Omaha, NE-based online brokerage firm, TD Ameritrade Holding Corporation (TO:TD) reported average client trades per day of 514,000 in its activity report for May 2017. The reported figure was up 2% from the prior-month tally and 16% from the year-ago period.

Broker performance is generally measured through monthly average client trades per day. This represents the number of trades from which brokers earn commissions or fees.

As of May 31, 2017, TD Ameritrade reported $872.3 billion in total client assets, up 2% from the prior month and 20% year over year. Average fee-based balances were $190.0 billion, up 2% from the prior month and 18% from the prior-year period. Average spread-based balance of $117.6 billion was up 2% from the prior month and 18% year over year.

Improved Quarterly Performance

During second-quarter fiscal 2017 (ended Mar 31, 2017), average client trades per day increased 2% year over year to 517,000.

As of Mar 31, 2017, net new client assets totaled $19.5 billion, up 38.3% year over year. Total client assets came in at $847 billion, up 19% year over year.

Average spread-based balance was $119.7 billion, jumping 13.1% year over year, and average fee-based investment balance was up 17.8% to $180.4 billion.

TD Ameritrade Poised for Growth

Innovations in online trading, long-term investment in products and services, delivery of advanced customer service, and creative marketing and sales are TD Ameritrade’s key strategies for boosting the trading and investing business.

Further, the company’s association with The Toronto-Dominion Bank (TO:TD) provides an opportunity to cross sell its products. This is anticipated to significantly drive organic growth. Also, its deal in Oct 2016, to acquire Scottrade, is likely to be accretive to EPS in double-digit figure. This deal is also projected to drive annual expense savings of $450 million, with additional $300 million of savings, over the long run.

However, we remain cautious as a persistent rise in expenses and stringent regulations may hurt the company’s financials in the upcoming quarters.

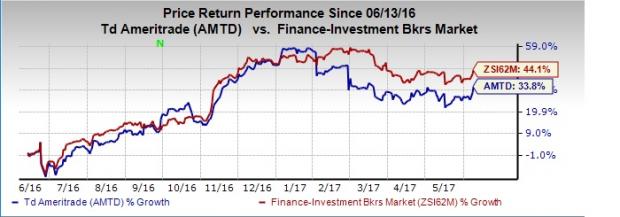

TD Ameritrade’s shares gained around 33.9% over the last one year, as against 44.2% growth recorded by the Zacks categorized Investment Bank industry.

At present, TD Ameritrade carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

.

Among other investment brokers, Interactive Brokers Group, Inc.’s (NASDAQ:IBKR) Electronic Brokerage segment reported a year-over-year increase in Daily Average Revenue Trades (DARTs) for May 2017. Total client DARTs were 675,000, up 5% from May 2016. Similarly, DARTs were up 5% from the prior month. Also, total customer accounts increased 19% year over year and 2% from the prior month to 418,000.

The Charles Schwab Corporation (NYSE:SCHW) is expected to report its monthly metrics later this week.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Toronto Dominion Bank (The) (TD): Free Stock Analysis Report

The Charles Schwab Corporation (SCHW): Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR): Free Stock Analysis Report

TD Ameritrade Holding Corporation (AMTD): Free Stock Analysis Report

Original post

Zacks Investment Research