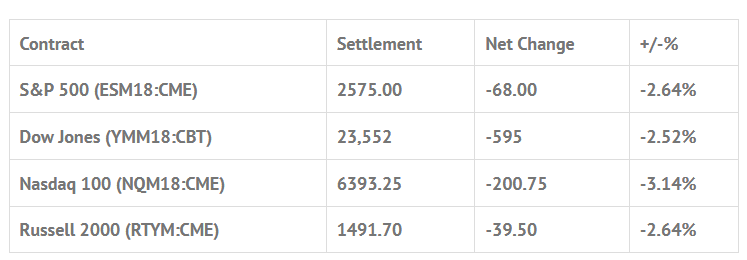

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 9 out of 11 markets closed lower: Shanghai Comp -0.85%, Hang Seng +0.29%, Nikkei -0.45%

- In Europe 12 out of 12 markets are trading lower: CAC -0.50%, DAX -0.92%, FTSE -0.24%

- Fair Value: S&P -0.35, NASDAQ +11.01, Dow -30.92

- Total Volume: 2.3mil ESM, and 923k SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Motor Vehicle Sales, Redbook at 8:55 AM ET. andNeel Kashkari Speaks at 9:30 AM ET.

S&P 500 Futures: Tech Drag Weighs on #ES As China Slaps 25% Tariffs On 120 US Goods

The S&P 500 futures followed the Asian markets lower Monday over global trade concerns and the weak tech sector. The markets were weak in response to U.S. duties on imports of aluminum and steel. China increased tariffs by up to 25% on 128 U.S. products, from frozen pork and wine, to certain fruits and nuts, that took effect yesterday. The tech sector was weak due to Trump’s comments about Amazon (NASDAQ:AMZN).

The first print off Mondays 8:30 futures open was 2632.00. The ES rallied up to 2638.25 and by 10:15 was trading 2589.50, a 48.50 handle drop in the first 45 minutes. After a little up tick and some back and fill, the ES broke through its 200 day moving average at 2587.00 and made a new low at 2572.25. From there, the futures rallied up to 2586.00, and then traded down to a new low 2570.25.

FAANG stocks were getting plastered. Facebook (NASDAQ:FB) closed down $4.52, or -2.83%, Apple (NASDAQ:AAPL) (APPL) closed down $1.43, or -0.85%, Amazon (AMZN) closed down $75.59, or -5.22%, Netflix (NASDAQ:NFLX) closed down $15.27, or -5.17% and Google (NASDAQ:GOOGL) (GOOG) closed down $25.74 or -2.48%.

The ES went on to make another new low at 2568.75 and then traded up to 2588.25. The next move was back down to a new low 2552.00, down 107.75 handles off Friday’s high at 2659.75. The futures then rallied up to 2569.00, pulled back and then double topped at the 2571.00 area, made a high at 2574.25, and sold back off down to 2562.25. After that, there was some short covering up to 2585.00 when the MiM came online showing $1.3 billion to buy. On the 3:00 cash close the ES traded 2581.50, and went on to settle at 2561.00 on the 3:15 futures close, down -61.50 handles, or -2.33%.

In the end, it was a big hot tech mess. It was straight down for most of the day. The markets did short cover late in the day when the MiM started showing big to buy, but fell off again as the buying shrunk on the close.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.