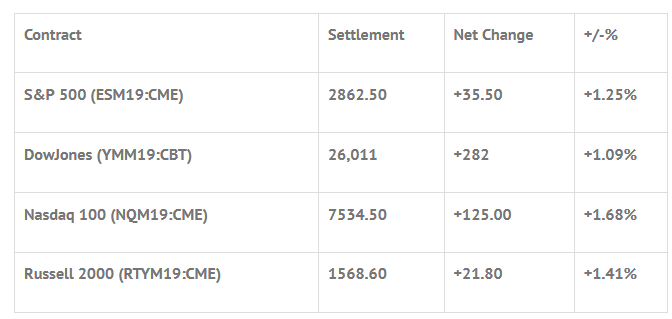

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed higher: Shanghai Comp +0.09%, Hang Seng +0.14%, Nikkei +0.09%

- In Europe 13 out of 13 markets are trading lower: CAC -1.03%, DAX -0.57%, FTSE -1.16%

- Fair Value: S&P +5.19, NASDAQ +30.02, Dow +23.86

- Total Volume: 1.6mil ESM & 329 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes PMI Composite FLASH 9:45 AM ET, Existing Home Sales 10:00 AM ET, Wholesale Trade 10:00 AM ET, the Baker-Hughes Rig Count 1:00 PM ET, Treasury Budget 2:00 PM ET, Raphael Bostic Speaks 9:30 PM ET, and Charles Evans speaks on Sunday 9:45 PM ET.

S&P 500 Futures: What Kind Of Meat Do The Bulls Eat? Bear Meat

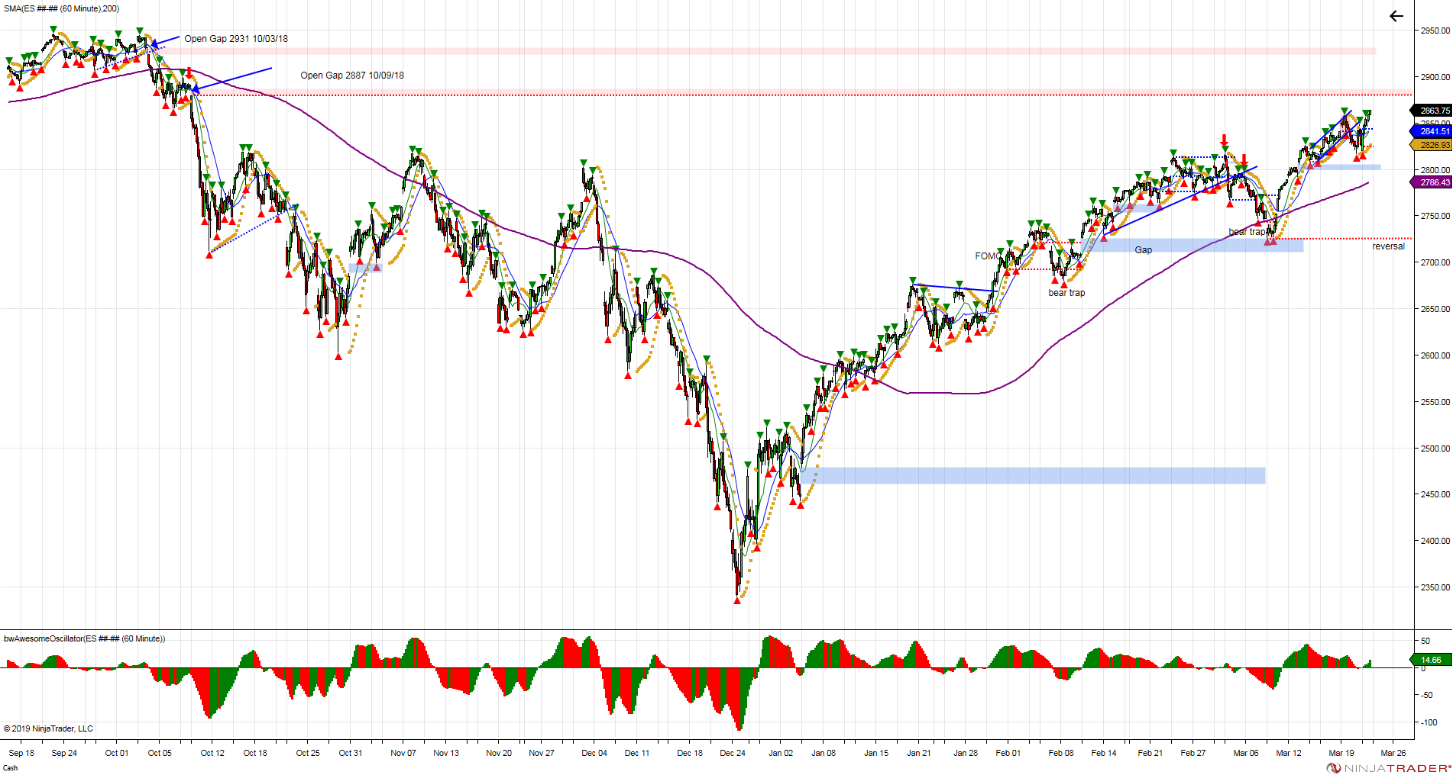

Chart courtesy of Stewart Solaka @Chicagostock – $ES_F Open gaps:

10/10/18 2887

10/03/18 2931

Wednesday weakness lead to lower prices on Globex during the night session and into early Thursday morning, but the ES started to short cover before Thursdays mornings 8:30 CT futures open. After that the bulls took over with tech stocks leading the S&P and Nasdaq to new highs as traders warmed back up to the Federal Reserve’s statements to not hike rates in 2019 and only one hike in 2020.

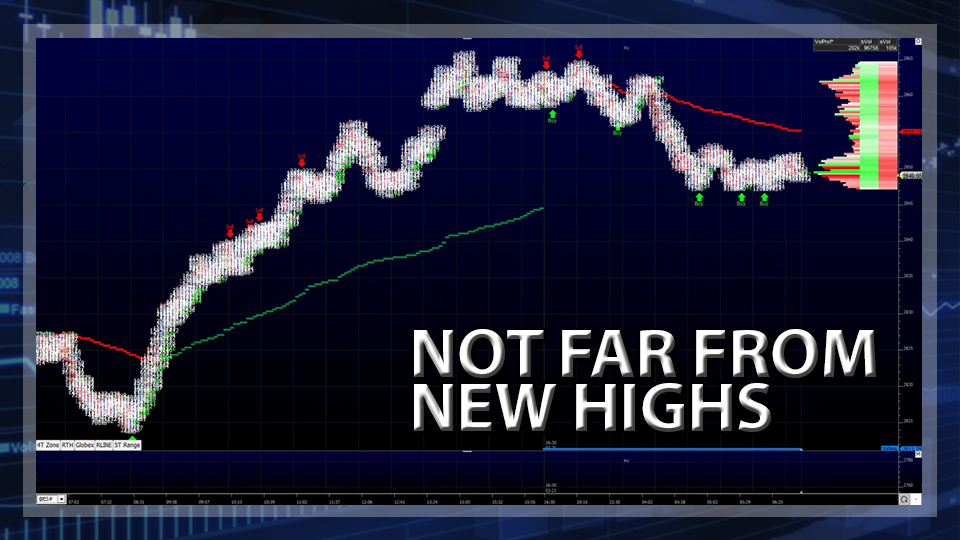

During Wednesday nights Globex session, the S&P 500 futures (ESM19:CME) printed a high of 2836.00, a low of 2813.75, and opened Thursday’s regular trading hours at 2820.25. After the 8:30 CT bell the ES launched higher, and by 9:15 had traded up to 2840.00, up +13.00 handles. By 10:30 it had traded up to 2849.75. This market was a freight train, and if you didn’t get out of the way, you got run over.

There wasn’t more than a 4 handle pullback until the ES topped out at 2856.50 just before 11:00. Once the morning high was in the futures back and filled down to 2846.25. Buyers came right back in though, and another leg up started. By 1:00 CT, when the MiM opened up showing $506M to buy, the ES was printing new highs, and the rally continued for the rest of the day. Going into the end of the day, the futures went on to print 2864.75 on the 2:45 cash imbalance reveal, then 2861.00 on the 3:00 cash close, and 2863.00 on the 3:15 futures close.

In the end, the overall tone of the ES was strong. In terms of the days overall trade, total volume was above average, with 1.65 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.