The second quarter ends today and with that we have an opportunity to step back, and look at the bigger picture. With markets trading in such a narrow range for so long we have all become accustomed to magnifying very small moves on charts. They seem bigger because the range has been so narrow for so long. And it is getting many traders and investors worried with every 20bp drop that this may be the big one.

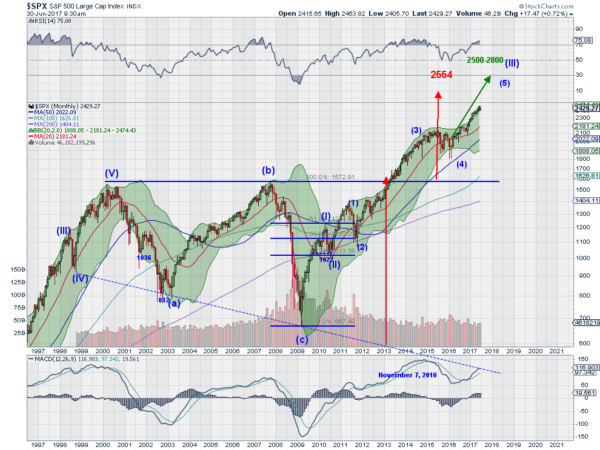

So it can be useful in this environment to step back and take a look at the forest instead of focusing on just one tree, or something like that. Below is my view of the forest for the S&P 500. And it still looks positive. I have posted a version of this chart without comment each week, as part of the week ahead summary. It has been a great guide for many years.

The monthly chart has two major patterns working out. The first is a simple triangle break to the upside. This pattern gives a target to 2554 on the S&P 500, still 100 points above the all time high. The second, an Elliott Impulse Wave, is a bit more complicated. The V Wave pattern started with the low in 2009. It made the smaller I Wave in early 2010 and pulled back to II later that year. Since then it has been building Wave III, typically the largest Wave. At the sub-level down it is building Wave 5 of Wave III, with a target between 2500 and 2800.

Aside from the trend being a continuation higher from a quick view of the price action, momentum also supports continuation. The RSI is strong in the bullish zone. Yes, the S&P 500 pulled back from this level in the RSI in 2000 and 2007. That does not mean it will happen again. 2013 is a good example of that where the peak in momentum worked out in a correction in the S&P over time, not price. The MACD is also climbing. In previous instances of a top it has leveled and started to move lower. No sign of that yet. The big picture looks just fine right now.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.