The US stock market has suffered a rough ride so far in 2018, but technology shares remain the strongest trend performer for the major US equity sectors, based on a set of exchange-traded funds through yesterday’s close (May 22).

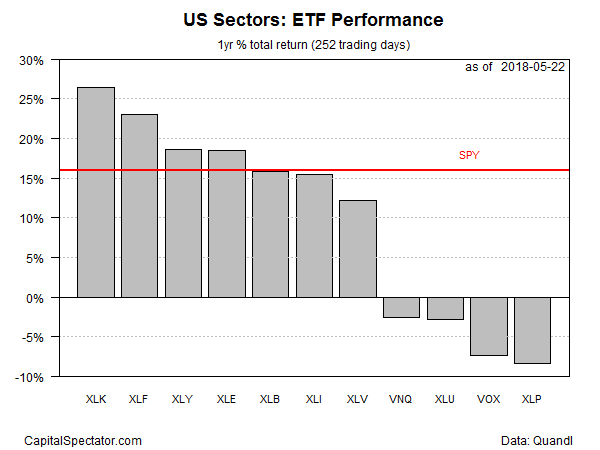

Technology Select Sector SPDR (NYSE:XLK) is up 8.8% so far in 2018, edging out the second-strongest 8.5% year-to-date gain in energy via Energy Select Sector SPDR (XLE (NYSE:XLE)). For the one-year change, XLK’s edge is even stronger: 26.4% vs. 23.0% for the runner-up performance in Financial Select Sector SPDR (NYSE:XLF).

On the flip side, consumer staples have the biggest year-over-year setback for sectors. The Consumer Staples Select Sector SPDR (NYSE:XLP) is down 8.4% for the trailing one-year total return through Tuesday.

The tailwind for stocks in general, although battered in recent history, remains solidly positive. The broad equity market is up more than 15% for the past year, based on the total return for the SPDR S&P 500 (NYSE:SPY)).

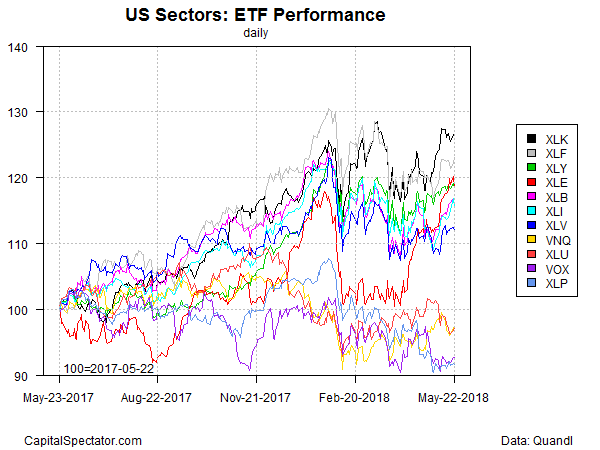

Tech’s leadership has been uneven this year, but XLK’s momentum remains unchallenged for now, as the performance chart below reminds (black line at top).

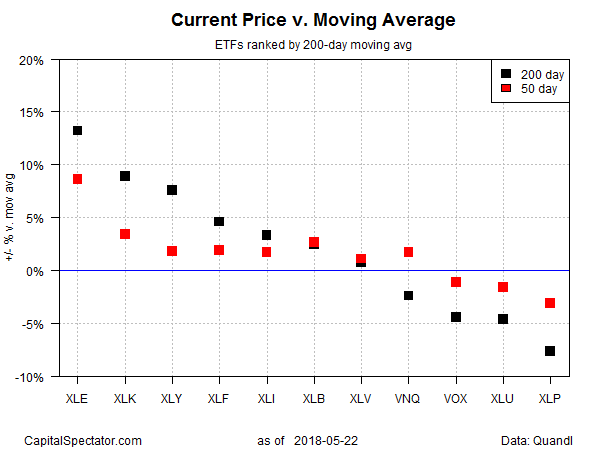

A challenger to the throne may be emerging in energy stocks, however. Ranking the sector ETFs by current price relative to 200-day moving average shows that Energy Select Sector SPDR (XLE) is in the leadership position, edging out XLK’s second-rank status.

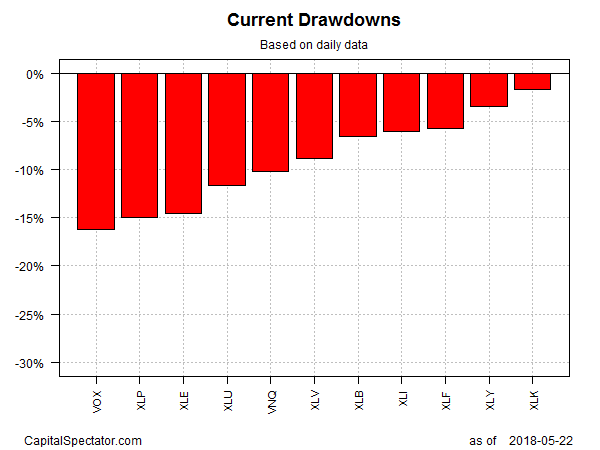

Profiling the sectors via drawdown shows that telecommunications stocks are posting the deepest peak-to-trough declines as of Tuesday’s close. Vanguard Telecommunication Services (NYSE:VOX) has fallen more than 16% from its previous summit. Tech, by contrast, has the smallest drawdown: XLK’s slide from its previous peak currently ranks at a slight 1.6%.