The purpose of swing trading to capture hundreds of 5-20% short-term gains within a year. Short-term means 2-10 days. To capture two hundred 5-20% gainers, we often might need to take four hundred trades because half of them will be losers. The trick is to keep the size of losers small – up to 3-4%.

When we apply an options filter on top of swing trading, its purpose becomes trying to capture hundreds of 100%-1000% short-term gains while risking 0.5% to 2% of our capital on every single one of them. Obviously, about half of them will be losers. When it comes to short-term calls or puts, the risk is often the entire premium.

A typical swing trade lasts two to 10 trading days. There are various swing trade setups. I am not going to go into details here but in most cases we are looking for some form of contraction in an established trend.

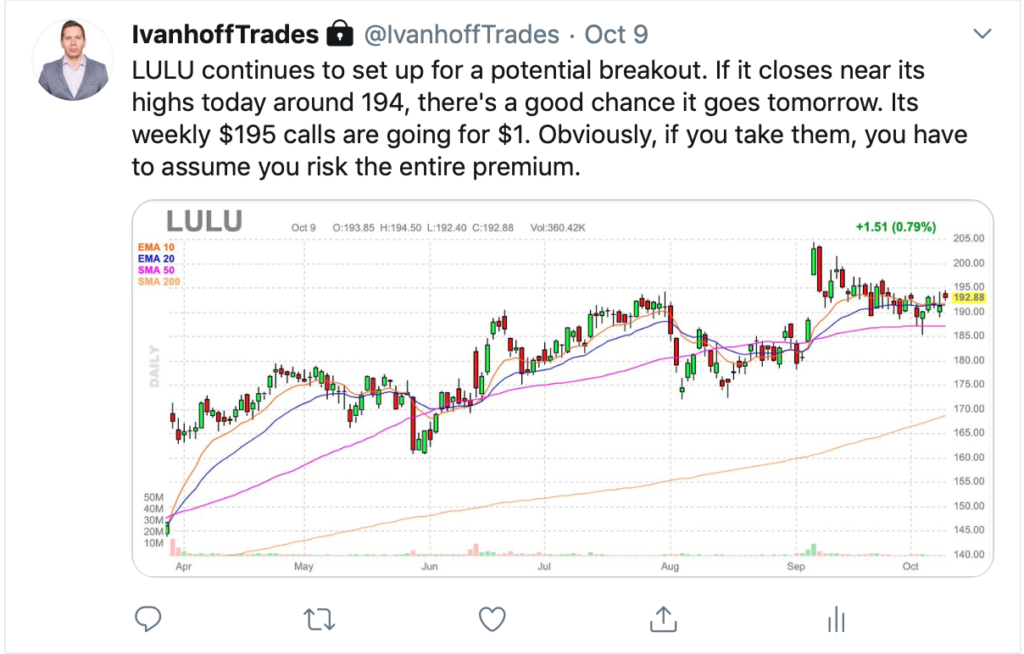

Here’s a recent trade we took. LULU had a big earnings breakouts to new 52wk highs followed by a pullback to its 50-day moving average where it found support. As soon it went above its 20-day EMA and started to consolidate in a tight range, I tweeted the following:

Obviously, you play the same setup with a stock. Buying it in anticipation of a breakout, risking 3 points to potentially make 5 to 10 points. We went with a short-term call option because our risk was better defined (the entire premium) and out upside potential was bigger. The same weekly call that was $1 when I tweeted that message was trading near $7 on its expiration day. Granted, I took profits much earlier (at $3) which is a matter of entirely different discussion (not optimal trade management) but the moral of the story is that short-term options often offer much better risk vs reward than swing stock trades.

Position trading is about capturing bigger moves: 10% to 50% moves (sometimes higher) that require holding a position for multiple weeks, even months. In my experience there are three types of solid position trade setups:

- Finding a theme in the market and exploiting it. There are several distinct themes every year in market and figuring them out in time can be very profitable. Themes persists and can last multiple weeks, sometimes multiple months. For example, two themes have persisted in the past couple of months: homebuilding stocks have been rising as a group and High-momentum software stocks have been demolished due to fear of unsustainable valuation.

- Huge-volume breakout to new 50-day high. I am talking 5x, 10x, 20x and higher than the average daily volume that leads to a 10%+ daily gain. There’s typically a clear catalyst behind the move – an earnings report, FDA approval, new contract, etc. Many of the best performing stocks in any given year start their moves with a huge-volume earnings breakout. Finding them is not hard. Riding them is what’s the biggest challenge for many because short-term 10-20% gains are too tempting for many and they never give their stocks a chance to double. Also, going through deep 20% drawdown is too scary for most people and bigger gains in individual stocks require bigger drawdowns.

- Buying after a major market correction: 15-20% correction for the S&P 500 or the Nasdaq 100. Two types of stocks outperform significantly after a major market correction:

a) The stocks that go hit the worst – typically recent IPOs with small float that went down 50-90% during the correction. Some of these stocks will double and triple within a quarter of the correction bottom.

b) The first high-growth stocks that break out to new 52-week highs right after the correction.

We can apply a simple options filter to position trades as well. Since position trades often last multiple week, they require buying longer-term options (at least 2-3-month in duration). Obviously, those options are much more expensive than the weeklies because they have a lot more time value in them. At the end of the day, going with a stock or an option comes down to risk vs reward. If you need to risk 4 points in a stock to potentially make 12 points and you need to pay $6 for a long-term option to potentially make 12, you are better off going with the stock because it offers better risk vs reward (and it is more liquid).

When done correctly, swing trading can compound capital much faster than position trading because there are many more great swing trade opportunities than position trade opportunities in any given year. The challenge for many is that swing trading is a lot more demanding in terms of required efforts, preparation, skills, and time.