My Swing Trading Strategy

I did not add any new positions yesterday as the market's price action simply didn't warrant it. Instead I raised my stops where I could. I will be open to adding another long position today, but won't hold out hope for it, if the market decides to fade tech strength today.

Indicators

- Volatility Index (VIX) - A 7% rally in the VIX yesterday, which spent most of the day rising, and now testing that stubborn 20-day moving average.

- T2108 (% of stocks trading above their 40-day moving average): Despite breadth on NYSE being quite flat, the T2108 was able to still rise 1% to finish at 65%.

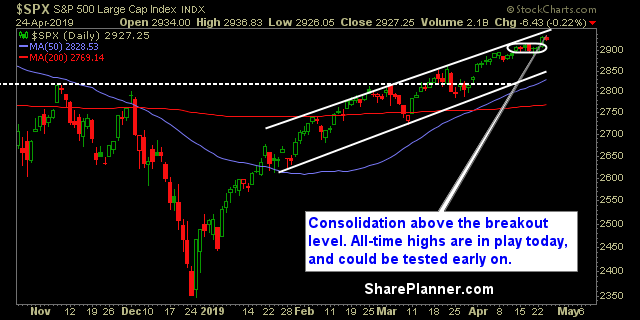

- Moving averages (SPX): Price is trading above all the major moving averages now.

- RELATED: Patterns to Profits: Training Course

Sectors to Watch Today

The only strength in the market yesterday was Real Estate) and Utilities. Technology remained strong, but didn't add anything to its recent gains yesterday. I suspect with Microsoft (NASDAQ:MSFT) and Lam Research (NASDAQ:LRCX) rallying on its earnings that it should help to propel the sector higher.

My Market Sentiment

There was no follow through yesterday, and the low volume remained. However. the lack of major profit taking and a turn lower, keeps the market in play for additional upside and another attempt to take out the all-time highs.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

- 50% Long.