So you thought that the biggest fallout over higher taxes for the wealthy might be the selling of stock assets. Indeed, investors sitting on monster capital gains in Apple (AAPL) have liquidated scores of shares in the culture-changer company.

Yet a wide variety of riskier categories have held up nicely, including high yield corporate bonds, preferred stock, dividend stocks, consumer defensive and consumer cyclical stocks. Any selling in these categories is more attributable to fiscal cliff uncertainty than an actual outcome with higher tax rates for $250,000+ families.

Perhaps ironically, a safer haven area on the risk spectrum has taken a bit of a recent nose-dive. Muni Bond ETFs are experiencing uncharacteristic declines on speculation that U.S. leaders will agree to reduce income tax breaks on muni debt. (Is this what Republicans mean by “closing loopholes?”)

According to John D. McKinnon and Andrew Ackerman of the Wall Street Journal, both political parties consider it reasonable to tax higher-income households on a portion of municipal bond interest. Meredith Whitney’s “default-gate” notwithstanding, all Muni Bond ETF investors are currently suffering the consequences of the proposed changes.

Muni Bond ETFs might have continued notching high after 52-week high were it not for the recent news report. For instance, SPDR Nuveen S&P High Yield Muni (HYMB) had been up 8.3% over 6 months prior to this week; it has since given up -2.3% in the last 5 days.

Keep in mind, part of the muni bond attraction over the last 6 months can be traced to the expectation that tax rates on capital gains and dividends might rise for the wealthy next year. Some folks clearly shifted assets into tax-exempt municipal bonds. Now, that tax-exempt status is under fire.

Will curbing exemptions for muni bond interest on the “wealthy” reduce demand for muni bonds? Will it result in higher borrowing costs for states and municipalities that are already struggling? Quite possibly.

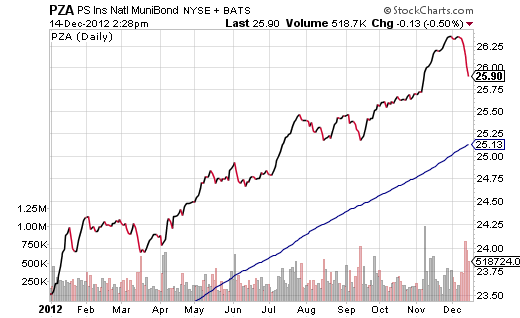

My clients still have an allocation to exchange-traded muni vehicles like PowerShares Insured National Muni (PZA) and iShares S&P National Muni (MUB). Both remain above 200-day moving averages. In essence, it is more sensible to let the market trends aid in decision-making, rather than speculate on how a budget agreement may or may not affect Muni Bond ETFs over the longer-term.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Taxing The Wealthy And The Selling Of Muni Bond ETFs

Published 12/16/2012, 04:03 AM

Taxing The Wealthy And The Selling Of Muni Bond ETFs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.