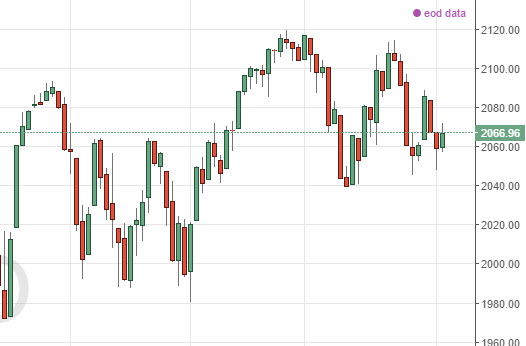

Looking at the Monday session, there isn’t too much to move the marketplace. In fact, most of the world will be away from their trading desks, with perhaps the exception of North America. With that being said, we look at the S&P 500 and recognize that there is still plenty of bullish momentum underneath. We are buyers of calls on short-term pullbacks, just as we buy calls on breakouts to the upside. We believe that ultimately the S&P 500 heads to the 2100 level, so we have no interest in buying puts.

The EUR/USD rose drastically during the session on Friday as the jobs number out of the United States missed. With that, it makes sense that the US dollar sold off a bit, but quite frankly we are heading towards some very serious resistance, so therefore we do not think that this market can go much higher. We are buying puts on resistive short-term candles.

The USD/JPY pair fell as well, and for much of the same reason. However, it stopped near the 118 level, so we believe that the buyers are going to step in fairly soon. With that being the case, we are buyers on supportive looking candles or some type of impulsive green candle. We even look to the short-term charts in order to find that trade as we still believe that the entirety of the uptrend is still most certainly in effect.