Emerging Markets have had a wild ride since April. The iShares MSCI Emerging Markets (N:EEM) ETF fell from a high at 44 down to 30, losing 32% at the low in late August. But since then it found support and has been trying to bounce. With a bevy of macro events going on as a backdrop including a possible US Dollar breakout higher, it is time to put this sector under the microscope.

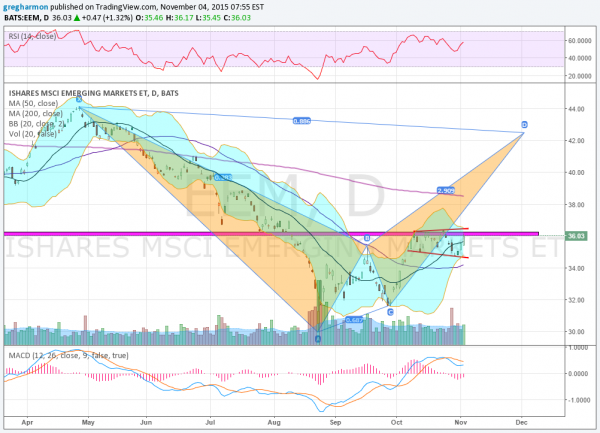

The chart below shows at least 4 major events interacting that could determine where this sector goes in the near term. The first is a harmonic Bat. As it has cleared the top of point ‘B’ this now suggests that a run up to ‘D’ at 42.50 is more probable before the pattern completes. This view has support from the momentum indicators with the RSI bullish and rising and the MACD turning back higher.

There is also a broadening wedge of consolidation that has developed after the last move higher. Broadening wedges are thought to be bearish, and a move lower would not surprise many as the consolidation is occurring right at the retest of a 7 year channel of price action from below. But broadening wedges, and any consolidation, can resolve in either direction.

The chart also shows a Golden Cross, the 50 day SMA crossing up through the 200 day SMA. This is supposed to be a bullish event, but like Death Crosses can often just be a late indication confirming what has already happened in a move that is mostly over.

The final piece of the puzzle is the squeeze in the Bollinger Bands®. This quick tightening is often a good timing indicator for a big move to occur. If you go with the trend then the Bollinger Bands had been moving higher prior to the squeeze.

So the Bollinger Bands say something happens very soon, the Golden Cross and Bat suggest it is to the upside but major resistance and an expanding wedge give caution for a reversal lower. Which way will it be…….

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.