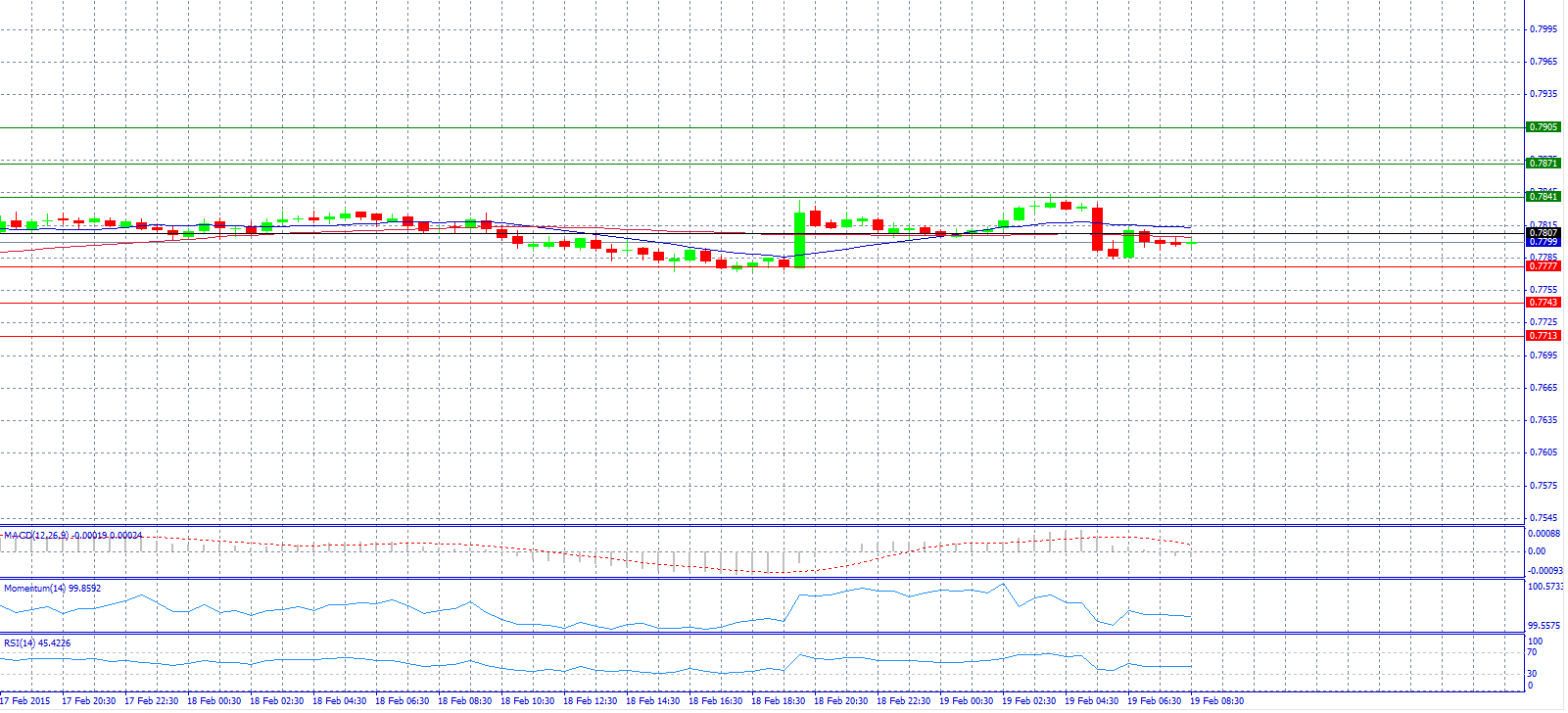

*All the charts are 30M charts with daily pivot points.

Market Scenario 1: Long positions above 0.7807 with targets @ 0.7841 and 0.7871.

Market Scenario 2: Short positions below 0.7807 with targets @ 0.7777 and 0.7743.

Comment: The pair recovered partial losses from S&P’s warning of Oz rating downgrade.

Supports and Resistances:

R3 0.7905

R2 0.7871

R1 0.7841

PP 0.7807

S1 0.7777

S2 0.7743

S3 0.7713

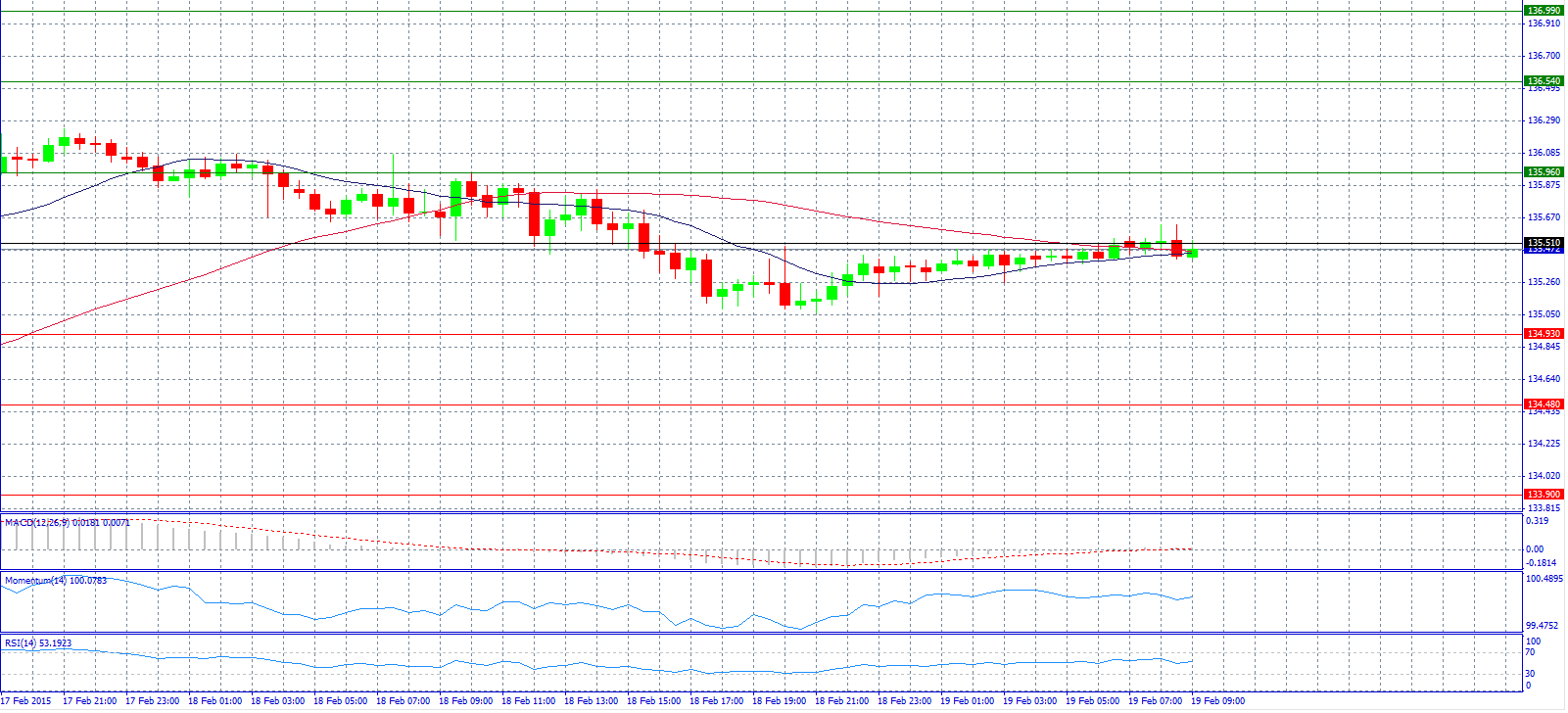

Market Scenario 1: Long positions above 135.51 with targets @ 135.96 and 136.54.

Market Scenario 2: Short positions below 135.51 with targets @ 134.93 and 134.48.

Comment: The pair trades steady with a bullish bias.

Supports and Resistances:

R3 136.99

R2 136.54

R1 135.96

PP 135.51

S1 134.93

S2 134.48

S3 133.90

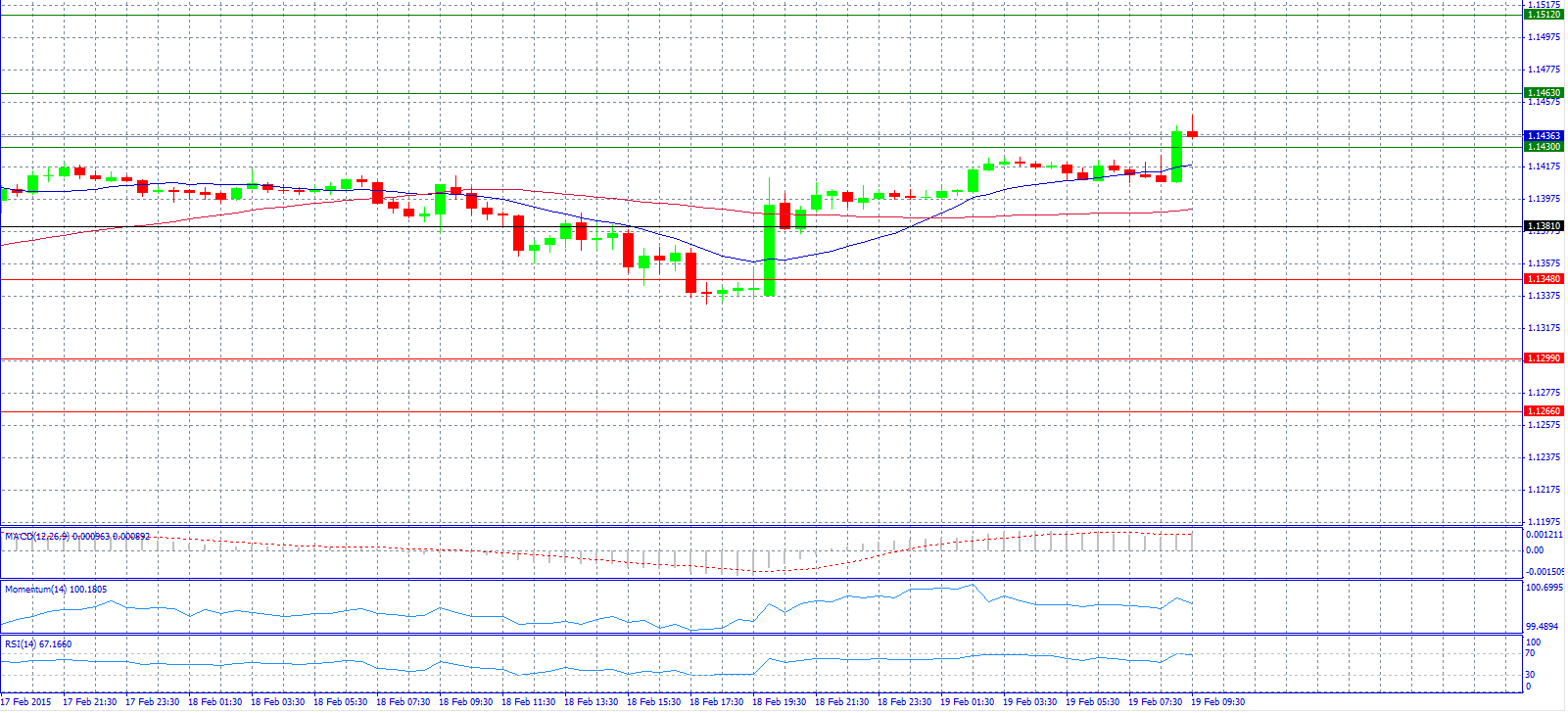

Market Scenario 1: Long positions above 1.1381 with targets @ 1.1430 and 1.1463.

Market Scenario 2: Short positions below 1.1381 with targets @ 1.1348 and 1.1299.

Comment: The pair trades above 1.1400 as traders await ECB Monetary Policy Meeting Accounts.

Supports and Resistances:

R3 1.1512

R2 1.1463

R1 1.1430

PP 1.1381

S1 1.1348

S2 1.1299

S3 1.1266

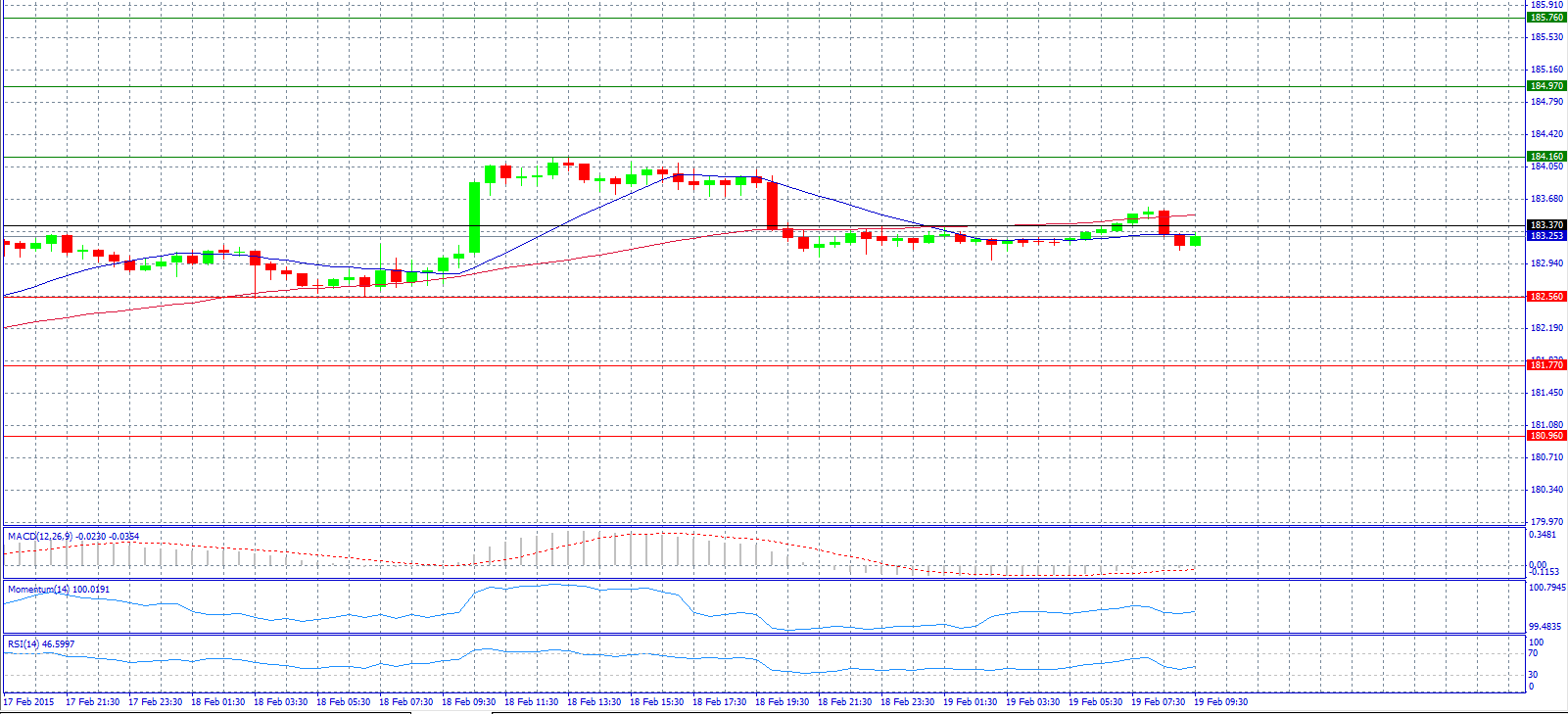

Market Scenario 1: Long positions above 183.37 with targets @ 185.76 and 184.97.

Market Scenario 2: Short positions below 183.37 with targets @ 182.56 and 181.77.

Comment: The pair seems to formed a nice bullish trend.

Supports and Resistances:

R3 185.76

R2 184.97

R1 184.16

PP 183.37

S1 182.56

S2 181.77

S3 180.96

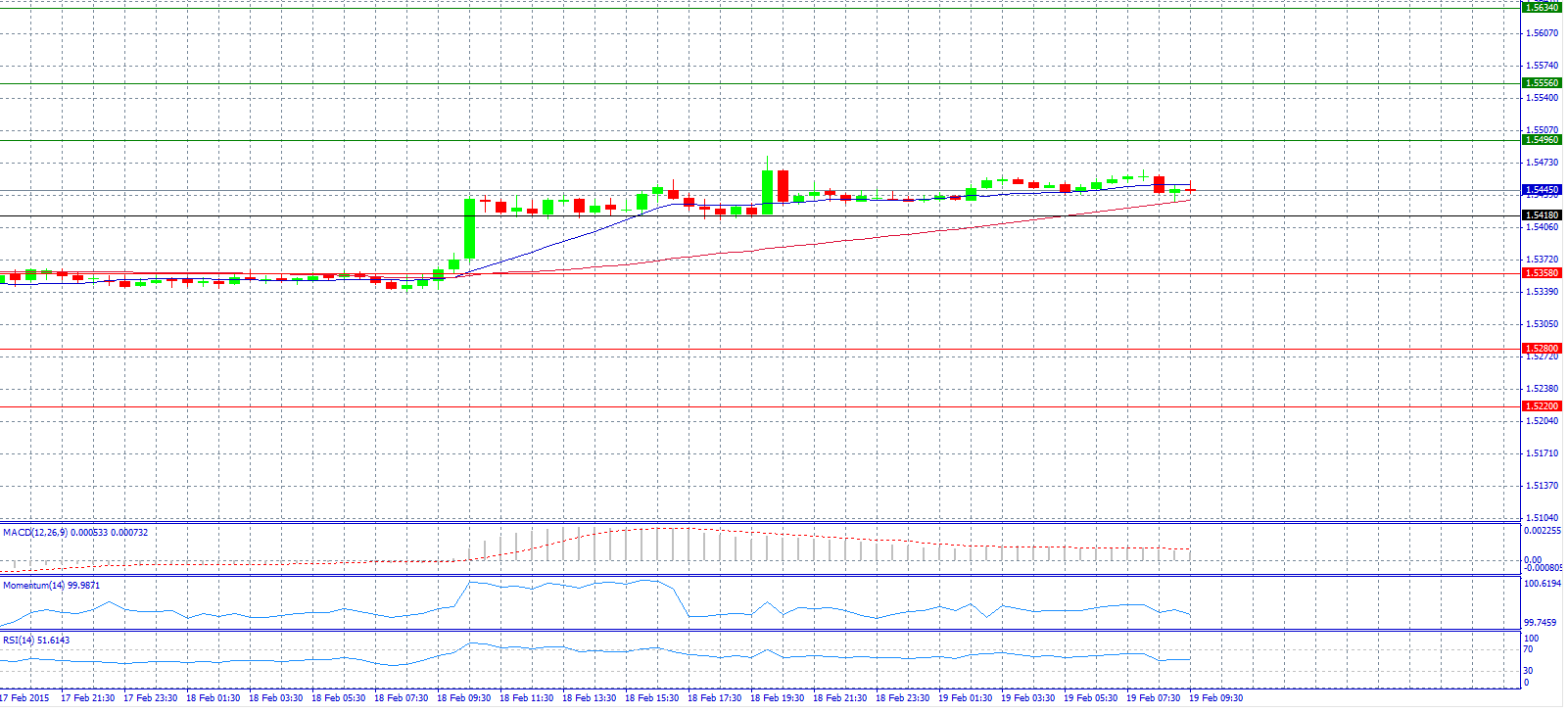

Market Scenario 1: Long positions above 1.5418 with targets @ 1.5496 and 1.5556.

Market Scenario 2: Short positions below 1.5418 with targets @ 1.5358 and 1.5280.

Comment: The pair trades above 1.5400.

Supports and Resistances:

R3 1.5634

R2 1.5556

R1 1.5496

PP 1.5418

S1 1.5358

S2 1.5280

S3 1.5220

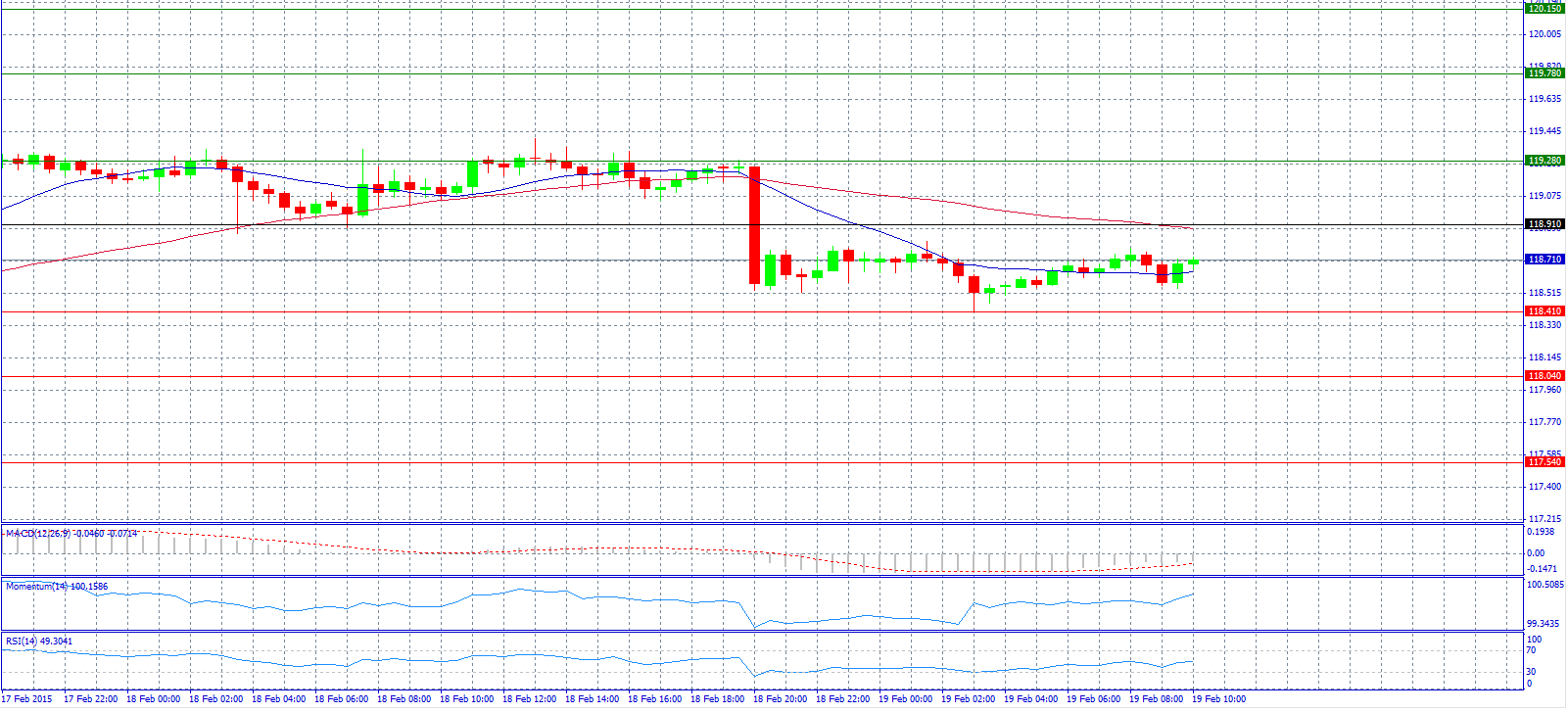

Market Scenario 1: Long positions above 118.91 with targets @ 119.28 and 119.78.

Market Scenario 2: Short positions below 118.91 with targets @ 118.41 and 118.04.

Comment: The pair regains strength again by hitting session highs at 118.57.

Supports and Resistances:

R3 120.15

R2 119.78

R1 119.28

PP 118.91

S1 118.41

S2 118.04

S3 117.54

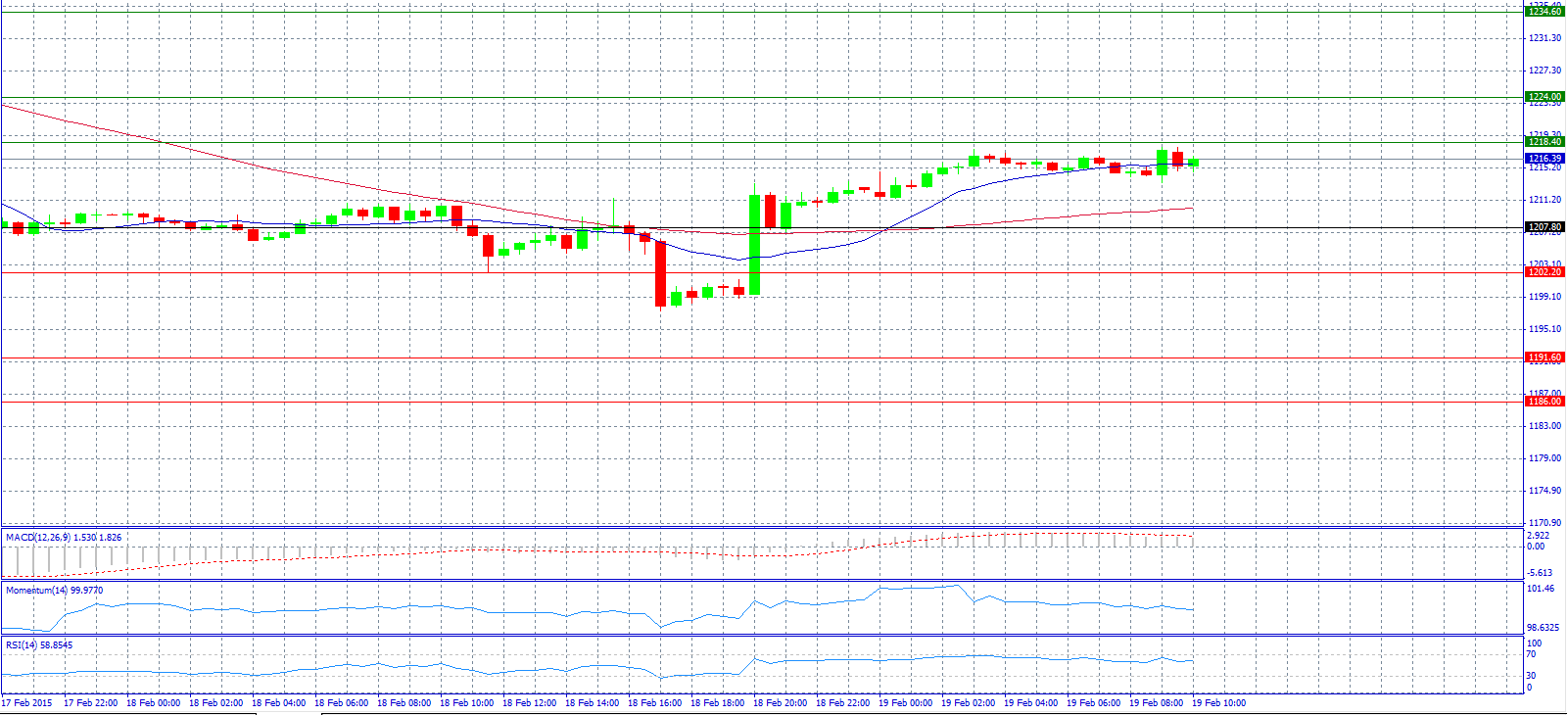

GOLD

Market Scenario 1: Long positions above 1207.80 with targets @ 1218.40 and 1224.00.

Market Scenario 2: Short positions below 1207.80 with targets @ 1202.20 and 1191.60.

Comment: Gold prices rose after the Fed minutes changed yesterday the investors’ expectations regarding the timing of the interest rate hike in the US.

Supports and Resistances:

R3 1234.60

R2 1224.00

R1 1218.40

PP 1207.80

S1 1202.20

S2 1191.60

S3 1186.00

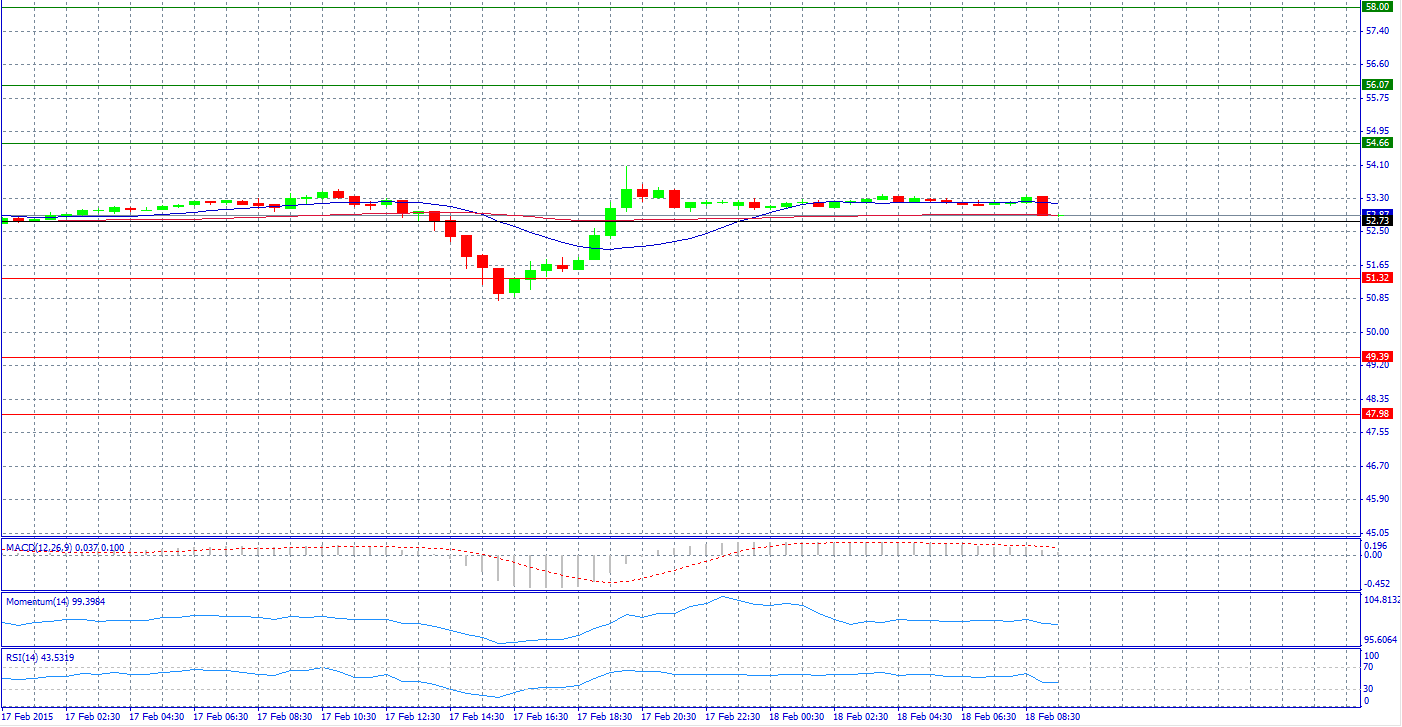

Market Scenario 1: Long positions above 51.40 with targets @ 52.49 and 54.49.

Market Scenario 2: Short positions below 51.40 with targets @ 49.40 and 48.31.

Comment: Crude Oil prices drop most in a month.

Supports and Resistances:

R3 55.58

R2 54.49

R1 52.49

PP 51.40

S1 49.40

S2 48.31

S3 46.31

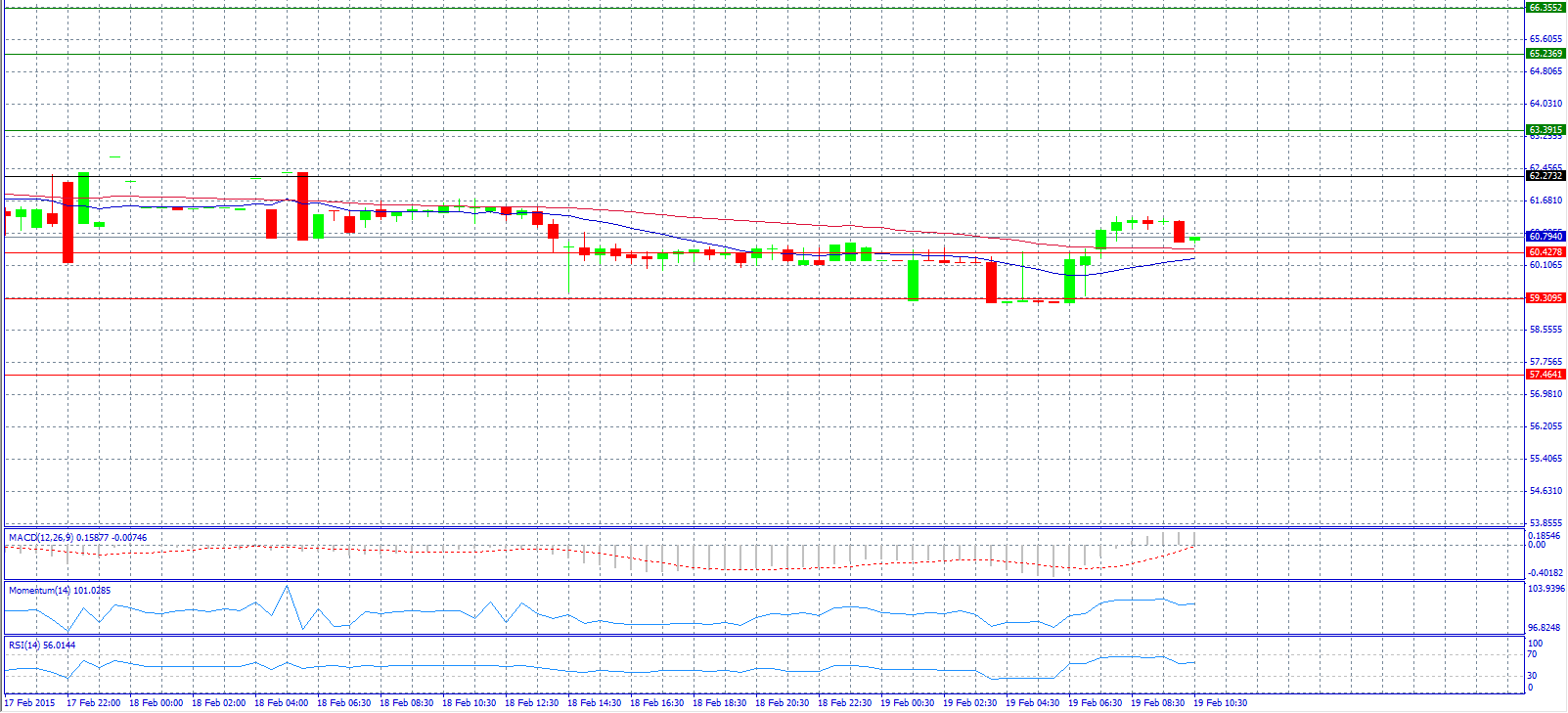

Market Scenario 1: Long positions above 62.2732 with targets @ 63.3915 and 65.2369.

Market Scenario 2: Short positions below 62.2732 with targets @ 60.4278 and 59.3095.

Comment: The pair remains bearish on the outlook.

Supports and Resistances:

R3 66.3552

R2 65.2369

R1 63.3915

PP 62.2732

S1 60.4278

S2 59.3095

S3 57.4641

Forexcorporate Marketing Research Department

Disclaimer: 1. Information on this page / e-mail / letter is not a recommendation to buy or sell and of course, can not guarantee a profit, it should be considered only as information that may assist you in making good decisions in your trading. Information and graphics presented above have been obtained from reliable sources, but their accuracy can not be fully guaranteed. Forexcorporate, its representatives, employees, and other authors will not be liable for any loss resulted from the use of this information.

2. The purpose of this risk disclaimer is to inform users of the potential financial risks involved in trading in foreign currencies. The transaction or operations in the Forex or OTC markets does involve a substantial degree of risk, and should not be undertaken until the user has carefully evaluate whether their financial situation is appropriate for such transactions. Trading may result in a substantial or complete loss of funds and therefore should only be undertaken with risk capital.