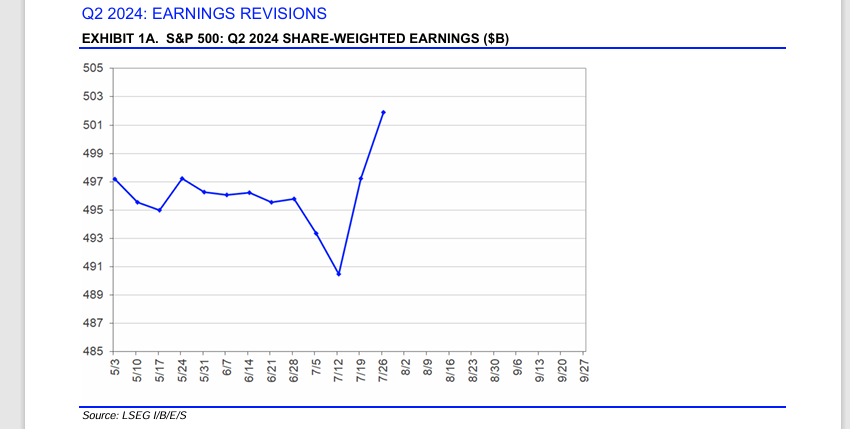

Below is essentially a net income chart from LSEG I/B/E/S – for the S&P 500 as earnings season progresses each quarter.

This is a normal chart of the quarterly progression and explains the “fish-hook” effect Ed Yardeni talks about frequently, where the S&P 500 EPS estimate starts lower from negative revisions from the last few weeks in the previous quarter (in this case the last few weeks of June ’24), and the first two weeks of the new quarter (in this case, July ’24), and then moves higher as the bulk of the S&P 500 reports the last quarter.

From the above graph, nothing is out of the ordinary.

On the other hand, this chart from TrendSpider, ( a new face on X, but I like the charts), may give readers pause:

So, are you a believer more in fundamentals or technicals?

Here’s how expected tech sector EPS growth has changed from July 1 for the forward quarters Q2 ’24 through Q2 ’25:

- Q2 ’24: +16.9% EPS growth expected on July 1, +17.8% tech EPS growth expected today;

- Q3 ’24: +15.4% tech sector EPS growth expected on July 1, +15.6% tech sector EPS growth expected today;

- Q4 ’24: +16.4% tech sector EPS growth expected on July 1, +17% tech sector EPS growth expected today;

- Q1 ’25: +18.9% tech sector EPS growth expected July 1, +19.6% tech sector EPS growth expected today;

- Q2 ’25: +20.3% tech sector EPS growth expected July 1, +24.6% tech sector EPS growth expected today;

Next week, Microsoft (NASDAQ:MSFT) reports Tuesday night, July 30th, after the close, while Amazon (NASDAQ:AMZN) and META (NASDAQ:META) also report next week, but Amazon is a member of the consumer discretionary sector, while META is a member of the communications services sector, thus neither company will impact the tech sector estimates.

Microsoft and Intel (NASDAQ:INTC) (Thursday, 8/1 after the close), as well as Apple (NASDAQ:AAPL) (8/1, after the close) will be the big movers for the tech sector.

While Apple’s market cap weight is similar to Microsoft’s in the S&P 500 ($3.8 trillion, and Apple has now regained the #1 market cap weight in the S&P 500 after Thursday night, July 25th, ’24), Apple’s “earnings weight” is larger than Microsoft’s, which means an Apple upside surprise or bigger beat will mean more to the “expected tech sector EPS growth rates” than Microsoft.

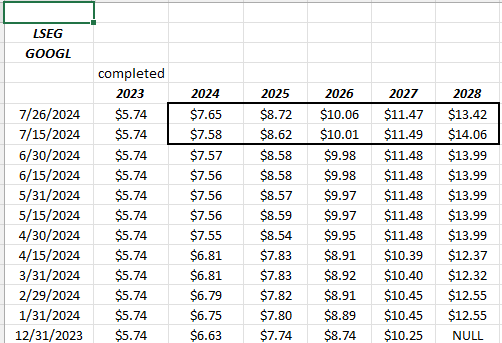

Here’s Alphabet’s (NASDAQ:GOOGL) EPS and revenue revisions following this week’s earnings release:

Source: LSEG I/B/E/S

There is a substantial difference in the stock price action and the EPS estimate revisions.

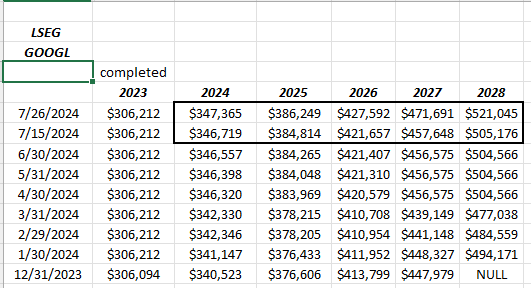

Source: LSEG I/B/E/S

Revenue estimate revisions for GOOGL look healthy too.

The problem for GOOGL is capex: 2023 full-year capex was $32.3 billion, and the expected 2024 full-year capex is on a run rate of $48 to $50 billion.

Conclusion:

Not to bury the lede, but the title statement about “capex is not earnings” means that the increased capex projections we are seeing in the major tech companies, won’t impact earnings per share (EPS), but rather valuation, which is a much bigger issue.

Capex is not run through the income statement, but rather the cash-flow statement, and capex is deducted directly from cash-flow-from-operations, thus valuation is much more heavily influenced by changes to capex (higher capex – cash-flow from operations remaining constant – means free-cash-flow (FCF) is lower, and FCF being a direct input to the discounted cash-flow valuation model) may be what is influencing stock prices currently.

The rub is that heavier investments in capex, are expected to lead to higher revenue in future quarters unless you get diminishing returns from all the major tech companies overinvesting.

Maybe Elon Musk summed it up best this week, in a quote which showed up on one of Bespoke’s Morning Lineup releases:

“They were building a Ferrari for every launch, when it was possible that a Honda Accord may do the trick.”

The “capex factor” is not one regular readers may be familiar with. It’s highly likely that it’s not something widely considered at the retail level of investing.

***

Just thinking out loud. None of this is advice, a recommendation, but only an opinion. Past performance is no guarantee of future results. Investing can involve the loss of principal, even for short periods of time. All EPS and revenue data is sourced from LSEG.