PSTG Tends To Rally After Pullbacks To 160-Day Moving Average

Pure Storage (NYSE:PSTG) will report earnings after the close tomorrow, Aug. 21. While PSTG stock has moved lower after the cloud concern's last three earnings reports, the shares are trading at a key level right now -- and could be flashing "buy" before earnings.

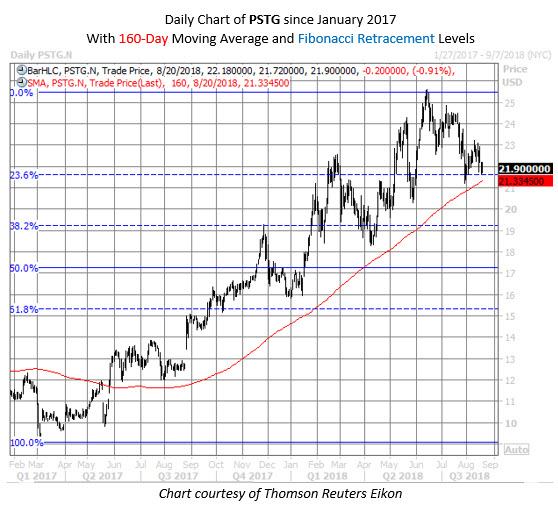

Pure Storage stock has soared 77% in the past year. However, since touching a record high of $25.62 in mid-June, the equity has pulled back to test its footing in the $21-$22 region. This area represents a 23.6% Fibonacci retracement of PSTG's rally from its early 2017 lows to the aforementioned peak, and is also home to the stock's ascending 160-day moving average.

In fact, PSTG shares are now within one standard deviation of their 160-day trendline, after a lengthy stretch above this moving average. Per data from Schaeffer's Senior Quantitative Analyst Rocky White, there have been two similar pullbacks of this kind -- and both preceded huge gains for the shares. Specifically, PSTG went on to rally 14.96%, on average, a month after those dips. From the security's current perch at $21.90, a similar pop would put the shares around $25.17 -- back near all-time highs.

On average, PSTG shares have moved 8.7% the day after the firm's last eight earnings reports, regardless of direction. This time around, the options market is pricing in a much bigger 14.8% move for the equity.

In the past two weeks, long calls have been picked up at an unusually fast pace. On the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), speculators bought to open nearly 36 Pure Storage calls for every put in the past 10 days. The resultant 10-day call/put volume ratio of 35.96 is in the 85th percentile of its annual range, pointing to a much healthier-than-usual appetite for purchased calls over puts of late.

However, some of that call buying -- particularly at out-of-the-money strikes -- could be attributable to short sellers seeking an options hedge ahead of earnings. Short interest represents more than 10% of the stock's total available float, or more than eight sessions' worth of pent-up buying demand, at PSTG's average pace of trading. Should the company report strong earnings tomorrow night, a short squeeze could propel the shares higher.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI