The Powell inspired S&P 500 stop run is almost history now, with the futures trading over 3,880 again as we speak. No surprise here, but since the long-term Treasuries plunge went on largely unabated, that‘s concerning. Even if not now, iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) and iShares 10-20 Year Treasury Bond ETF (NYSE:TLH) have the power to trouble the stock bulls seriously.

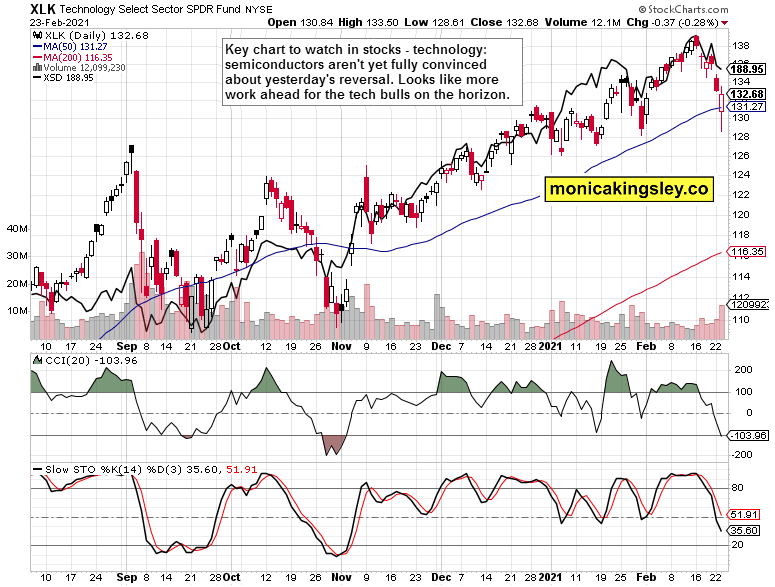

And the financials benefiting from the greater spread, won‘t save the day, as the key chart to watch now is technology – also health care. Health care especially because biotech didn't get its act together yesterday really, while semiconductors did better. With consumer discretionaries hurt, utilities and consumer staples can't be relied on in a rising rates environment, and communications can't save the day either. The sectoral outlook remains mixed, even as value continues greatly outperforming growth this month.

The stock bulls simply need tech clearly stabilized and turning here so as to think about new S&P 500 highs again. Long-term Treasuries are starting to hold greater sway over the stock market fate now, too. The dollar‘s woes thus far continue playing out largely in the background.

Let‘s remember what I said yesterday about trends and flashes in the pan:

(…) Powell‘s testimony is about to bring volatility, but does it have the power to change underlying trends? Not really – while his latest high-profile assessments brought about a downswing, stocks recovered in spite of the GameStop (NYSE:GME) drama too. Should we see a replay of the above, new highs are coming – and they are, in both stocks and precious metals. We're in a commodities supercycle on top!

Let‘s get right into the charts (all courtesy of www.stockcharts.com).

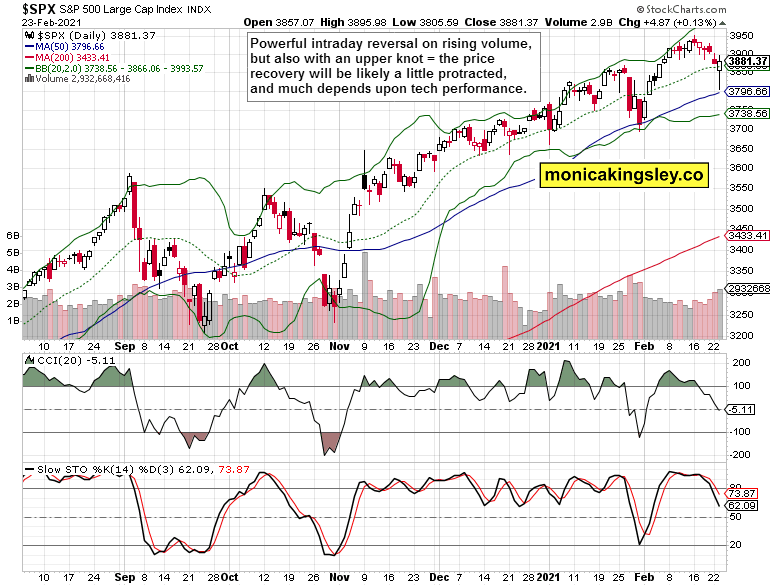

S&P 500 Outlook

Yesterday‘s intraday reversal reached just a little above Monday‘s closing prices, highlighting that more needs to be done for the index to regain upside momentum. The Powell testimony reversal was a good start, and stock bulls need to do more once this event gets in the rear-view mirror later today. Given the premarket action reaching 3,890, the case is not lost.

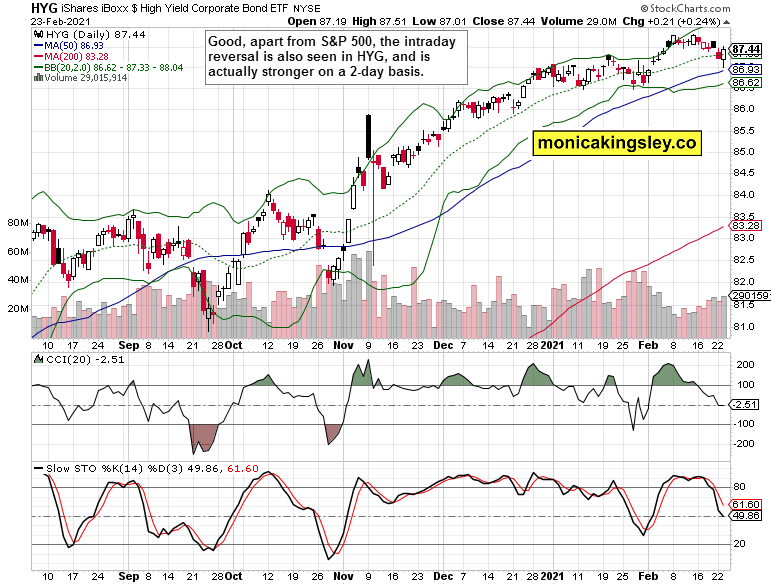

Credit Markets

High-yield corporate bonds (iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG) recovered, and crucially did better than stocks. The volume comparison is also a tad more positive. Should this credit market outperformance in the short run hold, then the S&P 500 is more likely to advance than not, too.

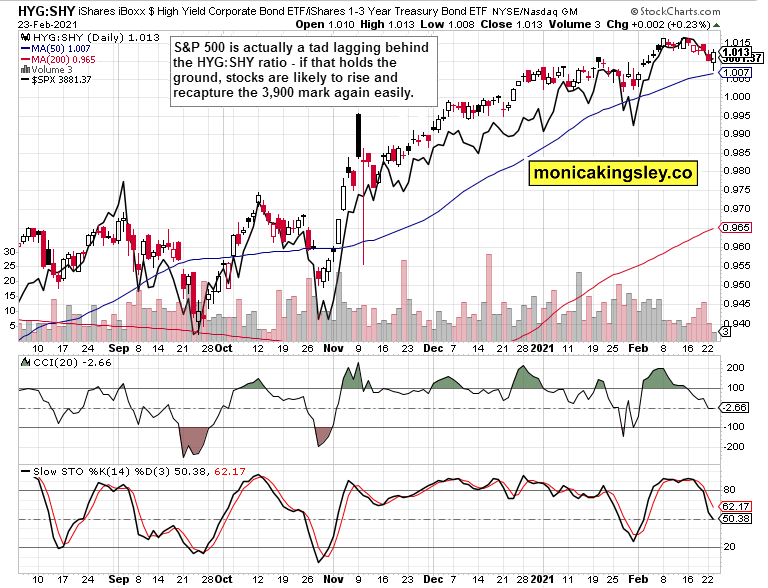

High-yield corporate bonds to short-term Treasuries (HYG:SHY) ratio is still behaving reasonably – the overlaid S&P 500 prices (black line) aren‘t accelerating to the downside. The cue to move higher in stocks is apparent.

Technology

It's the tech (Technology Select Sector SPDR® Fund (NYSE:XLK) ETF) again. It reversal yesterday is not nearly enough for the S&P 500 to think about taking on new highs. Semiconductors (SPDR® S&P Semiconductor ETF (NYSE:XSD)) subtly outperformed, but they don‘t give outrageously bullish signs either. The tech jury is still out, and this heavyweight sector remains vulnerable, with consequences to the S&P 500 if it doesn‘t keep on the muddle through recovery path at the very least.

Summary

Stock bulls are not out of the woods yet, and technology stabilization must kick in first. Little proof thus far it's there. And I view the rising rates as starting to bite the stock market too.