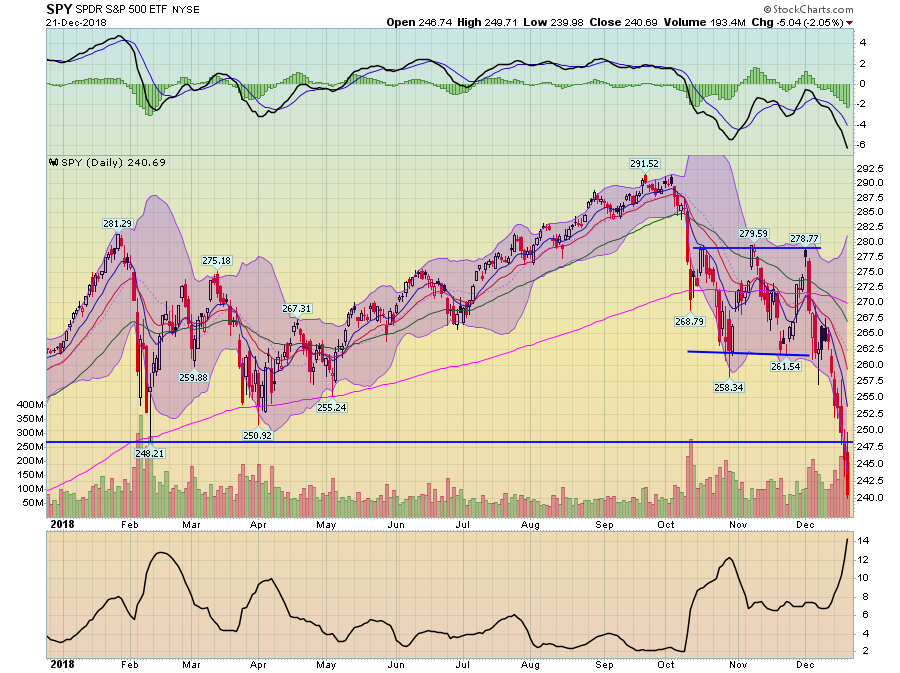

Let's look at some of the key SPY (NYSE:SPY) charts to determine if there is any bullishness anywhere (hint -- there isn't).

Prices tried to rally above yesterday's close but couldn't keep the momentum up. They spent the rest of the day moving lower, ending just slightly above the daily low. Notice the 200-minute EMA was mostly trending lower, as were the other, shorter EMAs.

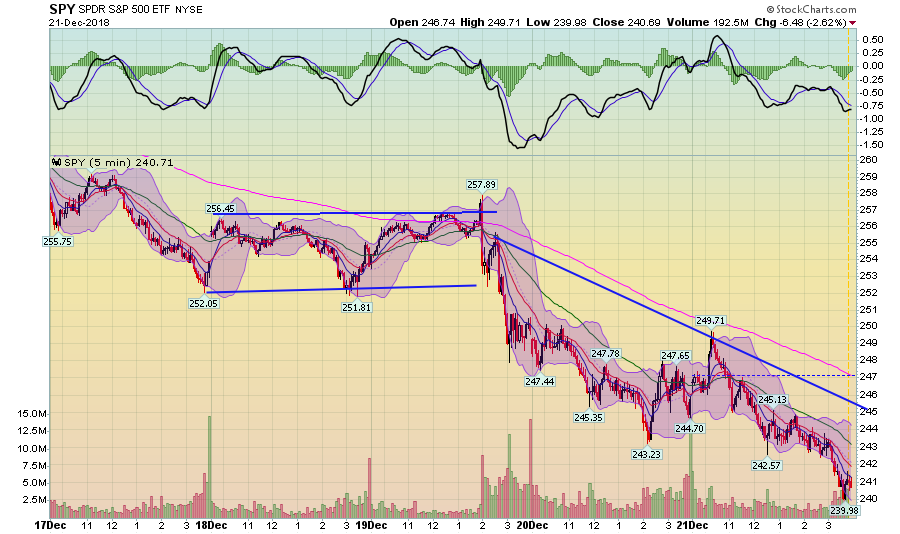

On the 5-day chart, we now see that prices tried to form a short-term bottom early this week. But, prices didn't hold and they continued moving lower on Thursday and Friday.

The 30-day chart is at monthly low as is ...

.... the daily chart.

Insert your "lump of coal" comment here. The market is just ugly right now. About the only good thing is that we have a weekend and short-trading day on Monday.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.