My Swing Trading Approach

One additional long position was added to my portfolio yesterday, while taking a 0.7% loss on Eastman Chemical Company (NYSE:EMN). I am open to adding another position today, but I need to see a little more out of my existing positions first.

Indicators

- Volatility Index (VIX) - Broke through the 20-day moving average momentarily, which hasn't really been done at all, of late. But by the close, all the gains, plus an extra 3% was subtracted from the final tally. Closed at 14.70.

- T2108 (% of stocks trading above their 40-day moving average): A little bit of a rollover here on the T2108, as the indicator shed another 2.3% yesterday, to take it to 80%. There's no panic seen, just appears to be a natural pullback for the market as it consolidates a two-month rally.

- Moving averages (SPX): Currently trading above all the major moving averages.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

Financials (NYSE:XLF) still appears ready to push higher here, and Energy (NYSE:XLE) remains in the bull flag pattern. Technology (NYSE:XLK) had a significant dip and bounce to finish the day in positive territory. Utilities (NYSE:XLU) on a 3-day pullback, but that too, looks like a low volume bull flag to watch.

My Market Sentiment

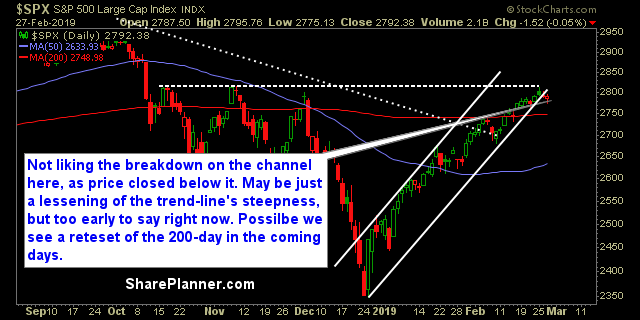

The rising trend-line off of December lows was broken. I don't think this is cause to sound the alarm. I think more importantly it may just be that the trajectory of the current rally has changed in terms of steepness. Potential for further weakness to result in a re-test of the 200-day moving average.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 30% Long.