Tech Data Corp. (NASDAQ:TECD) reported fiscal second-quarter 2018 non-GAAP earnings of $1.74 per share, which missed the Zacks Consensus Estimate of $2.06. Moreover, a tepid outlook for the current quarter sent investors’ into panic mode. Shares fell over 19% in the aftermarket session following the quarterly results.

However, revenues of $8.88 billion came in well ahead of the consensus mark of $8.71 billion.

On a year-over-year basis, earnings and revenues grew 22.5% and 39.8%, respectively. The year-over-year sales growth was primarily attributed to strong contribution from the recently acquired Technology Solutions business from Avnet (NYSE:AVT) . Tech Data's net sales increased almost 41% on a constant currency (CC) basis.

Quarter Details

Net sales from the Americas (47% of revenues) surged 57% to $4.2 billion. Sales from Europe (50%) grew 20% to $4.4 billion. Driven by the acquisition of Technology Solutions, revenues from Asia Pacific (3%) came in at $288 million.

The company said it was on track to achieve $50 million in the year from the date of closing of the technology solutions acquisition. It will achieve another $50 million by the second year.

Gross margin expanded 80 basis points (bps) from the year-ago quarter to 5.8%, primarily due to the addition of Technology Solutions.

Non-GAAP selling, general & administrative (SG&A) expense as a percentage of revenues increased 62 bps to 4.37% in the reported quarter.

Non-GAAP operating margin expanded 21 bps to 1.44%. Segment wise, Americas and Europe expanded 57 bps and 18 bps, respectively.

Balance Sheet and Cash Flow

As of Jul 31, 2017, Tech Data had approximately $1.03 million in cash and cash equivalents compared with $2.13 billion as of Jan 31, 2017. In the quarter, cash provided by operations was $146 million. For the first six months, cash flow from operations was $371 million.

Outlook

For third-quarter fiscal 2017, Tech Data forecasts net sales in the range of $9–$9.35 billion. Non-GAAP earnings are anticipated to be in the range of $1.84–$2.04 per share.

The Zacks Consensus Estimate is currently pegged at $2.20 per share on revenues of $8.60 billion.

Zacks Rank & Share Price Movement

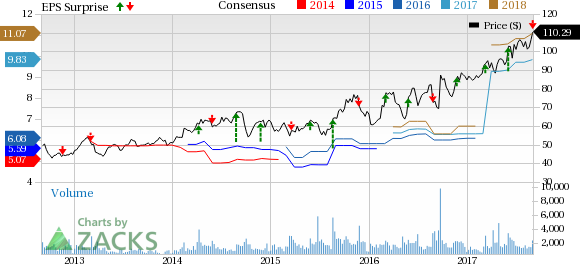

Currently, Tech Data carries a Zacks Rank #2 (Buy). The stock has outperformed the industry on a year-to-date basis. While the stock has returned 27%, the industry gained 24.8%.

Key Picks

Better-ranked stocks in the broader technology sector include Applied Materials (NASDAQ:AMAT) , Activision Blizzard (NASDAQ:ATVI) and Applied Optoelectronics (NASDAQ:AAOI) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings growth rate for Applied Materials, Activision and Applied Optoelectronics is currently projected to be 17.1%, 13.6% and 17.5%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Avnet, Inc. (AVT): Free Stock Analysis Report

Tech Data Corporation (TECD): Free Stock Analysis Report

Activision Blizzard, Inc (ATVI): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post