Technical Analysis is never about certainty. In fact I tell my students that Technical Analysis provides the researcher with Points of Reflection, not Points of Inflection. It can help identify where something may happen because there is a pattern or history that suggests it might. This leads many to think that it is a worthless pursuit. Spend your time doing research to come to the conclusion that something may or may not happen.

But that conclusion is exactly the wrong conclusion to reach. It does in fact tell you where something will happen, just not what. A reversal will happen here, or it will not. Support will hold, or it will not. These are the Points to Reflect upon.

In its best examples, Technical Analysis can give a strong edge in one direction. When multiple forms of Technical Analysis all point to a move in the stock price in one direction the mosaic can be powerful. And then there are times when multiple forms give differing conclusions.

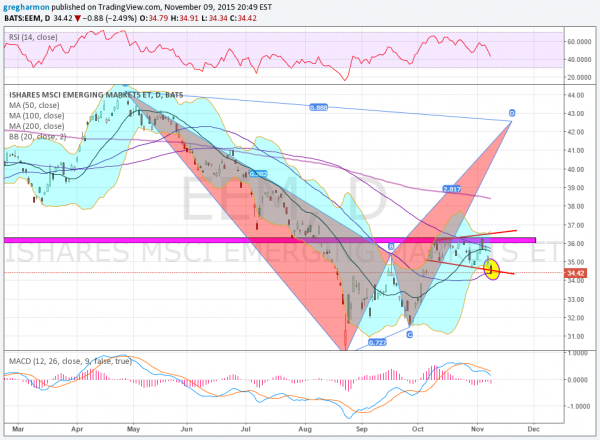

Last week I wrote about two sets of conflicting Technical Analysis in the Emerging Market ETF (iShares MSCI Emerging Markets (N:EEM)). In instances like this, technical traders do one thing, then wait to see what happens.

Monday we got the answer in the Emerging Markets ETF. It followed the path lower that was suggested by the rejection at major resistance near 36 and out of the expanding wedge. What is next for it?

With confirmation of one set of data the extent of the damage can be estimated. Support looks to come next in the 33.75 area and then 31.80 before 30. Under that and you have to look left over 7 years ago to find prior price history. Momentum indicators are following lower, an indication it will continue. Time to trade the downside or watch to see how far it goes.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.