Improving economic performance is bullish for French stock index

Improving economic performance is bullish for French stock market. Will CAC 40 continue rallying?

France’s economy recorded third consecutive quarterly growth in Q2 at 0.5% on quarter pace. Unemployment in France declined to 9.5% in Q2 from 9.6% and French headline inflation rose to 0.9% in August from 0.7% in July. Euro-zone economy and Germany are France’s main export markets. Euro-zone’s and German economies accelerated in the Q2 to 2.3% and 2.1% on year respectively from 2% rate in first three months of 2017. The French economy is forecast to accelerate as global growth improves. Improving economic data are bullish for French stock index FR 40.

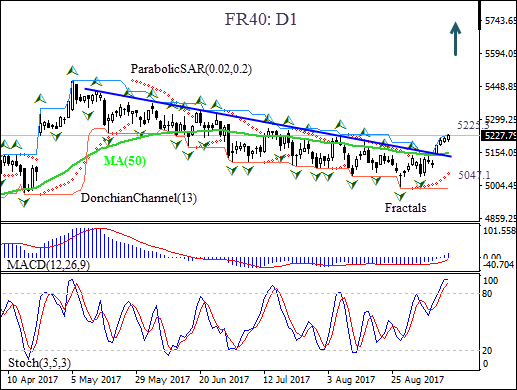

On the daily timeframe FR 40: D1 has been rising after breached above the resistance line.

- The Donchian channel indicates uptrend: it is tilted up.

- The Parabolic indicator has formed a buy signal.

- The MACD indicator is bullish: it is above the signal line and the gap is widening.

- The stochastic oscillator is in the overbought zone, this is a bearish signal.

We believe the bullish momentum will continue after the price closes above the upper boundary of Donchian channel at 5225.34. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below the last fractal low at 5047.14. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level (5047.14) without reaching the order (5225.34), we recommend cancelling the position: the market has undergone internal changes which were not taken into account.

Technical Analysis Summary

Position - Buy

Buy stop - Above 5225.34

Stop loss - Below 5047.14