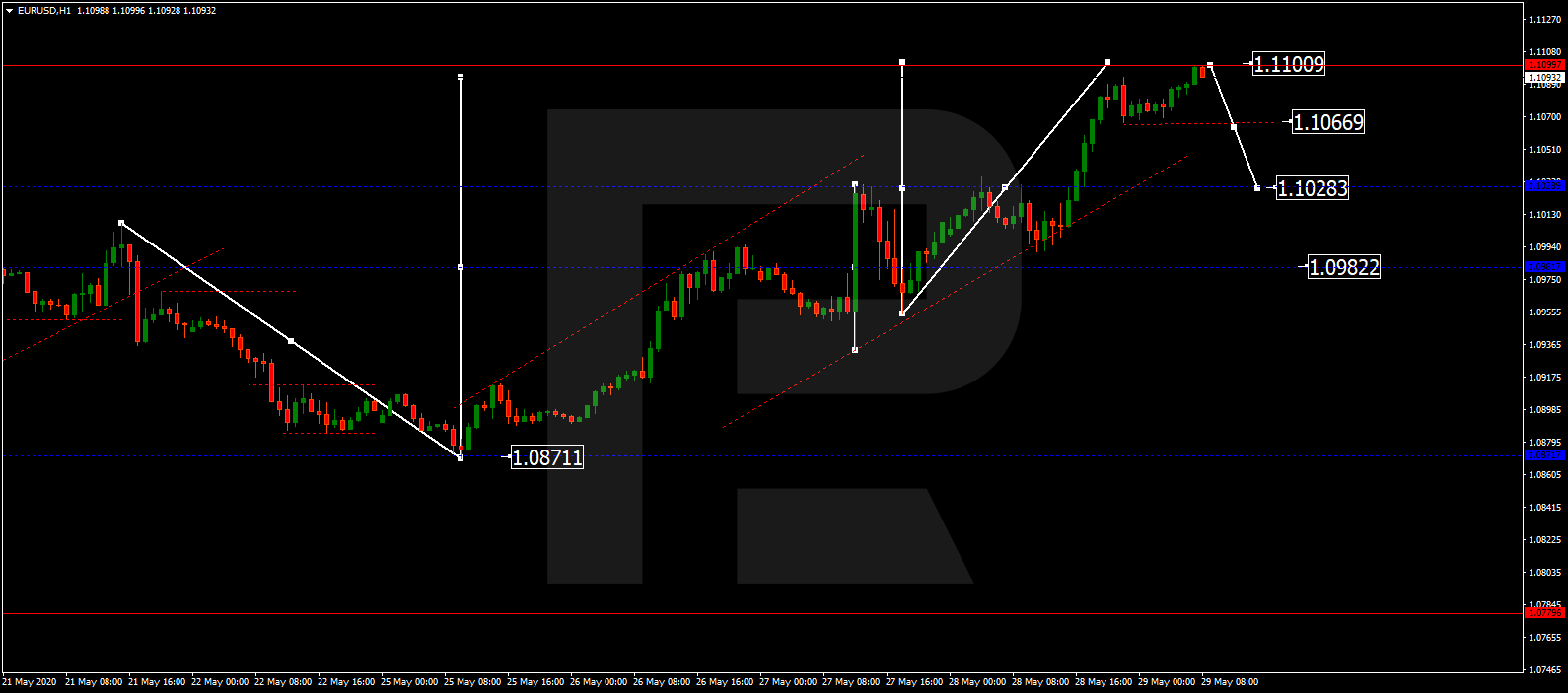

EURUSD

After breaking 1.1028 to the upside, EURUSD continues moving upwards to reach 1.1100. Possibly, the pair may reach it and then start a new correction to break 1.1066. Later, the market may continue trading inside the downtrend with the target at 1.1028.

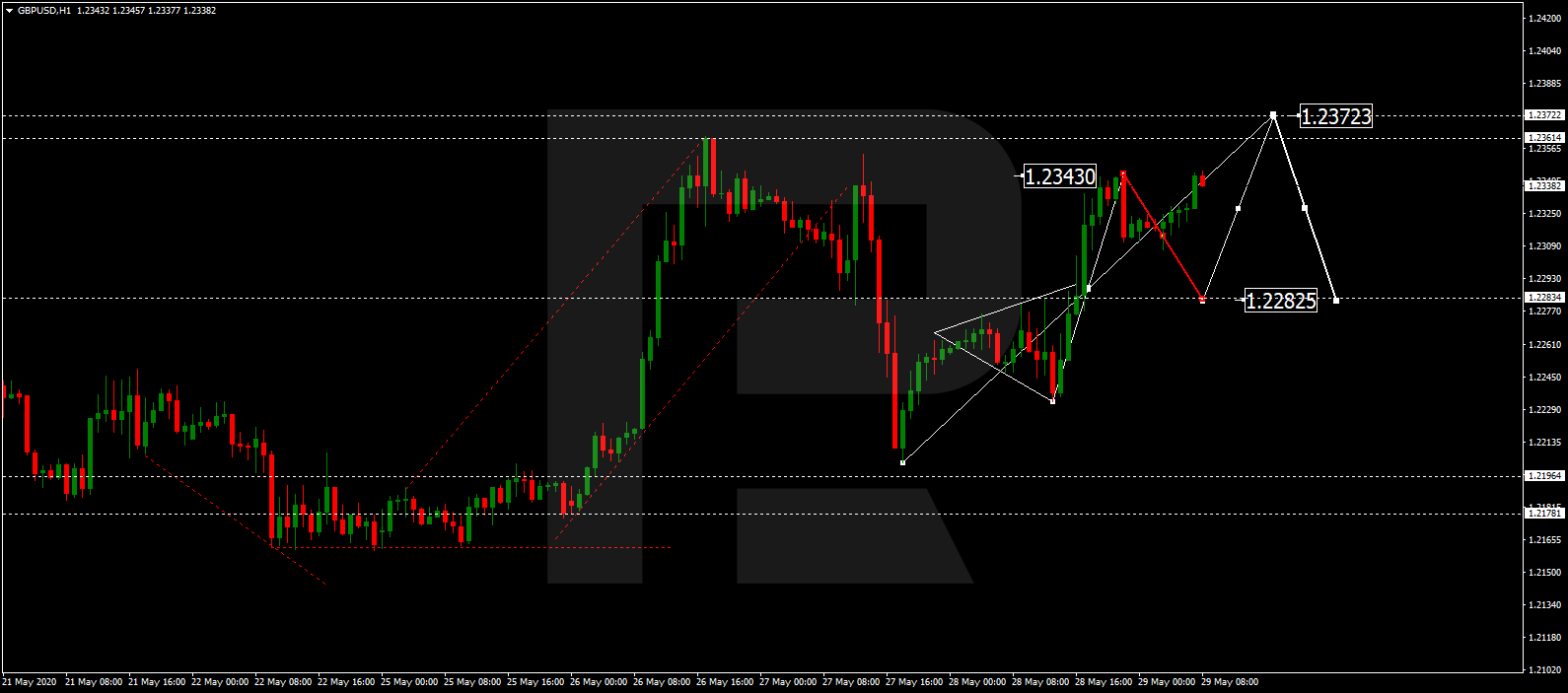

GBPUSD

After breaking 1.2282 to the upside and reaching 1.2343, GBPUSD is expected to correct and return to 1.2282. After that, the instrument may form one more ascending structure with the target at 1.2372.

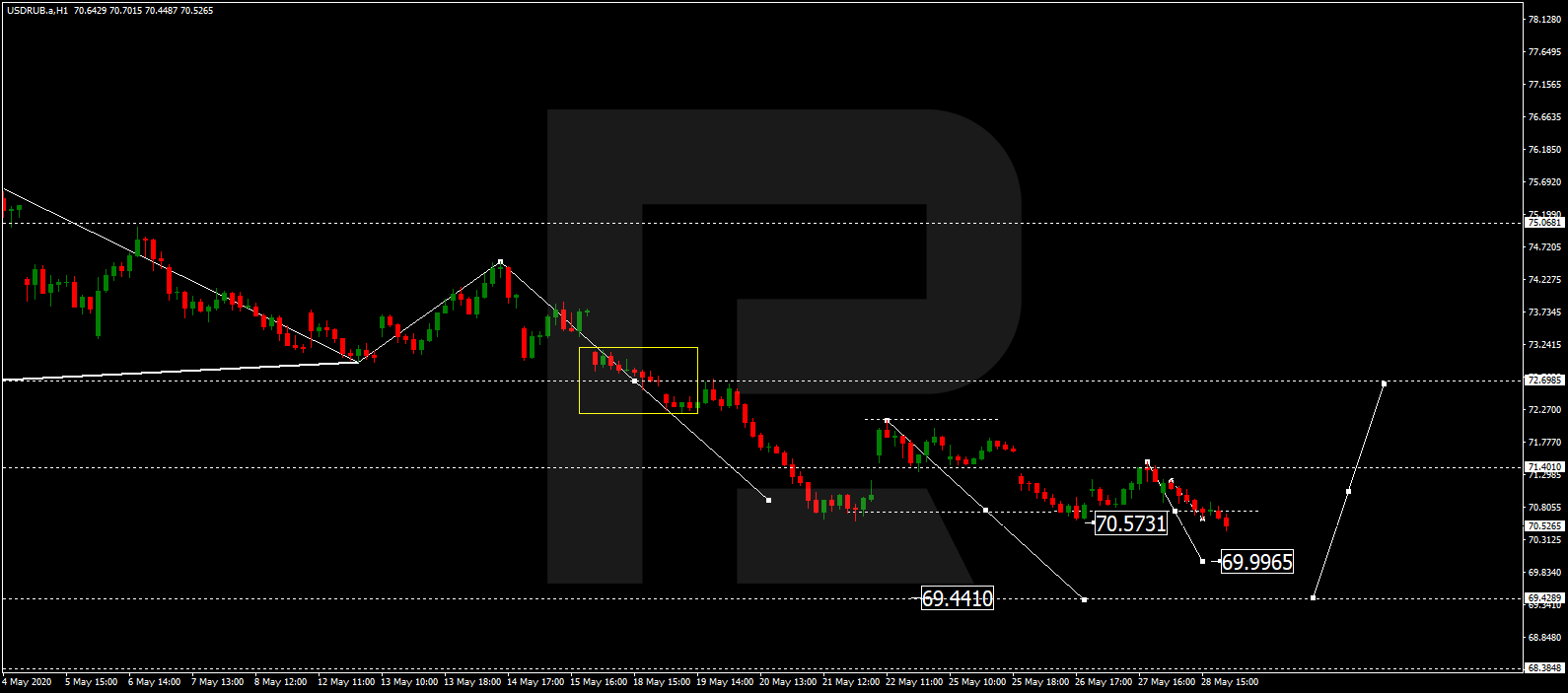

USDRUB

USDRUB is still falling towards 70.00. After reaching this level, the instrument may grow to test 70.50 from below and then form a new descending structure with the target at 69.44.

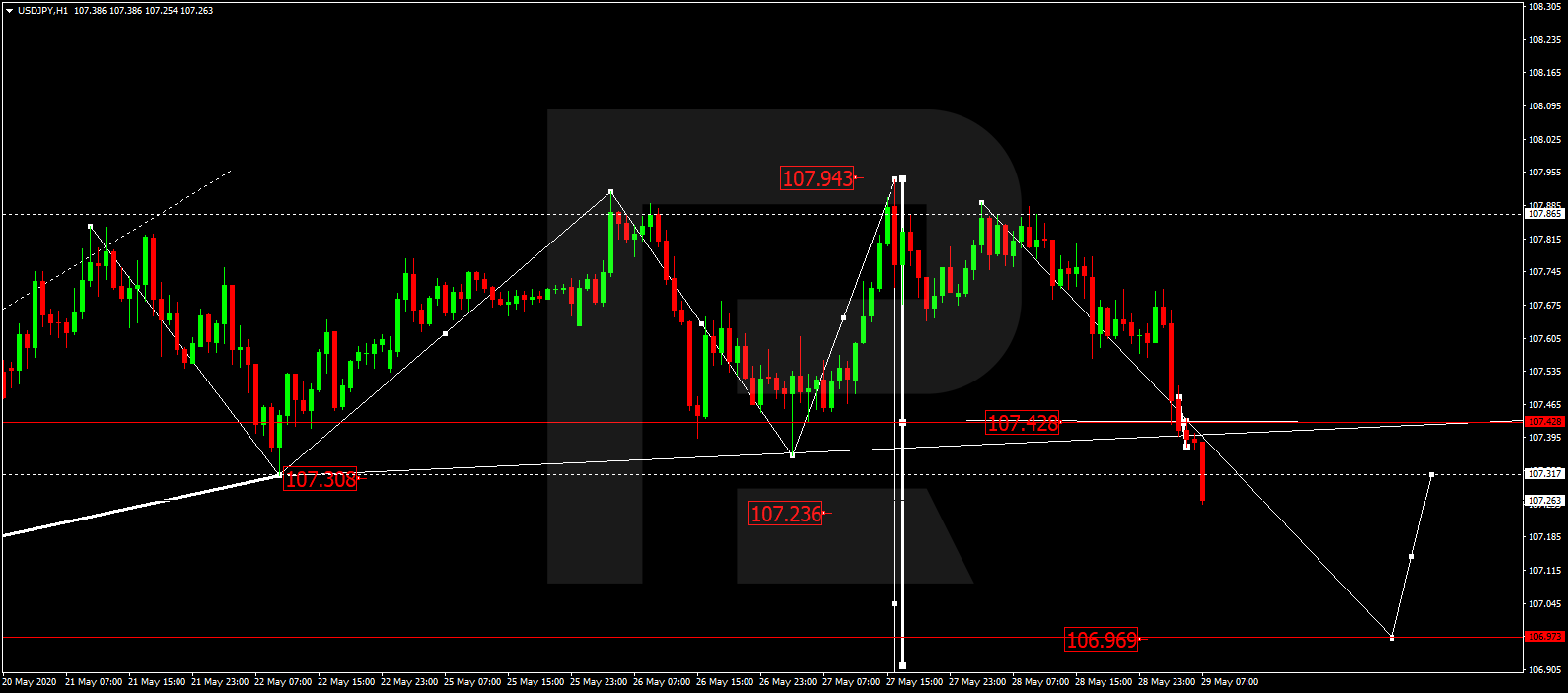

USDJPY

After breaking 107.42 to the downside, USDJPY is expected to continue falling and reach 106.96. After that, the instrument may correct towards 107.30 and then resume trading downwards with the target at 106.60.

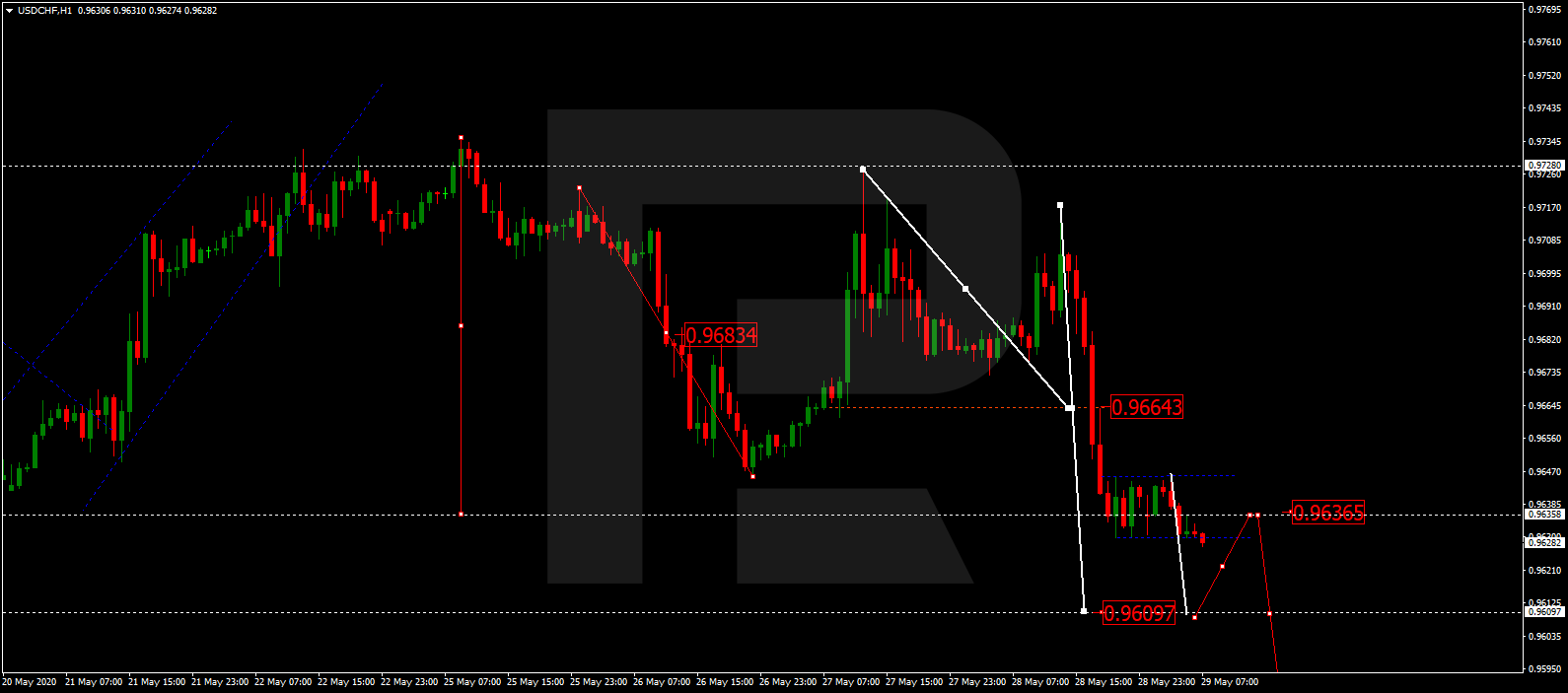

USDCHF

After breaking 0.9666 downwards and reaching 0.9636, USDCHF is expected to consolidate near the lows. If later the price breaks this range to the downside, the market may resume trading downwards with the target at 0.9600; if to the upside – start a new correction towards 0.9666.

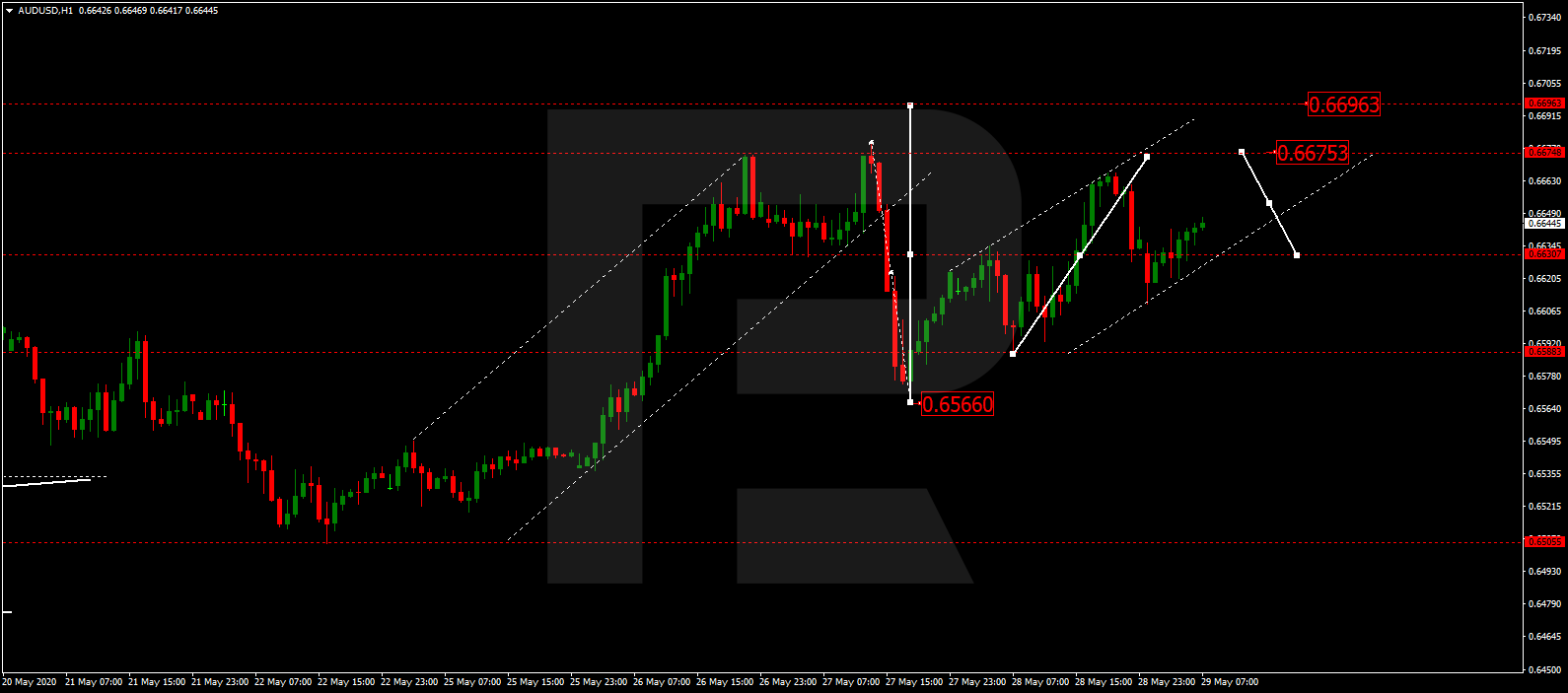

AUDUSD

After breaking 0.6629 to the upside, AUDUSD is expected to continue growing towards 0.6675. Later, the market may fall to return to 0.6629 and then form one more ascending structure with the target at 0.6696.

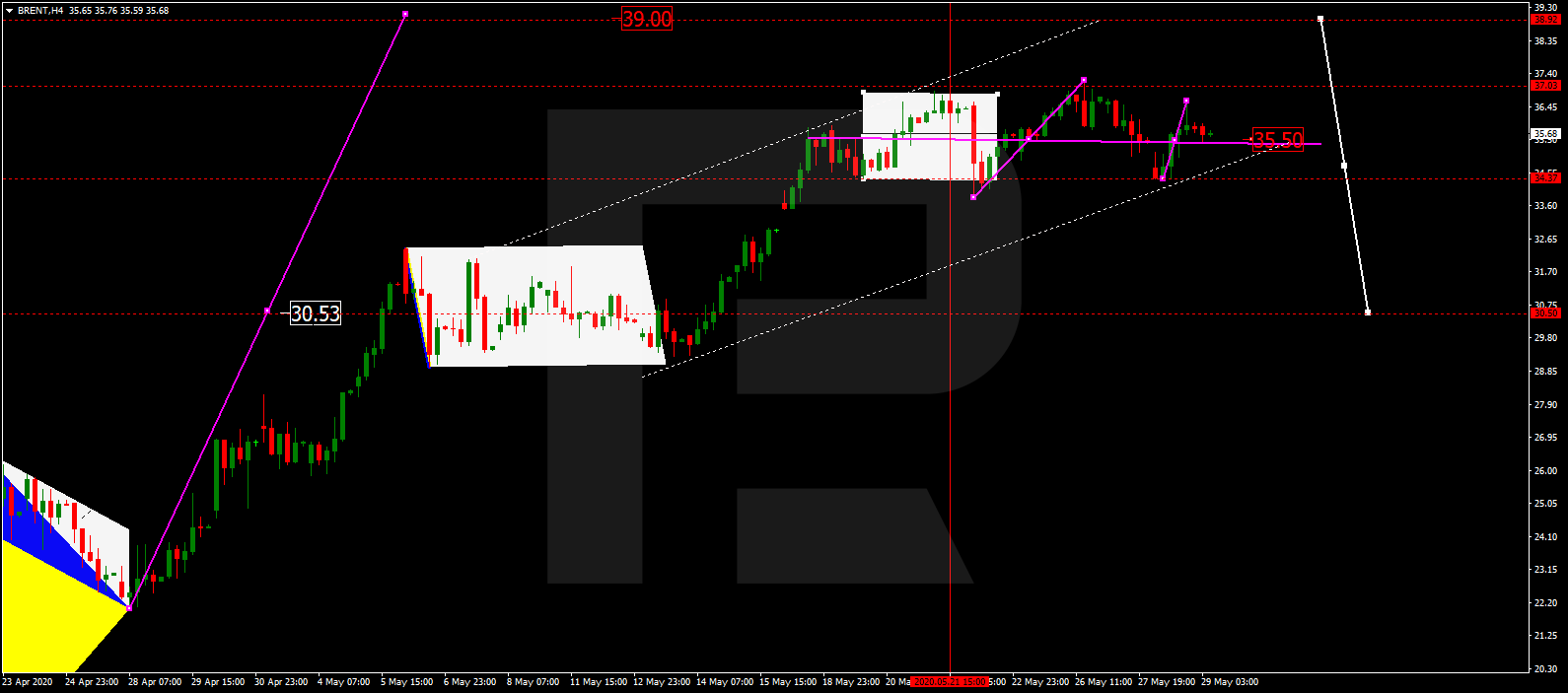

BRENT

Brent is consolidating around 35.50 without any particular direction. If later the price breaks this range to the upside, the market may resume trading upwards with the target at 39.00; if to the downside – start a new correction towards 30.50.

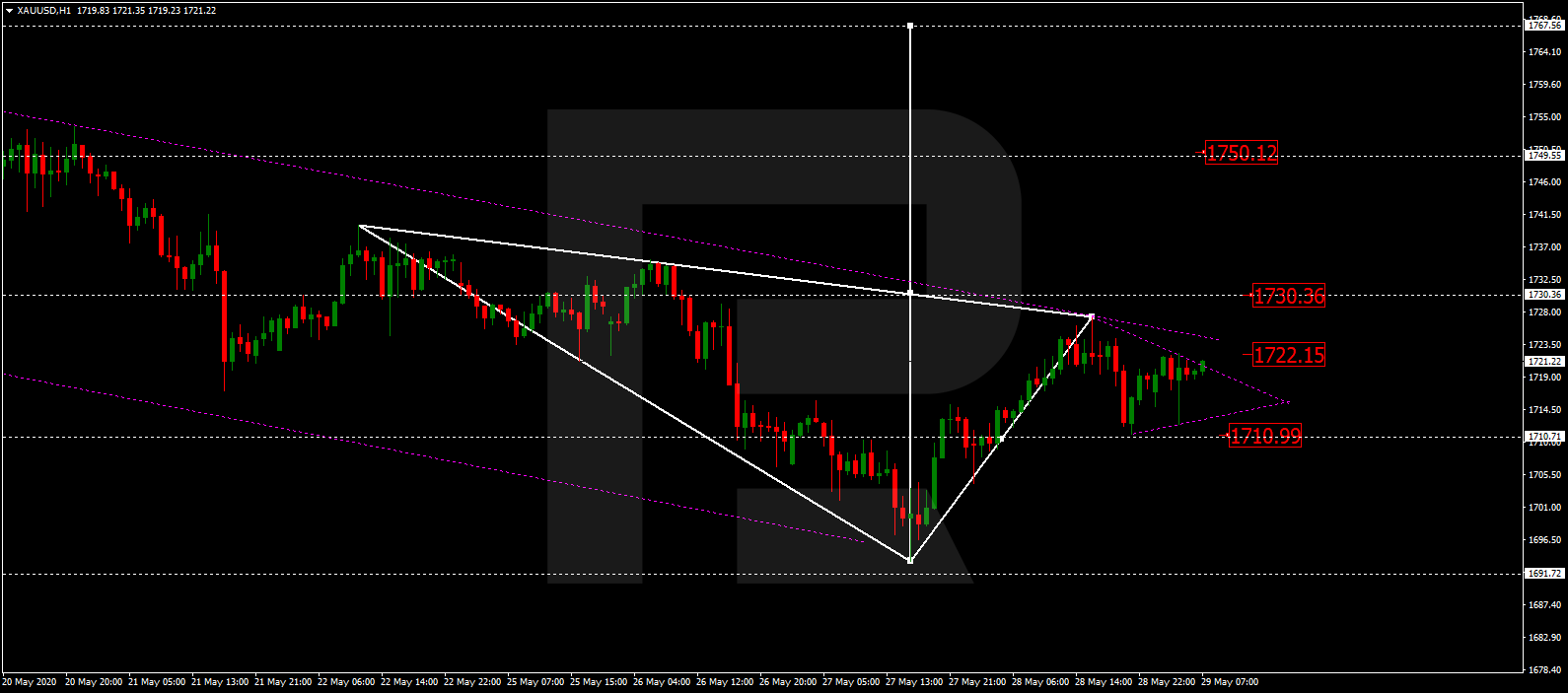

XAUUSD

Gold is forming one more ascending structure to break 1730.00. After that, the instrument may continue trading upwards with the short-term target at 1750.10.

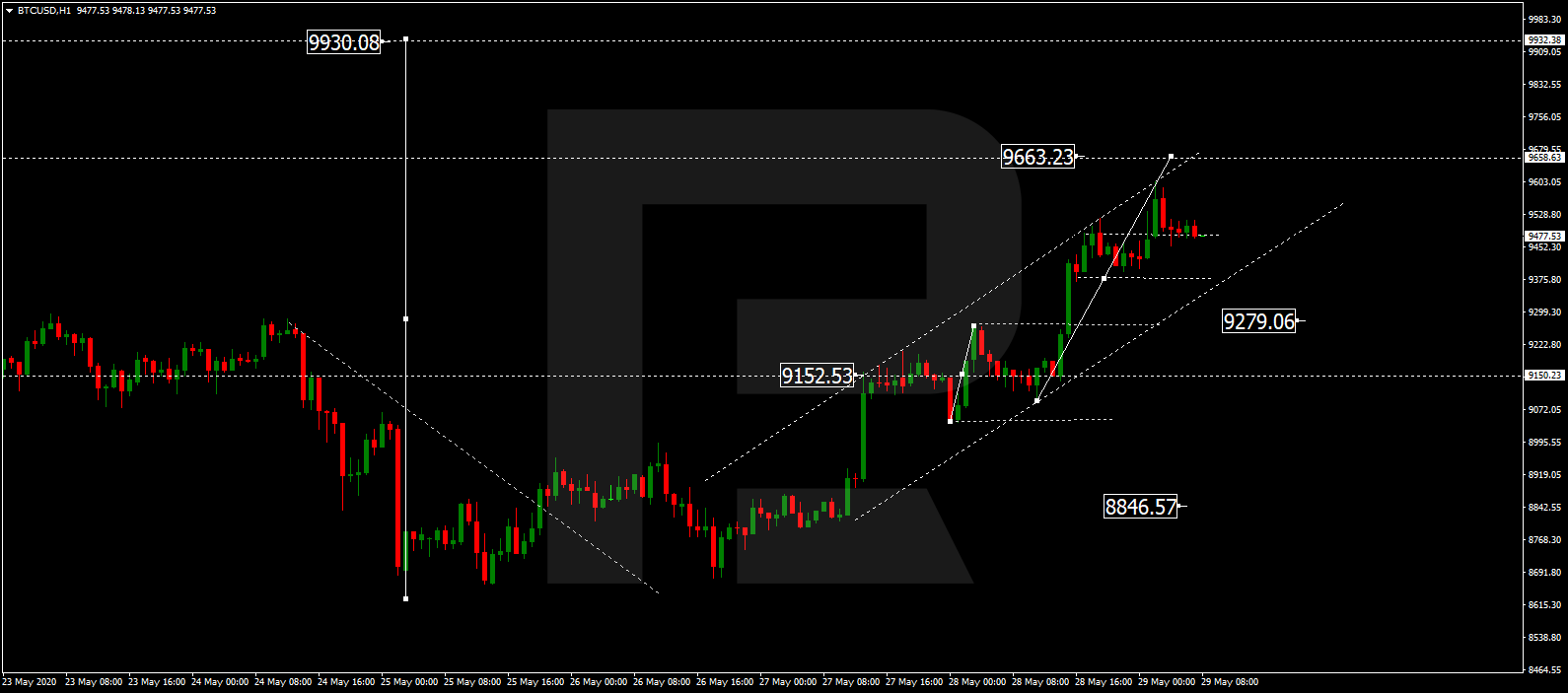

BTCUSD

BTCUSD continues forming the ascending wave towards 9660.00. Possibly, today the pair may reach it and then start another correction with the target at 9200.00.

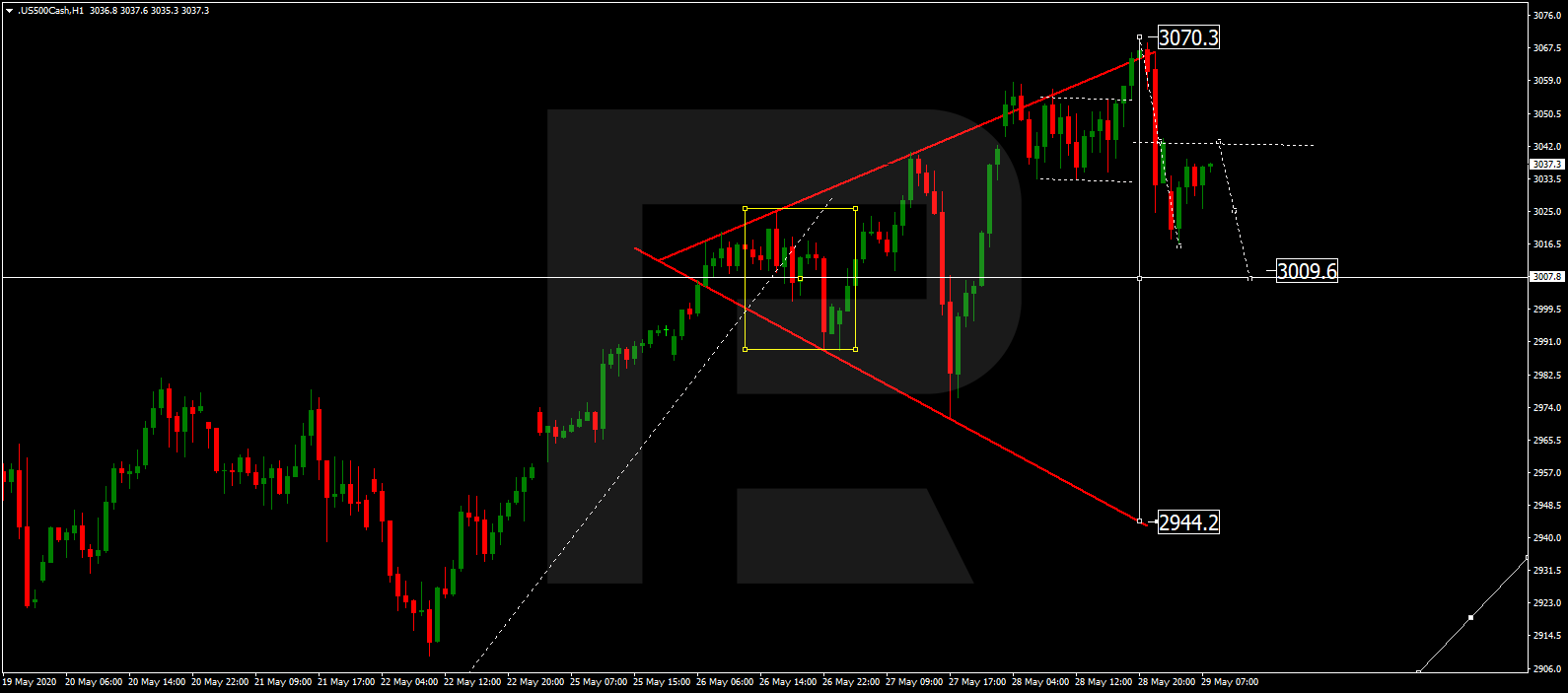

S&P 500

The Index is consolidating around 3040.5. Today, the asset may fall towards 3008.0 and then grow to reach 3040.5. If later the price breaks this range to the downside, the market may resume trading downwards with the target at 2944.4; if to the upside – start a new growth towards 3160.5.