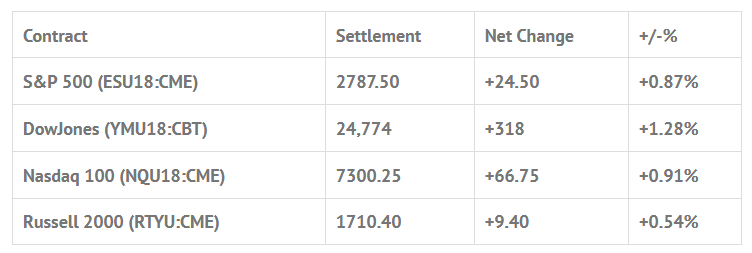

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 8 out of 11 markets closed higher: Shanghai Comp +0.44%, Hang Seng -0.02%, Nikkei +0.66%

- In Europe 12 out of 13 markets are trading higher: CAC +0.70%, DAX +0.66%, FTSE +0.22%

- Fair Value: S&P +2.23, NASDAQ +17.52, Dow -10.63

- Total Volume: 967k ESU & 335 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes NFIB Small Business Optimism Index 6:00 AM ET, Redbook 8:55 AM ET, and JOLTS 10:00 AM ET.

S&P 500 Futures: Bulls Run The Shorts Out, DJIA Up 320 Ponts / DJT Up 214 Points

Mondays trade started with the Shanghai Comp +2.49%, Hang Seng +1.32%, Nikkei +1.21%, the CAC +0.25%, DAX -0.02%, and FTSE +0.28% at midday. The range on Globex for the S7P 500 futures was 2561.75 to 2775.25 with 127,000 contracts traded. The first print off Monday’s futures open was 2773.50.

Just after the open the futures traded up to 2779.00, stutter stepped down to 2772.75 at 9:20 CT, abd then in came a big buy program the pushed the ES up to 2782.75, up +20 handles, going into 10:30. After a couple three and four handle pullbacks the ES traded up to 2785.50. Once the high was in, the ES pulled back down to 2780.75 and then rallied back up to 2784.00 before dropping down to 2779.25. At 1:00 CT total volume was only 670,000.

As the ES moved into the final part of the trading day the futures started to rally into the close, pushing up to 2786.25 just after 2:00 pm, then pulled back to 2782.50 before rallying up to a new high of day of 2787.75 just before the close. At the 3:00 pm the ES printed 2786.50, and then settled the day at 2787.50, up +24.50 handles on the day, or +0.89%.

In the end the bears had their way for several weeks, and now the bulls have gained leadership. When the markets go down like they have been, traders get nervous, they sell the S&P as a spec trade, they sell the S&P as a hedge, and they sell calls. This type of selling can take several days to unwind.

In terms of the days overall tone, the bulls kept things pretty tight with only a few four or five handle pull backs. In terms of the days overall trade, volume was low, only 967k ESU18s traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.