Looking at the upcoming Monday session, it appears that there is almost nothing on the economic calendar to move the markets. In fact, it’s just two central bank governors speaking that could have an effect. Ultimately, the markets will more than likely be technically driven.

The EUR/USD pair tried to rally during the course of the session on Friday, but found the area above the 1.08 level to be far too resistive. Ultimately, we ended up forming a nice-looking shooting star, and that suggests that we are going to go much lower levels. The 1.06 level is our target, if we can get below the bottom of the shooting star, and we would go into the markets buying puts positions in order to continue profiting from this very strong trend.

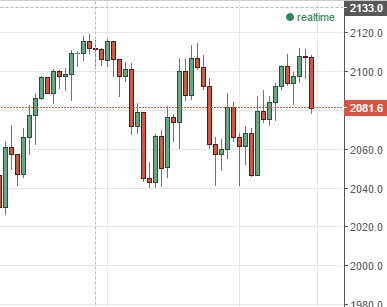

Looking at the S&P 500, you can see that we fell rather hard during the course of the session on Friday, testing the 2080 handle. With that, it seems as if the market will have to trying to find support below. If we can find a supportive daily candle, we would be buyers of calls as we believe ultimately the S&P 500 continues to go much higher over the longer term.

S&P 500

Gold markets continue to meander around the $1200 level, as the larger consolidation area bounces back and forth between $1180 and $1220, and keeps the market fairly choppy. With that, we would feel much more comfortable buying a position once we break out of this area, as we would recognize that it would be a significant move and signal that the markets are ready to head in one direction or the other. In the meantime, gold markets are going to be very difficult.