My Swing-Trading Strategy

I came into yesterday with just one long position and I left with just one long position. I made no new trades. The market showed no willingness to commit to a direction and as a result, I stood to the side and let the market play itself out.

Indicators

- Volatility Index (VIX) - Again, much of its gains given up on the day, resulting in only a 2% rally yesterday to 16.31. While the daily chart makes you think it wants to pop, the large upper shadows has me thinking otherwise.

- T2108 (% of stocks trading above their 40-day moving average): Dropped 9% and trading at 38%. Didn't create new lower-lows on the day, but still a very bearish pattern for now.

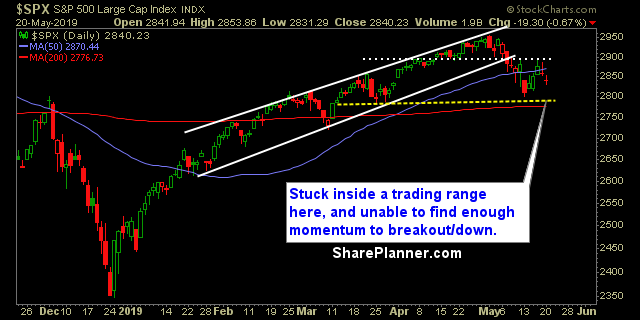

- Moving averages (SPX): Broke below the 5-day moving average. Currently only trading above the 200-day moving average.

Sectors To Watch Today

Mixed bag yesterday with Technology being the main reason for the sell-off at almost 2% lower. Very close to confirming a head and shoulders pattern on the daily. Discretionary very close to establishing a lower-low and lower high. Materials is the worst sector right now in the market with selling for seven weeks straight. Due for a bounce no doubt, but can't seem to catch a bid in order to do so. Energy could finally be setting up for a pop higher.

My Market Sentiment

Low volume price action yesterday told me not to trust the selling early on. Today we have a pre-market pop and I'll be looking to add 1-2 new long positions today if it can sustain the momentum.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 10% Long