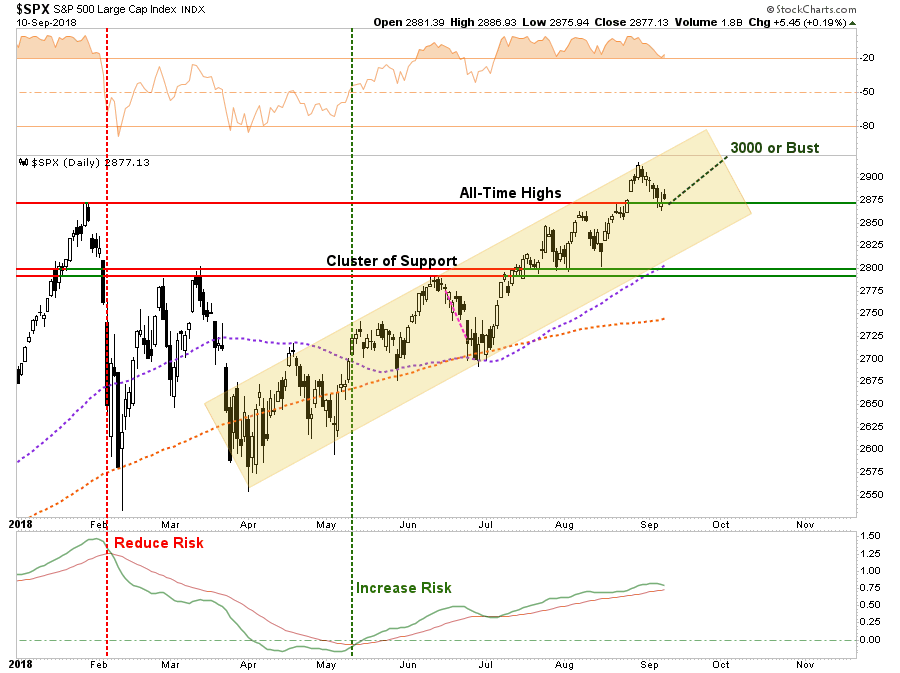

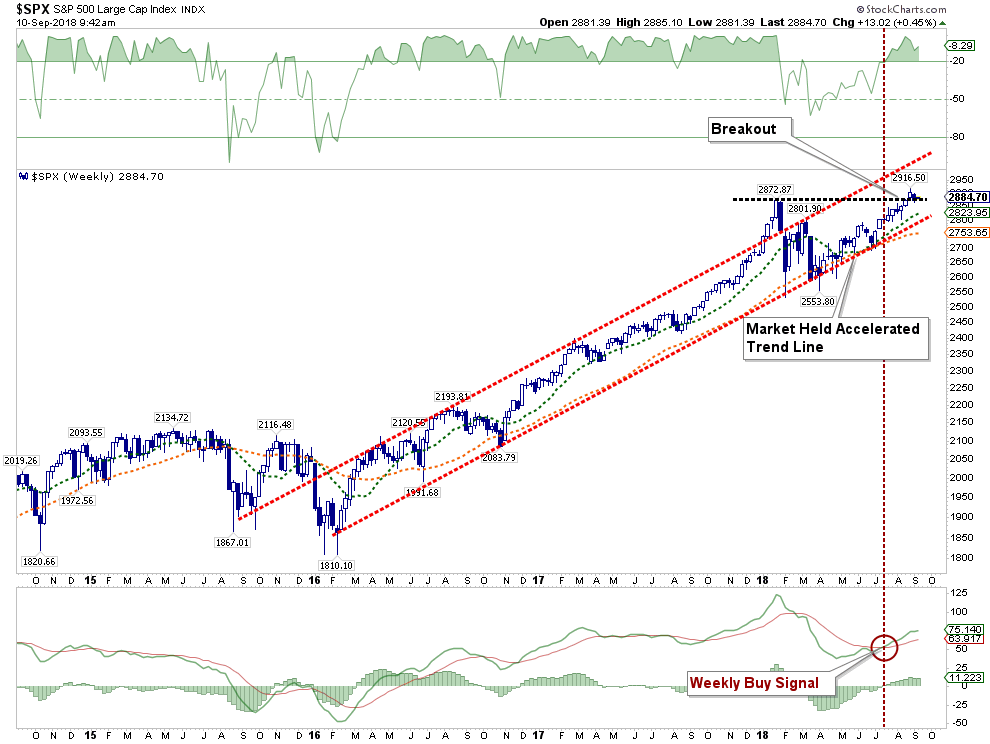

A couple of weeks ago, I discussed the recent breakout to “all-time” highs and the potential run to 3000 for the S&P 500 index.

“Regardless of the reasons, the breakout Friday, with the follow through on Monday, is indeed bullish. As we stated repeatedly going back to April, each time the market broke through levels of overhead resistance we increased equity exposure in our portfolios. The breakout above the January highs now puts 3000 squarely into focus for traders.

This idea of a push to 3000 is also confirmed by the recent ‘buy signal’ triggered in June where we begin increasing equity exposure and removing all hedges from portfolios. The yellow shaded area is from the beginning of the daily ‘buy signal’ to the next ‘sell signal.'”

Importantly, at that time I specifically noted:

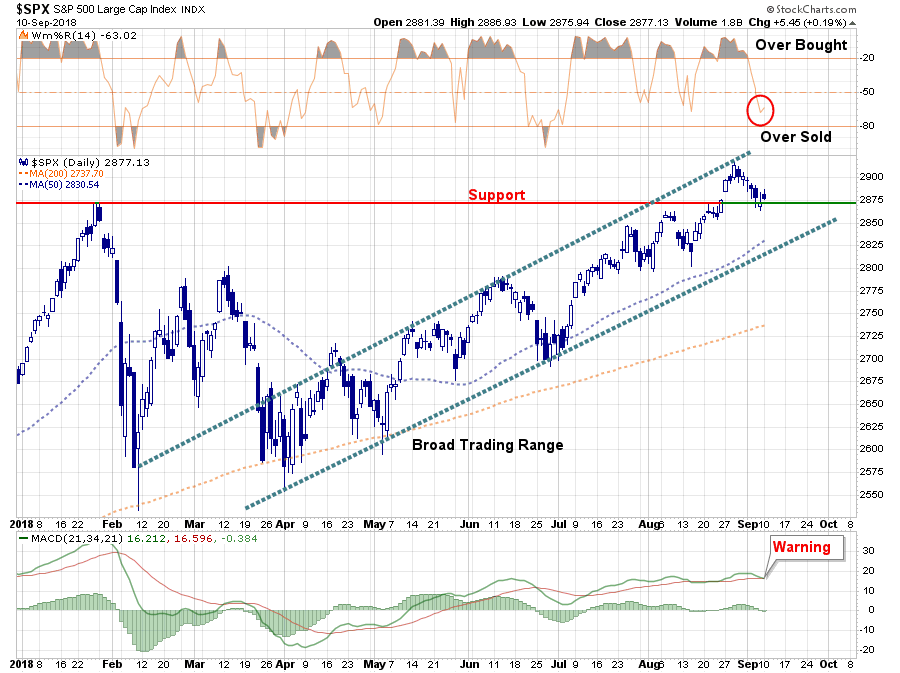

“However, with the markets VERY overbought on a short-term basis, we are looking for a pullback to the previous ‘breakout’ levels, or a consolidation of the recent gains, to increase equity exposure further.”

That pullback occurred last week providing a very short-term trading opportunity with a higher reward/risk ratio than what existed previously.

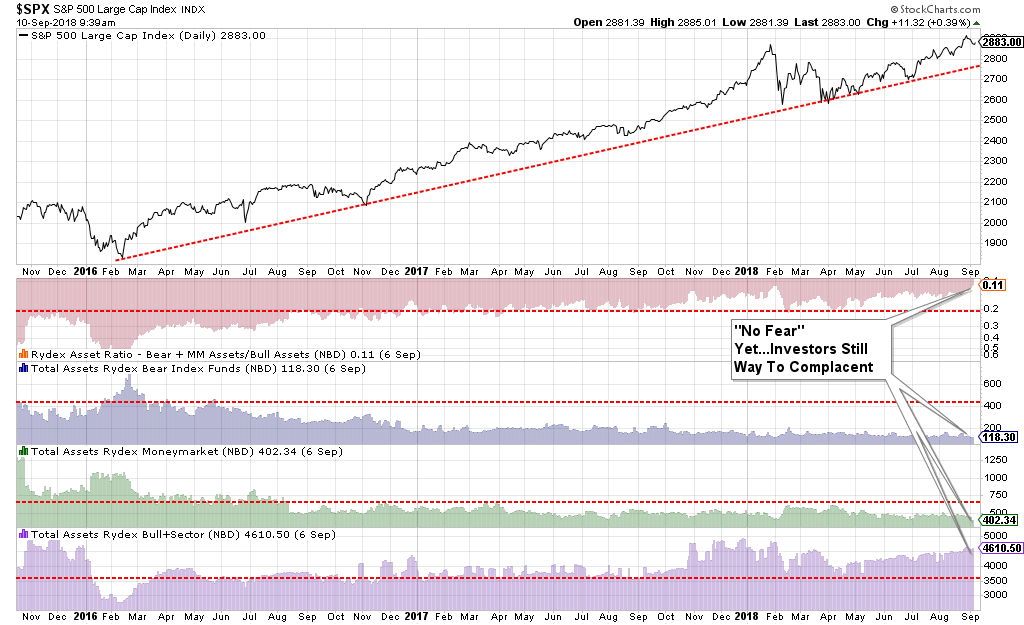

The only short-term concern is the warning signal in the lower panel. Just like in early August, when a warning was issued, it never matured into a deeper correction. While I am not dismissing the current warning, given Monday’s bounce off of support combined with a very short-term oversold condition, and very high levels of bullish “optimism,” the most likely outcome currently remains a push towards 3000 through the rest of this year. This high level of “optimism” is shown in the chart below which compares the S&P 500 to investors in bearish funds, money markets, and bullish funds. (Investors are “all in.”)

Remember, in the very “short-term,” it is all about “psychology.”

In the long-term, it is all about “fundamentals.”

Over the next several weeks to the next couple of months, the “bullish bias” is clearly in control.

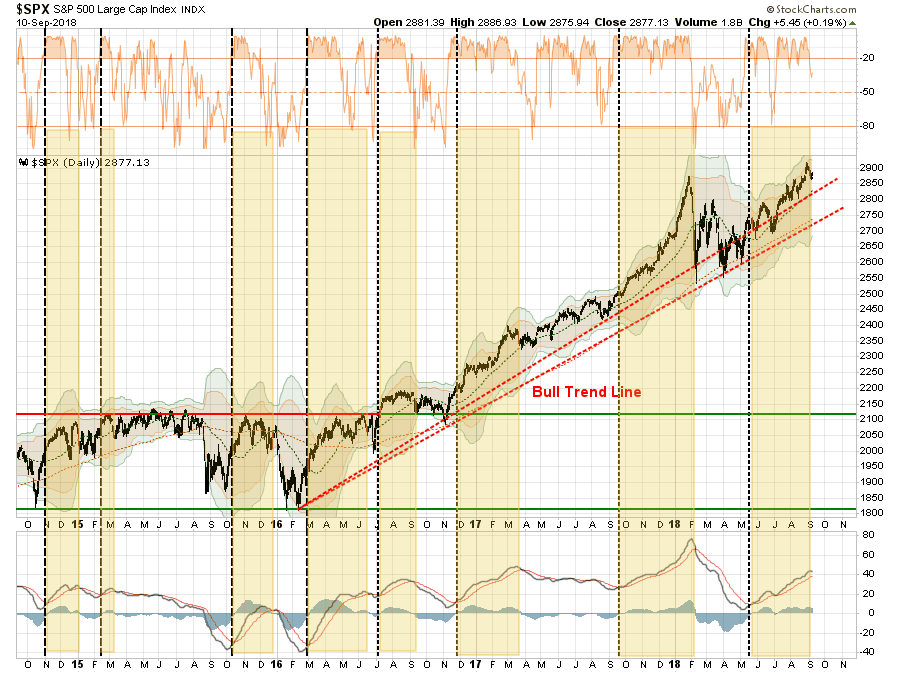

Weekly Data Is Bullish Too

If we smooth out daily volatility by using weekly data, much of the same picture currently emerges. The market has broken out to all-time highs and the accelerated “bullish trend line” from the 2016 correction was successfully tested in March and April.

Several weeks ago we upgraded our portfolio allocations back to 100% of model weights as the weekly “buy signal” suggested a return to a more bullish backdrop for investors.

As we have repeatedly noted in our weekly missives, while we remain concerned about the longer-term prospects for the markets due to valuations, late-stage economic dynamics, and normalized profit cycles, our portfolios remain nearly fully allocated in the short-term.

Adding Exposure Cautiously

With the recent pullback to support, which confirms the recent breakout above the January highs, we are adding some additional exposure this week.

(If you want to see our model portfolios click here and subscribe for a free trial.)

In case you missed our weekend missive, this doesn’t mean we are just ignoring all risk and neglecting our portfolio management process. As I stated:

“It is worth remembering that portfolios, like a garden, must be carefully tended to otherwise the bounty will be reclaimed by nature itself.

- If fruits are not harvested (profit taking) they ‘rot on the vine.’

- If weeds are not pulled (sell losers), they will choke out the garden.

- If the soil is not fertilized (savings), then the garden will fail to produce as successfully as it could.

So, as a reminder, and considering where the markets are currently, here are the rules for managing your garden:

1) HARVEST: Reduce “winners” back to original portfolio weights. This does NOT mean sell the whole position. You pluck the tomatoes off the vine, not yank the whole plant from the ground.

2) WEED: Sell losers and laggards and remove them from the garden. If you do not sell losers and laggards, they reduce the performance of the portfolio over time by absorbing “nutrients” that could be used for more productive plants. The first rule of thumb in investing “sell losers quickly.”

3) FERTILIZE AND WATER: Add savings on a regular basis. A garden cannot grow if the soil is depleted of nutrients or lost to erosion. Likewise, a portfolio cannot grow if capital is not contributed regularly to replace capital lost due to erosion and loss. If you think you will NEVER LOSE money investing in the markets…then shouldn’t be investing to begin with.

4) WATCH THE WEATHER: Pay attention to markets. A garden can quickly be destroyed by a winter freeze or drought. Not paying attention to the major market trends can have devastating effects on your portfolio if you fail to see the turn for the worse. As with a garden, it has never been harmful to put protections in place for expected bad weather that didn’t occur. Likewise, a portfolio protected against ‘risk’ in the short-term, never harmed investors in the long-term.

With the overall market trend still bullish, there is little reason to become overly defensive in the very short-term. However, there are plenty of warning signs the ‘good times’ are nearing their end, which will likely surprise most everyone.”

Again, we are moving cautiously. With the trend of the market positive, we realize short-term performance is just as important as long-term. It is always a challenge to marry both.

The Fly In The Ointment

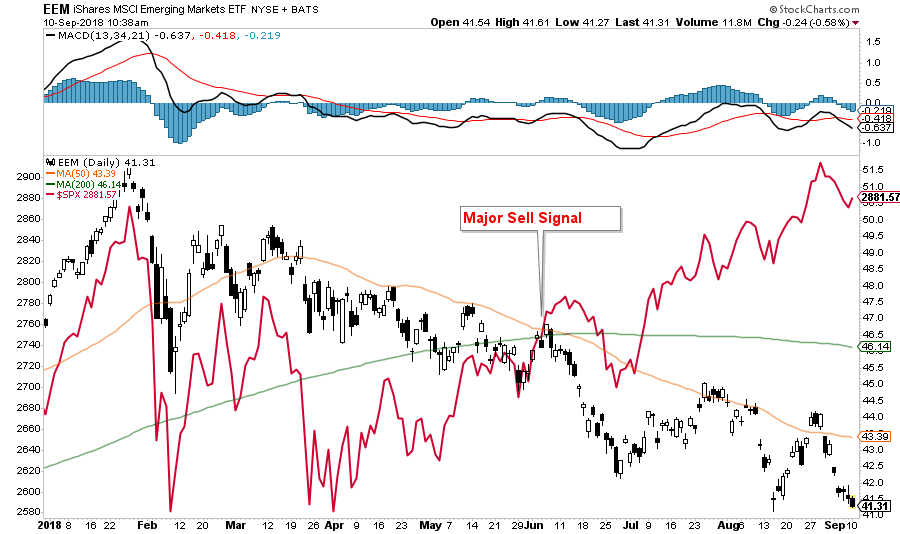

The one thing that continues to weigh on us is the deviation in international performance relative to the U.S. As discussed this past weekend:

“Emerging and International Markets were removed in January from portfolios on the basis that ‘trade wars’ and ‘rising rates’ were not good for these groups. With the addition of the ‘Turkey Crisis,’ ongoing tariffs, and trade wars, there is simply no reason to add ‘drag’ to a portfolio currently. These two markets are likely to get much worse before they get better. Put stops on all positions.

The recent bounce again failed at the declining 50-dma. Positions should have been sold on that failed rally. Stops at the recent lows were triggered on Friday and suggests positions be closed out as lower levels are likely at this time.”

This has been the right call, despite the plethora of articles suggesting the opposite.

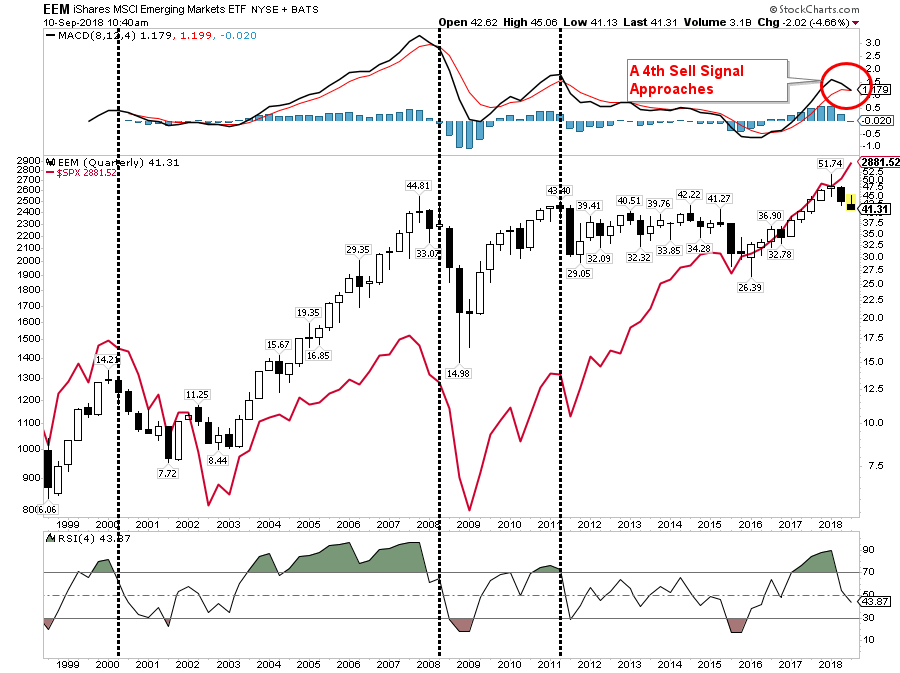

Over the last 25-years, this has remained a constant.

In 2000, 2007 and 2012, emerging markets warned of an impending recessionary drag in the U.S. (While 2012 wasn’t recognized as a recession, there were many economic similarities to one.)

With emerging markets diverged from domestic markets, it suggests economic growth may not be as robust as many believe. While a 2-quarter divergence certainly isn’t suggesting a ‘financial crisis’ is upon us, it does suggest that something isn’t quite right with the global economic backdrop.

This underperformance in international markets combined with a bond market which continues to “NOT buy” the rally in stocks also keeps us on guard. Such suggests capital continues to seek “safety” over “risk” in the short term. More importantly, the 10-year Treasury rate has a strong history of warning of dangers in the market over the longer-term time frame.

The point here is simple.

While bullish sentiment very much controls the short-term trend and direction of the market, in which we must participate, the longer-term dynamics still remain clearly bearish.

Peak earnings, employment, economic and profits growth all suggest the next leg of the market will likely be lower rather than higher.

But that is an article, and portfolio management and allocation change, which is yet to be written.