The second-quarter reporting cycle has begun and 54 S&P 500 members, representing 16.9% of the index’s total market capitalization, have already reported their results.

Per the latest Earnings Trends, total earnings of these companies are up 11.9% on a year-over-year basis (79.6% of the companies beat EPS estimates) while total revenue is up 5.5% on a year-over-year basis (72.2% of the companies also beat top-line estimates).

Overall second-quarter earnings for S&P 500 companies are anticipated to be up 7.2% from the year-ago quarter on revenues that are estimated to increase 4.5%.

Technology Earnings Expectations

Technology is one of the five sectors projected to report the highest growth in the second quarter. The other four are Energy, Aerospace, Construction and Industrial Products.

We note that the technology sector has been a strong performer on a year-to-date basis. The sector is benefiting from increasing demand for cloud-based platforms, growing adoption of Artificial Intelligence (AI) solutions, Augmented/Virtual reality devices, autonomous cars, advanced driver assisted systems (ADAS) and Internet of Things (IoT) related software. Earnings for the technology sector are anticipated to be up 10.1%.

Let’s take a sneak peek into four technology companies that are set to report their quarterly earnings on Jul 24:

Alphabet Inc. (NASDAQ:GOOGL) is unlikely to beat second-quarter 2017 expectations as it has an unfavorable combination of a Zacks Rank #2 (Buy) and an Earnings ESP of -3.15%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

This is because, as per our proven model, a company needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 or 3 (Hold) to deliver an earnings surprise. You can see the complete list of today’s Zacks #1 Rank stocks here.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into an earnings announcement, especially when the company is seeing negative estimate revisions.

However, we note that Alphabet beat the Zacks Consensus Estimate in three of the trailing four quarters, resulting in an average positive surprise of 5.74%.

We believe Alphabet’s strengths in mobile platform, YouTube and cloud will play important roles. On a cautionary note, Google’s troubles in the EU are mounting. (Read More: Alphabet Q2 Earnings: Is Disappointment in Store?)

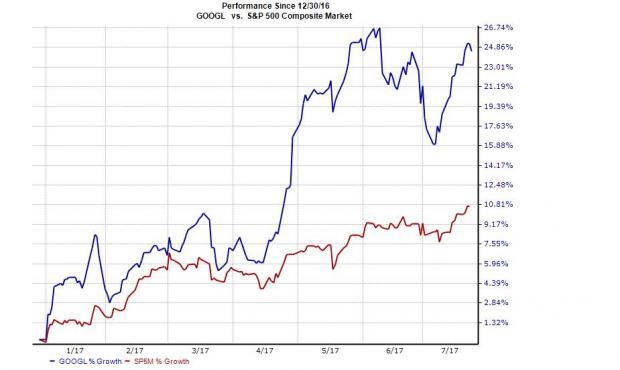

Alphabet has outperformed the S&P 500 on a year-to-date basis. While the stock returned 25.2%, the index gained 12.5% over the same time frame.

Similarly, Cadence Design Systems Inc. (NASDAQ:CDNS) is unlikely to beat second-quarter 2017 estimates as it has an unfavorable combination of an Earnings ESP of 0.00% and a Zacks Rank #3.

Notably, the company has beaten the Zacks Consensus Estimate in two of the preceding four quarters. It has an average four-quarter positive surprise of 2.8%.

We believe opportunities in higher growth areas like automotive, cloud infrastructure, machine learning, and aerospace & defense are a positive for the company.

Cadence’s second-quarter guidance was unimpressive. Management noted increased variability in quarter to quarter results due to growing portion of hardware and IP in the business mix. (Read More: Cadence Set to Report Q2 Earnings: What's in Store?)

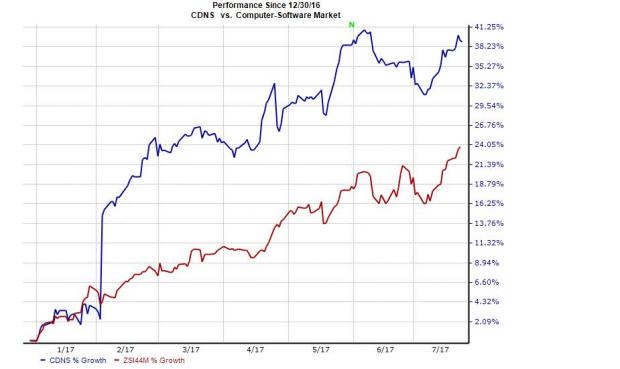

Notably, its shares have gained 38.9% on a year-to-date basis in contrast to its industry’s gain of 23.4%.

Scientific Games Corporation (NASDAQ:SGMS) is also not expected to beat second-quarter 2017 estimates as it has an unfavorable combination of an Earnings ESP of -24.32% and a Zacks Rank #2.

Notably, Scientific Games has missed the Zacks Consensus Estimate in two of the four preceding quarters with an average negative surprise of 2.9%.

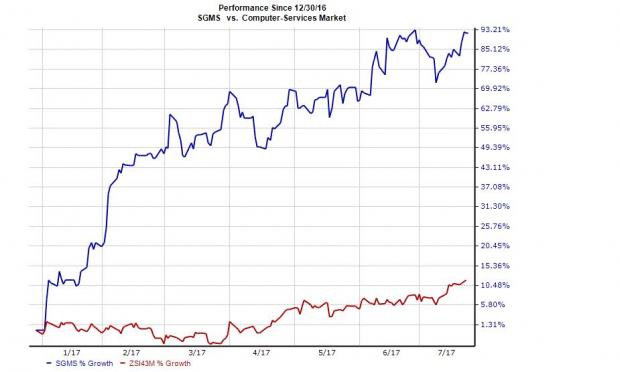

Shares have gained a massive 91.8% on a year-to-date basis compared with the industry’s gain of 11.7%.

However, Logitech International S.A. (NASDAQ:LOGI) looks likely to beat first-quarter fiscal 2018 estimates as it has a favorable combination of a Zacks Rank #3 and an Earnings ESP of +11.77%.

Notably, Logitech has beaten the Zacks Consensus Estimate in each of the four preceding quarters with an average positive surprise of 94.1%.

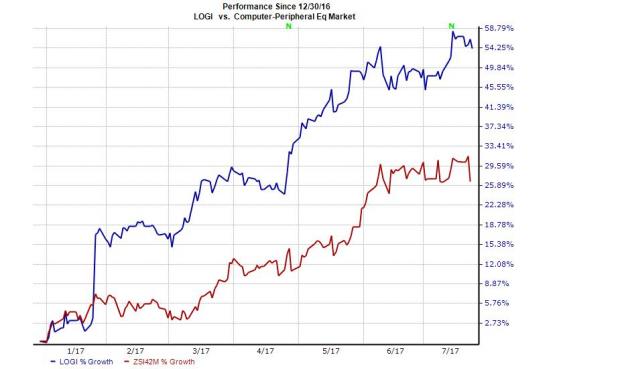

Moreover, the company has outperformed the industry on a year-to-date basis. While the stock gained 54.2%, the industry recorded an increase of 26.7%.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Logitech International S.A. (LOGI): Free Stock Analysis Report

Scientific Games Corp (SGMS): Free Stock Analysis Report

Cadence Design Systems, Inc. (CDNS): Free Stock Analysis Report

Original post

Zacks Investment Research