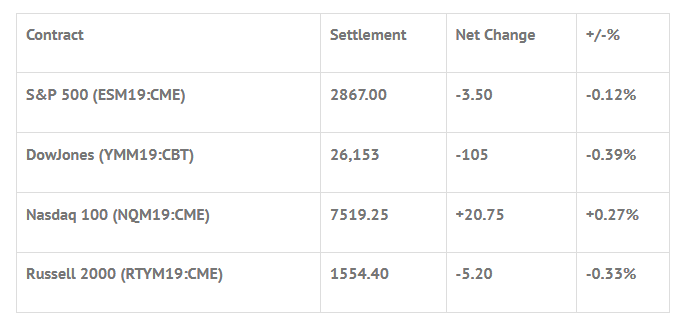

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed higher: Shanghai Comp +1.24%, Hang Seng +1.22%, Nikkei +0.97%

- In Europe 11 out of 13 markets are trading higher: CAC +0.64%, DAX +1.30%, FTSE +0.18%

- Fair Value: S&P +3.74, NASDAQ +24.25, Dow +0.90

- Total Volume: 857k ESM & 259 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, ADP (NASDAQ:ADP) Employment Report 8:15 AM ET, Raphael Bostic Speaks 8:30 AM ET, PMI Services Index 9:45 AM ET, ISM Non-Mfg Index 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, and Neel Kashkari Speaks 5:00 PM ET.

S&P 500 Futures: #ES Short Sellers Are Toast

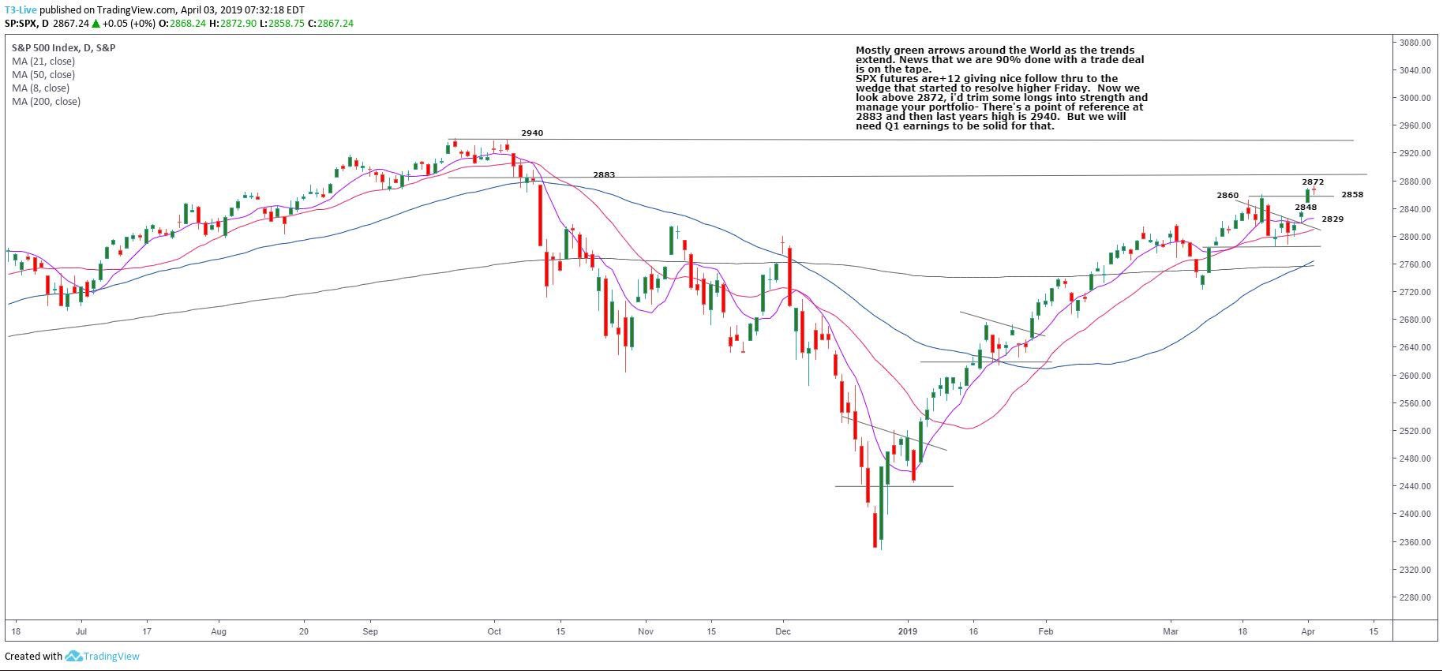

Chart courtesy of Scott Redler @RedDogT3 – $spx futures +14 giving some nice upside follow thru to the wedge they resolved higher starting Friday. Manage/trim and trail into Strength.

If you’re bearish, you’re not a happy camper. I know I was off by a week or two on my call of the Nikkei / S&P comparison charts, but you know what, that’s how the cookie crumbles.

I told the PitBull last week that the ES is ‘fed supercharged’, and to forget the short call stuff. I also told him that 2880-2890 was on tap. I am not saying that some out of the blue headline won’t come flying out that knocks the S&P down, but after the algos digest it, it will just be more fuel for the upside. Let’s face it traders, QE is back and that means new all time highs.

During Monday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 2873.75, a low of 2864.50, and opened Tuesday’s regular trading hours at 2871.75.

The first move after the 8:30 CT bell was a quick dip down to 2869.25, followed by a bump up to 2871.00. After that, a sell program activated that helped pull the futures back down to 2865.75, but by 9:30 it had recovered back up to 2871.75.

After testing the RTH high, the ES set its sights on a new low, and at 10:15 traded down to 2862.25. From there, the futures again recovered, and within the hour had rallied back to 2871.00. For the rest of the morning, and into the afternoon, the ES traded sideways between 2871.00 and 2866.00.

Just after 2:00 CT the futures finally broke out of the range and slowly started to inch higher. It wasn’t the kind of rally you buy into though, volume had not even broken 700k contracts at that point, and the MiM showed some early signs of a negative imbalance.

The ES hovered near the highs going into the close and printed 2873.00 on the 2:45 cash imbalance reveal, then 2871.50 on the 3:00 cash close, and ended the day on a weak note, trading down to 2867.25 on the 3:15 futures close, down -3.25 handles, or -0.11%.

In the end, the overall tone of the ES was firm. In terms of the days overall trade, total volume was low, with only 857k futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.