Over the last 20-plus years, my opinions have aroused emotional reactions from readers and listeners alike. And the forum -- national talk radio, podcast, newspaper, magazine, digital ink -- has been far less critical than the topics themselves.

For example, I was one of a handful of original ETF advocates in the mid-90s when few people valued trade ability/liquidity. I was an “idiot, “jack-ass” and a “hack” for expressing the importance of planning when to sell. After all, if Vanguard’s Bogle and Oprah’s Orman understood that buy-n-hold was the key to financial freedom, what gave me the right to question their wisdom?

Obviously, the dot-com collapse and the mortgage meltdown went a long way toward validating my approach to investing success. Meanwhile, exchange-traded funds went from a pocketful of possibilities to nearly 1500 choices. Are all of the ETFs in existence good for investors? Heck no! Yet the ability to protect against extreme downside losses is now part and parcel of the successful investing discussion.

Fast forward to recent commentary that I offered on Muni Bond ETFs. In it, I explained that fiscal cliff conversation about removing or curbing the tax-exempt status of munis had created a broad-based sell-off in the space. The explanation amounted to a factual observation. I also opined that it is possible that altering the tax-free nature of muni bond interest for the wealthy MIGHT reduce muni demand and cause higher borrowing costs for states/municipalities.

What I regarded as a relatively innocuous thought seemed to stir up a firestorm. E-mails and comments slamming my “partisan politics” poured in. Others defended my commentary as entirely apolitical; still others defended the expression of opinion itself.

Perhaps ironically, my muni-bond piece had neither political agenda nor partisan slant. There may have been a joke or two, but even there, one could have misinterpreted the attempt at humor as “lefty liberalism” or “right wing conservatism.” In reality, I did not lean in any particular direction, but if I had, that would have been my prerogative. I am a money manager, writer and speaker… not a journalist.

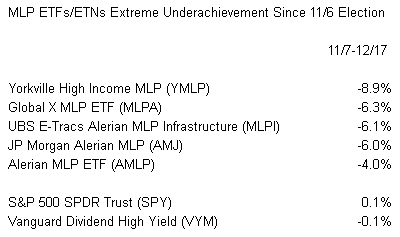

Worst-Performing Asset Class

So here’s a sequel to the previous article. The premise? MLPs are one of the worst performing asset classes since the election for more than dividend tax rate uncertainty alone. Specifically, MLPs have favorable pass-through partnership structures where there are no corporate taxes. It follows that… in the course of looking for more tax revenue from the wealthy… asset classes with favorable limited tax/non-tax structures may be targeted in the same way that asset classes with favorable tax statuses are (Muni Bond ETFs). MLP structure uncertainty as well as dividend tax rate uncertainty are damaging returns.

The wealthiest among us may have taken enormous risks to get to where they are today. On the other hand, most are far more cognizant of the importance of investing in less risky propositions in order to keep the wealth they have attained. While there is a fair degree of comfort in the income stream of dividend aristocrats and other corporations that consistently raise their dividend yield each year, those corporations are not required to pay out a certain percentage of their profits; MLPs distribute the income. More specifically, 90% of a MLP’s income must be derived from specific activities in order to maintain the favorable income tax exempt structure as a pass-through partnership.

Steep Buy In

Understandably, the wealthy may be drawn to MLPs as a means of ensuring an income stream. Moreover, there are few competitors that can enter the pipeline space, other than those companies already participating.

By the same token, the U.S. government is well aware that MLPs are particularly attractive to wealthier investors. And in a political environment where revenue generation looms particularly large, government leaders may look to tax wealthier individuals more on their MLP income; they might even propose a change to the MLP structure itself… the very same way that Canadian Royalty Income Trusts (”CANROYS”) found themselves filing for new tax designations.

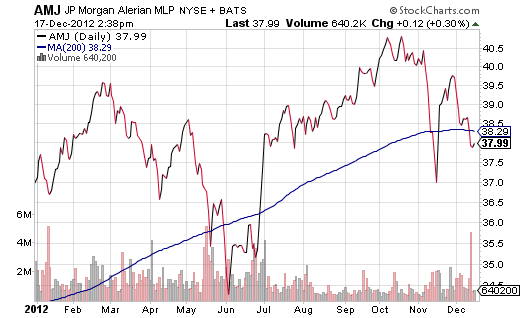

Struggling Against Trendline

In sum, with so many chips on the proverbial table, MLP investors may be selling first and asking questions later. And for the time being at least, MLP ETFs are one of the few asset classes that are struggling below a long-term, 200-day trendline.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Taxing The Wealthy Part II: MLP ETFs Experience A 'Double Whammy'

Published 12/18/2012, 09:00 AM

Taxing The Wealthy Part II: MLP ETFs Experience A 'Double Whammy'

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.