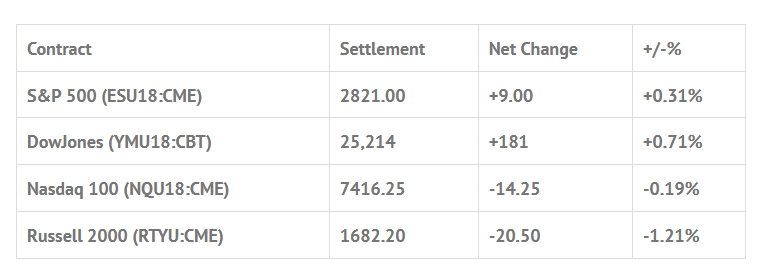

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 8 out of 11 markets closed higher: Shanghai Comp -0.04%, Hang Seng +0.90%, Nikkei +0.46%

- In Europe 9 out of 13 markets are trading lower: CAC -0.05%, DAX -0.63%, FTSE -0.85%

- Fair Value: S&P +0.83, NASDAQ +10.59, Dow -21.01

- Total Volume: 1.34mil ESU & 580 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, New Home Sales 10:00 AM ET, and the EIA Petroleum Status Report 10:30 AM ET.

S&P 500 Futures: ES Flunk At February 2nd 2831 High

Global markets rallied hard Monday night after Google (NASDAQ:GOOGL) reported record earnings. While the S&P did make a new late day high after the report, it really didn’t ‘take off’ until pulling back to 2810.75 just after 2:00 am Monday night, and rallied upto 2824.50.

On the 8:30 CT open the ES traded 2823.50, and then pulled back to 2821.75 in the first 3 minutes. After the early low the ES traded up to 2828.75, pulled back down to 2824.00, and ‘double topped’ at 2831.25 at 9:30. Before the high traded, @Chicagostock posted this:

Chicagostock:(9:13:02 AM):Feb 2nd high 2831

After the high was in I put this out:

Dboy:(9:36:50 AM): been a big stop run

Dboy:(9:43:25 AM): I think the early high is in…

The ES then sold off down to 2820.50. From there, the futures rallied up to 2826.00, pulled back to a higher low at 2821.25, rallied back up to 2827.00, and then broke all the way back back down to 2813.25. After that there was a move back up to a 2818.25 double top, and then back down to a new low at 2812.00 in the late afternoon trade.

The futures stutter stepped back up to the 2818 area as the MiM went from sell $445 million to sell $646 million just before 2:00 CT and then up to 2820.25 at 2:50 CT when the MiM showed over $1 billion for sale. The ES traded 2818.00 on the 2:45 cash imbalance, 2817.00 on the 3:00 cash close, and settled at 2820.50 on the 3:15 futures close, up +9.25 handles, or +0.33% on the day.

Yesterday, I asked in the Opening Print view if they would sell the Google earnings news, and after a big early morning rally the Nasdaq ran out of gas and took the ES for the ride back down. In terms of the ESs overall tone, the markets didn’t act bad, nor was I surprised by the pullback and late uptick. In terms of the days over all trade, volume was 1.32 million ES contracts traded, the most in several weeks. In the end the shorts got squeezed out early and so did the weak longs.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.