If you’re a regular Wall Street Daily reader, you know the drill by now. So go ahead and scroll down.

For the newbies, here’s the deal. Each Friday I embrace the adage that “A picture is worth a thousand words.” And I select a handful of graphics that put the week’s investment news into perspective for you.

All it takes is a quick glance and you’ll be up to speed — and, more importantly, poised to profit. So let’s get to it…

All Hail Trump Tech Stocks

Think news about Donald Trump is unavoidable right now?

Well, that’s nothing compared with the attention tech stocks are getting right now…

Even Warren Buffett can’t resist the tech temptation.

The billionaire who’s famous for his pithy investment wisdom is almost equally well-known for his aversion to technology stocks. Yet he’s currently one of the biggest shareholders in the largest technology company in the world, Apple Inc (NASDAQ:AAPL).

Truth is, we’re all bigtech investors now. By choice or by circumstance. And that’s simply because tech companies dominate the S&P 500 index.

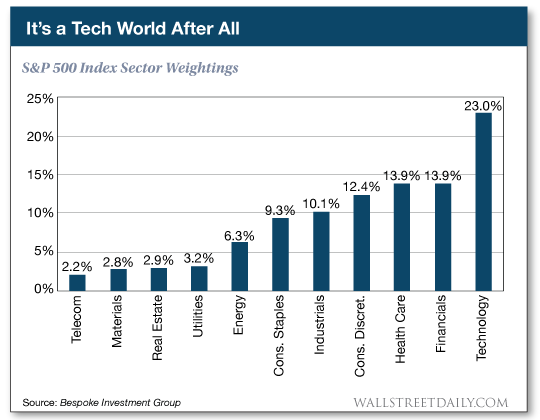

According to Bespoke Investment Group, “The technology sector’s weighting has exploded higher, up to 23%. That’s the highest weighting the tech sector has seen since January 2001.”

If you own an S&P 500 index fund — or a mutual fund managed by a closet indexer — you’re a tech investor.

Don’t fight it, though. Embrace it! Here’s why…

At the rate money is flowing into the space, sector weightings and stock prices are bound to head higher still.

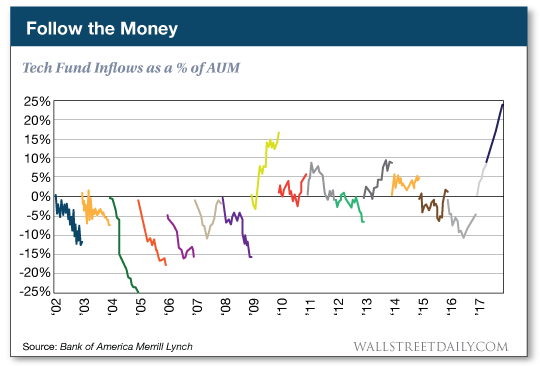

Per the latest number crunching at Bank of America Merrill Lynch, capital is flooding into tech stocks at the fastest pace in 15 years.

A little context is helpful here. Inflows into the tech sector are set to eclipse 25% of assets under management (AUM), compared with the previous high of 17% during the dot-com era.

I know that stat, combined with soaring stock prices, is bound to spike concerns about a pullback — or, worse, a crash.

Heck, legendary vulture investor Asher Edelman told CNBC this week that the entire stock market is a charade.

He believes the “Plunge Protection Team” (PPT), created in the aftermath of the 1987 stock market crash, is the only force propping up the markets.

In turn, he doesn’t want to own stocks because he doesn’t “know when the plug is going to be pulled.”

Silly rabbit!

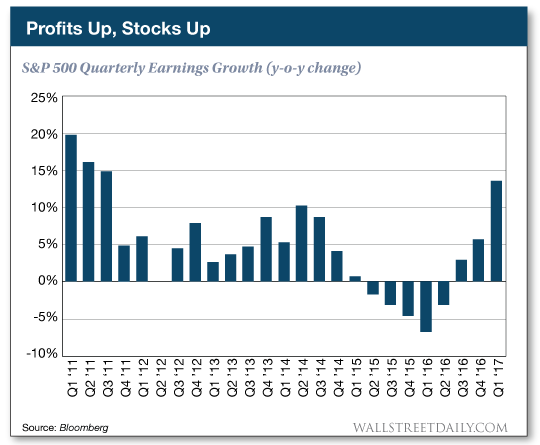

The PPT isn’t what props up stocks over the long haul — it’s profits. If earnings are growing, so should stock prices.

And guess what? Earnings are growing.

S&P 500 companies reported a 14% increase in earnings in the first quarter, the highest level since the third quarter of 2011, according to Bloomberg data.

As you can see, the quarterly uptick is part of a trend that’s been unfolding and intensifying for the past three quarters. And it’s expected to continue for the remainder of the year.

Sure enough, profit growth is projected to be the highest in the tech sector — up 19% in 2017.

Whether you want to give credit to the PPT or profits, it doesn’t matter. The conclusion is the same — we’re likely in store for more record highs for stocks.

To reiterate my colleague Jonathan Rodriguez’s analysis from earlier this week, being overweight technology stocks promises to do a portfolio good. So don’t miss out.