Looking at the Tuesday session, there is a very little in the way of economic announcements to move the markets. That being said, I am looking at the charts for a possible trading opportunities. The first chart that I am looking at is the EUR/USD pair, which bounced off of the 1.05 handle. Ultimately, I believe that this market breaks down below there, but in the meantime the best thing we can do is buy puts every time this market rallies.

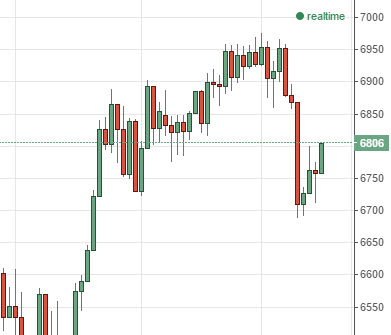

The FTSE 100 broke higher during the course of the session, breaking above the 6800 level. With this, the market looks as if it is ready to continue going higher, probably heading to the 6900 level. The FTSE should then make another attempt to reach the 7,000 level, and with that we are very bullish and think that any pullback will offer value and as a result buyers will continue to reenter the market.

Silver markets went back and forth during the course of the session as well, ultimately settling on a shooting star. The shooting star sits above the 15.50 level, which is the beginning of significant support. The support runs all the way down to the 15.00 level, so therefore we believe that the market could break down to that area, but expect quite a bit of volatility between here and there. Because of that, we believe that it’s much easier to trade short-term charts more than anything else.