My Swing Trading Approach

Yesterday, I booked profits in Netflix (NASDAQ:NFLX) for a +1.3% profit and I added one short position to the portfolio, which should play out well at the open of today's market. The dip mentality remains strong in this market, so today will be a key test for it. If a rebound is in the cards, it would make sense to add a new long position to the portfolio as well.

Indicators

- Volatility Index (VIX) - The S&P 500 broke its five day winning streak yesterday, but the VIX still managed to drop further with a 1.22% drop to 15.38. Look for a much needed bounce in this indicator today.

- T2108 (% of stocks trading above their 40-day moving average): A rare day in the red for this indicator of late, as it dropped 1.7% to 85%. Expect some deterioration in it again today.

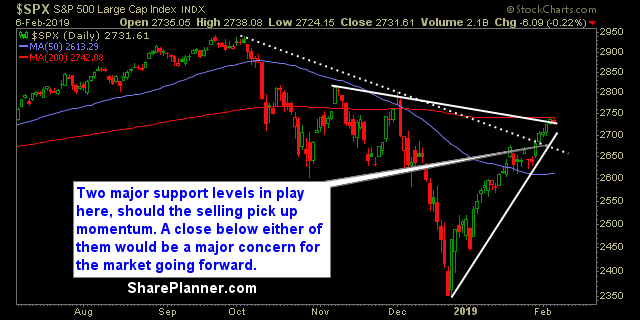

- Moving averages (SPX): Price has hovered just a few points below the 200-day moving average but has yet to actually test it legitimately. Nonetheless, traders seem to be taking profits ahead of a real test and today, we are looking at a potential break of the 5-day moving average as well.

Sectors to Watch Today

Technology (NYSE:XLK) showing relative strength with Industrial (NYSE:XLI) still, but that will be put to the test today with weakness ahead of the bell, while Healthcare continues to pile on the profits and extend its gains for a sixth straight day. Materials (NYSE:XLB) and Energy (NYSE:XLE) worked in lockstep to drag the market lower yesterday.

My Market Sentiment

We are seeing the market deep in the red ahead of the opening bell. There will more than likely be an attempt to buy the dip early on - whether it takes is anyone's guess at this point. A strong day in the red, and without being able to break the 200-day moving average could create a strong technical sell-off, as traders look to book their profits quickly.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 10% Long, 10% Short.