Fed Chair Jerome Powell has completed his testimony, with markets rejoicing the promise the Fed remains accommodative. Value keeps surging over growth, and regardless of yesterday‘s great performance, tech has a vulnerable feel to it – semiconductors lead higher, fine, but communications didn‘t confirm, and the health-care-biotech dynamic isn't painting an outperformance picture either. Real estate isn't taking as strong a cue, while consumer discretionaries' recovery could also be stronger. Thus far though, no need to think about taking losses to optimize your gains elsewhere.

Just as I wrote yesterday:

(…) the financials benefiting from the greater spread, won't save the day, as the key chart to watch now is technology and also health care. … The sectoral outlook remains mixed, even as value continues greatly outperforming growth this month. … Long-term Treasuries are starting to hold greater sway over the stock market fate now, too. The dollar‘s woes thus far continue playing out largely in the background.

Not to get complacent, the GameStop (NYSE:GME) squeeze has made a comeback yesterday. Will it coincide with broader stock market woes on par with late January? It is way too early to say.

Let‘s jump right into the charts for an objective momentary view instead.

Here they are, all courtesy of www.stockcharts.com.

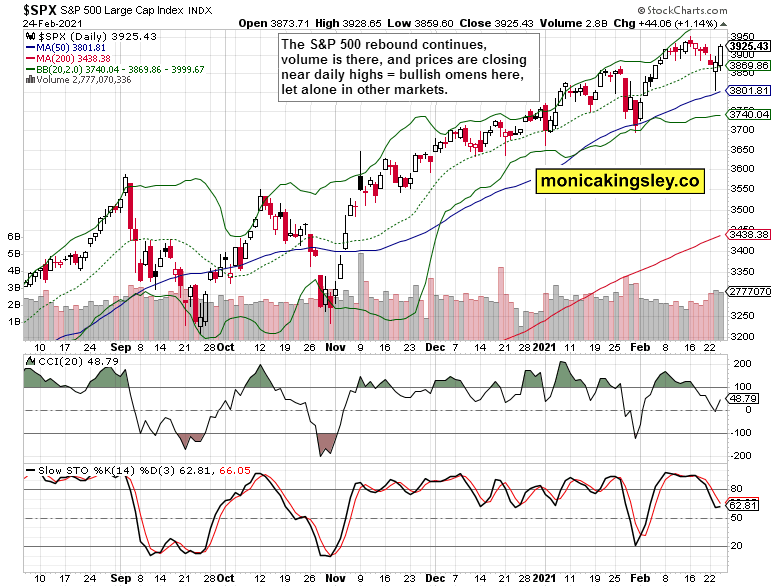

S&P 500 and Its Internals

Strong S&P 500, everything looks fine on the surface – just as should be, befitting buy-the-dip mentality. Strong volume, no meaningful intraday setback, so far so good.

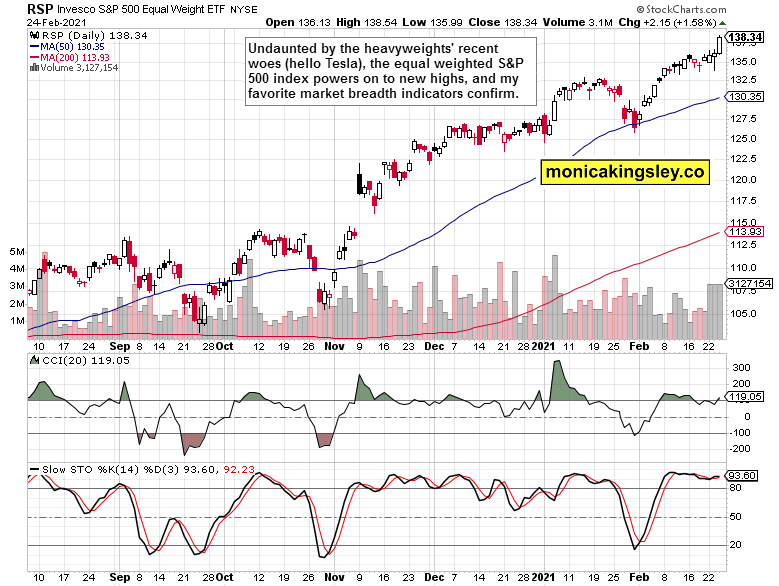

The equal weight S&P 500 chart is looking better and better day by day. New highs, strong uptrend, broadening leadership. It‘s a mirror reflection of the big names‘ woes, and a testament to value outperforming growth. This bull run is far from making a top.

Credit Markets

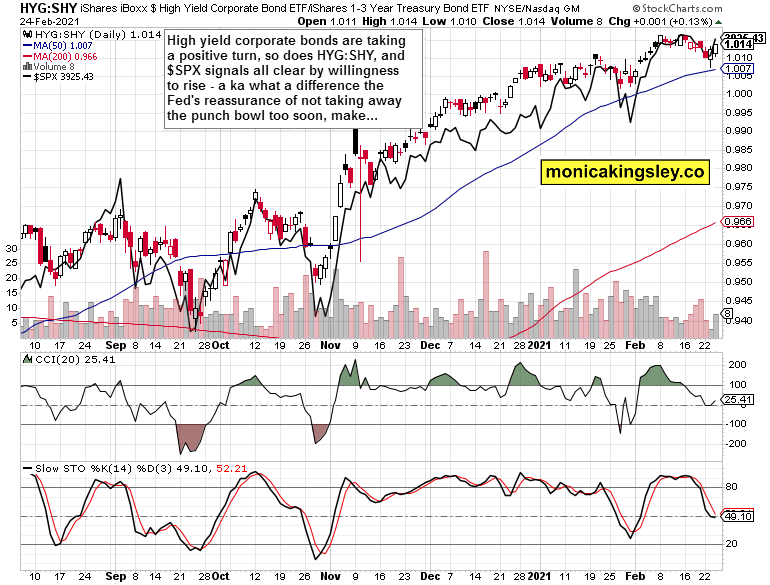

High-yield corporate bonds (iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG)) had a good day yesterday, and so did the high-yield corporate bonds to short-dated Treasuries (HYG:SHY) ratio. Yet, it‘s the daily stock market outperformance that is noticeable here – optimistic sign of an all-clear signal. I'm not taking it totally at face value given tech performance. In a short few days, I can easily become more convinced though.

Technology

Strong daily tech (Technology Select Sector SPDR® Fund (NYSE:XLK) ETF) upswing, yet only half the prior downside erased so far, and the volume could be higher compared with the preceding downswing. Semiconductors (SPDR® S&P Semiconductor ETF (NYSE:XSD) ETF) are leading again, fine. Yet, it's the heavyweight names that matter the most to me right now. Check out yesterday‘s observations:

(…) The tech jury is still out, and this heavyweight sector remains vulnerable, with consequences to the S&P 500 if it doesn‘t keep on the muddle through recovery path at the very least.

Summary

Stock bulls did great yesterday, but everything isn't fine yet in the tech realm. Due to its sheer weight in the S&P 500 index, pulling the cart a bit more enthusiastically is what the 500-strong index needs to take on new highs, because value stocks can't do it all.

Disclaimer: All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.