On Friday, inflation data will come out in Japan

In this review, we suggest considering the personal composite instrument (PCI) "ruble vs. yen". It reflects the price dynamics of the Russian ruble against the Japanese yen. The PCI grows in case of the strengthening of the ruble and the weakening of the yen. Is there a possibility for the RUB/JPY to grow?

The Russian ruble remains stable or is strengthening, while the price of Brent oil exceeds $50 per barrel. The strengthening of the yen has a negative impact on the performance of the Japanese exporting companies, so the Bank of Japan tries to struggle against it. In particular, it can refuse to tighten the monetary policy or raise rates, despite the inflation growth. This can weaken the yen exchange rate. On Friday, August 25, the consumer price index for July will be released in Japan. It is expected to grow for the 7th month in a row.

The key indicator of the Consumer Price Index Ex-Fresh Food may be 0.5%. This is still much lower than the Bank of Japan target level of 2%. According to the survey of the Japanese companies by the Nikkei Research agency, only 14% of the respondents support the further easing of the Bank of Japan monetary policy. They believe that such measures do not cope well with deflation and contribute to risky debts growth.

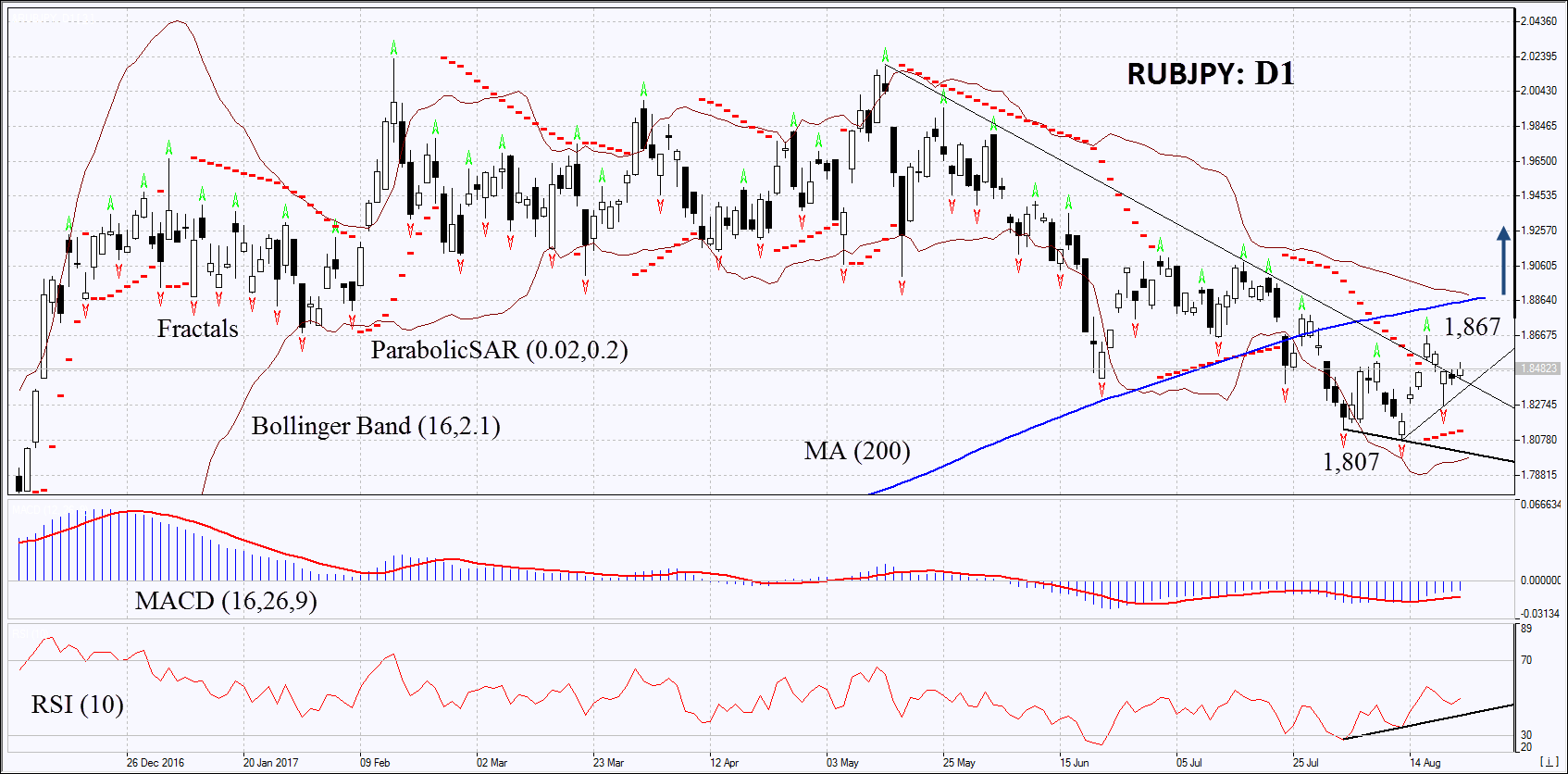

On the daily timeframe, RUB/JPY: D1 came out from the downtrend. The further price increase is possible in case the Brent oil price remains above $50 per barrel and the Bank of Japan continues the policy of low rates and the yen emission.

- The Parabolic indicator gives a bullish signal.

- The Bollinger bands widened, which means higher volatility. They are tilted upwards.

- The RSI indicator is above 50. It has formed a positive divergence.

- The MACD indicator still gives a bullish signal.

The bullish momentum may develop in case RUB/JPY exceeds the last fractal high at 1.867. This level may serve as an entry point. The initial stop loss may be placed below the last fractal low, the 9-month low and the Parabolic signal at 1.807. After opening the pending order, we shall move the stop to the next fractal low following the Bollinger and Parabolic signals. Thus, we are changing the potential profit/loss to the breakeven point.

More risk-averse traders may switch to the 4-hour chart after the trade and place there a stop loss moving it in the direction of the trade. If the price meets the stop level at 1.807 without reaching the order at 1.867 we recommend cancelling the position: the market sustains internal changes that were not taken into account.

Summary of technical analysis

Position - Buy

Buy stop - above 1,867

Stop loss - below 1,807