Synovus Bank, a wholly owned subsidiary of Synovus Financial Corp. (NYSE:SNV) , received the regulatory approval from the Board of Governors of the Federal Reserve System to acquire certain assets and liabilities of World's Foremost Bank. Notably, World's Foremost Bank is a wholly owned subsidiary of Cabela’s Incorporated (NYSE:CAB) .

Per the agreement, announced in April 2017, Synovus will subsequently resell the credit card portfolio to Capital One Financial Corporation (NYSE:COF) upon closure and hold back about $1.2 billion brokered time deposit portfolio. Synovus will receive $75 million from Cabela’s and Capital One.

Earlier, Capital One had entered into a deal to buy the above-mentioned banking unit. However, as the company was undergoing an anti-money-laundering controls’ probe leading to delayed regulatory approvals, the deal was terminated.

Nonetheless, the deal is subject to the completion of the merger of Cabela’s and Bass Pro Shops which has received regulatory approval as well as the nod from Cabela’s shareholders. As per the deal, Bass Pro will acquire Cabela’s for $61.50 per share in cash, representing an aggregate transaction value of approximately $5 billion. The merger is likely to close before Oct 3, 2017.

At the time of announcement of the transaction, Kessel D. Stelling, Synovus’ chairman and CEO, was optimistic as the deal will likely to provide additional liquidity for organic growth. This, in turn, will help the company in achieving long-term targets, which include return on assets of 1% and efficiency ratio to remain lower than 60%.

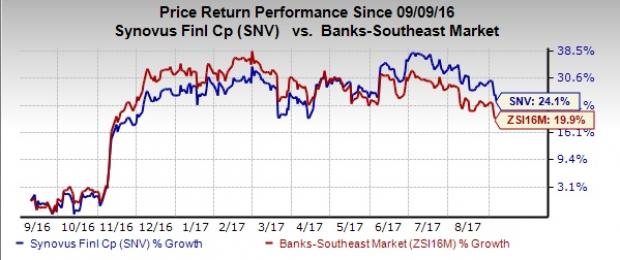

Synovus’ shares gained around 24.1% over the last 12 months as compared with 19.9% growth recorded by the industry.

Currently, Synovus carries a Zacks Rank #3 (Hold).

Of the better-ranked stocks in the space, Green Bancorp, Inc. (NASDAQ:GNBC) is noteworthy. It witnessed upward earnings estimate revision of 18.1% for the current year, in the last 60 days. Moreover, its share price increased 90.8% in the last 12 months. Green Bancorp sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Synovus Financial Corp. (SNV): Free Stock Analysis Report

Green Bancorp, Inc. (GNBC): Free Stock Analysis Report

Capital One Financial Corporation (COF): Free Stock Analysis Report

Cabela's Inc (CAB): Free Stock Analysis Report

Original post