There is a really big crisis coming.

Think about it this way.

After 8 years and a 230% stock market advance the pension funds of Dallas, Chicago, and Houston are in severe trouble. But it isn’t just these municipalities that are in trouble, but also most of the public and private pensions that still operate in the country today.

Currently, many pension funds, like the one in Houston, are scrambling to slightly lower return rates, issue debt, raise taxes or increase contribution limits to fill some of the gaping holes of underfunded liabilities in their plans. The hope is such measures combined with an ongoing bull market, and increased participant contributions, will heal the plans in the future.

This is not likely to be the case.

This problem is not something born of the last “financial crisis,” but rather the culmination of 20-plus years of financial mismanagement.

An April 2016 Moody’s analysis pegged the total 75-year unfunded liability for all state and local pension plans at $3.5 trillion. That’s the amount not covered by current fund assets, future expected contributions, and investment returns at assumed rates ranging from 3.7% to 4.1%. Another calculation from the American Enterprise Institute comes up with $5.2 trillion, presuming that long-term bond yields average 2.6%.

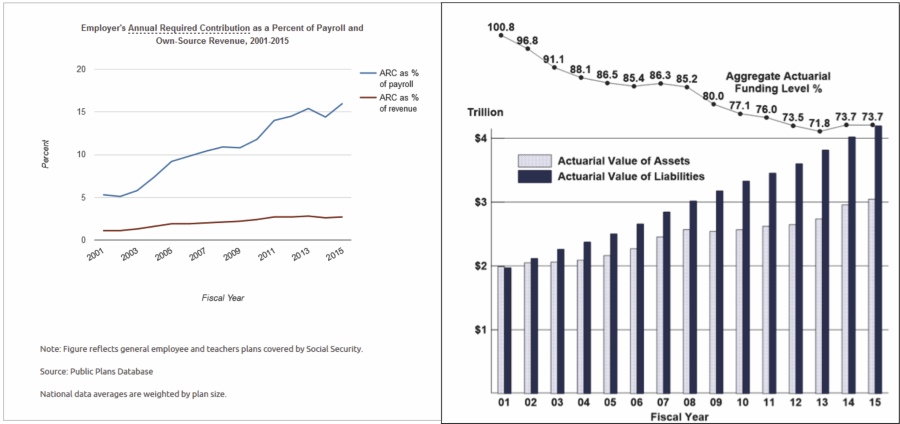

With employee contribution requirements extremely low, averaging about 15% of payroll, the need to stretch for higher rates of return have put pensions in a precarious position and increases the underfunded status of pensions.

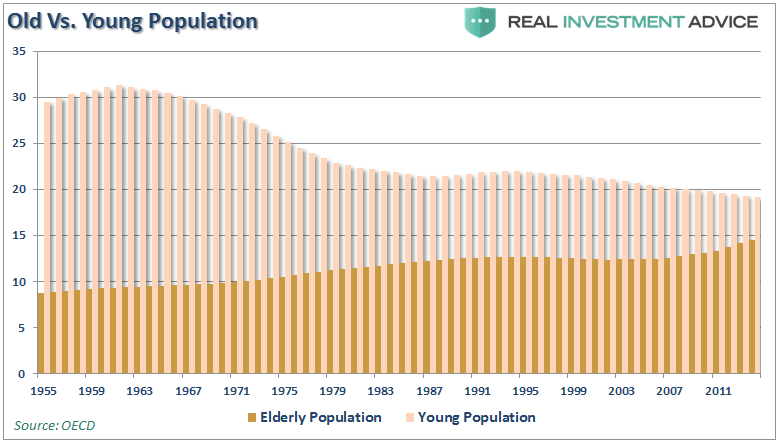

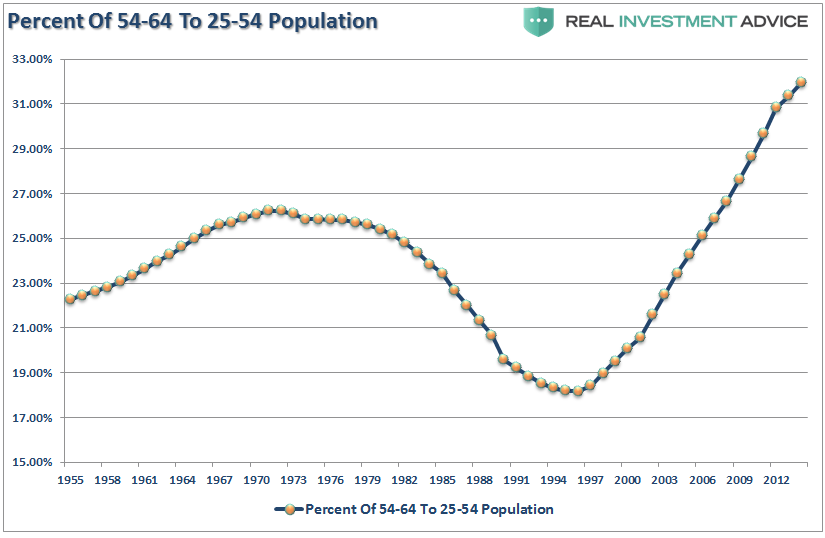

With pension funds already wrestling with largely underfunded liabilities, the shifting demographics are further complicating funding problems.

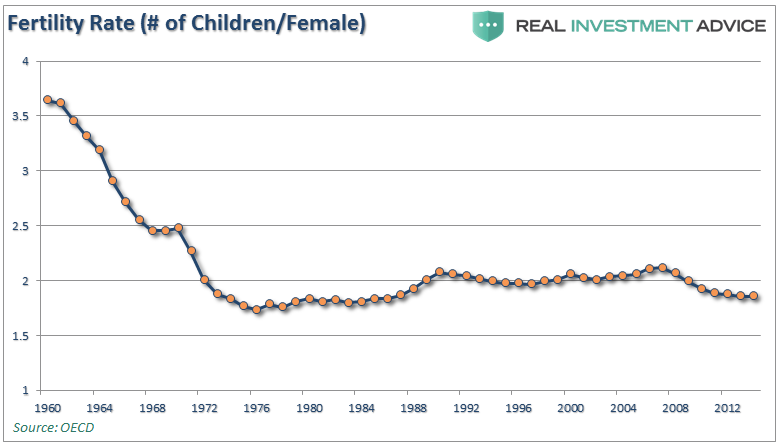

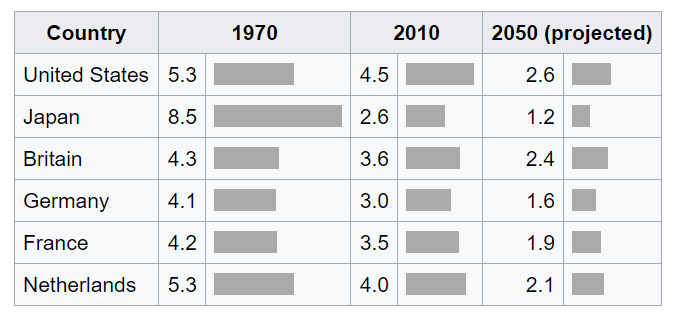

One of the primary problems continues to be the decline in the ratio of workers per retiree as retirees are living longer (increasing the relative number of retirees), and lower birth rates (decreasing the relative number of workers.) However, this “support ratio” is not only declining in the U.S. but also in much of the developed world. This is due to two demographic factors: increased life expectancy coupled with a fixed retirement age, and a decrease in the fertility rate.

In 1950, there were 7.2 people aged 20–64 for every person of 65 or over in the OECD countries. By 1980, the support ratio dropped to 5.1 and by 2010 it was 4.1. It is projected to reach just 2.1 by 2050. The table below shows support ratios for selected countries in 1970, 2010, and projected for 2050:

Of course, as I have discussed previously, the problem is that while the “baby boom” generation may be heading towards retirement years, there is little indication a large majority of them will be actually retiring. With a large majority of individuals being dependent on the pension systems in retirement, the burden will fall on those next in line.

Welcome to the “sandwich generation” when more individuals will be “sandwiched” between supporting both parents and children in the same household. It should be no surprise multi-generational households in the U.S. are at their highest levels since the “Great Depression.”

Market’s Don’t Compound

However, let’s discuss the elephant in the room.

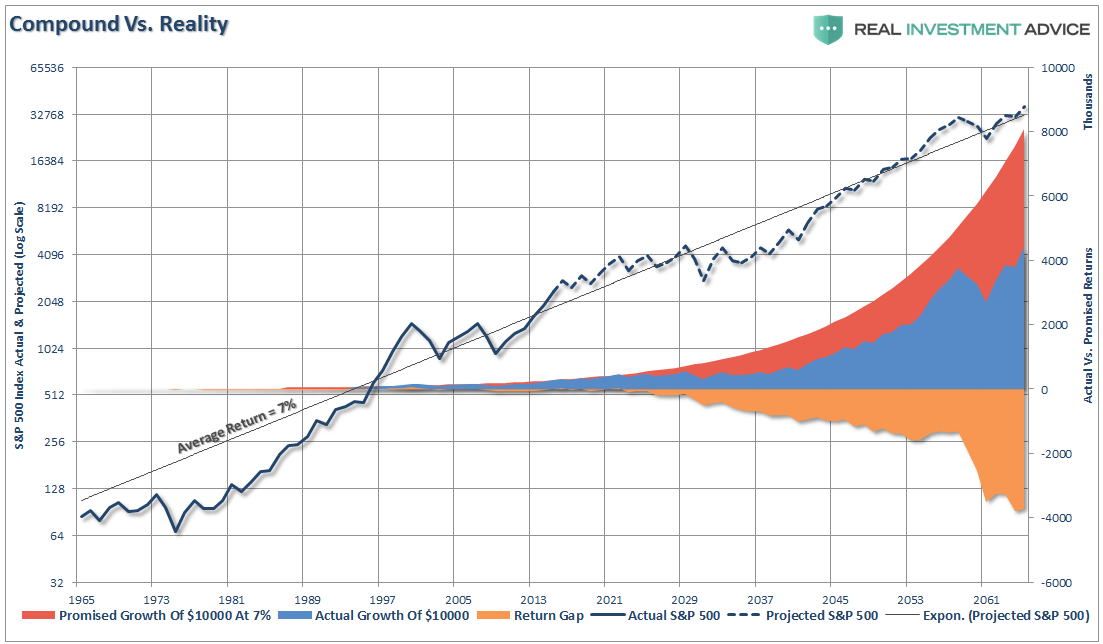

Pension computations are performed by actuaries using assumptions regarding current and future demographics, life expectancy, investment returns, levels of contributions or taxation, and payouts to beneficiaries, among other variables. The biggest problem, following two major bear markets and sub-par annualized returns since the turn of the century, is the expected investment return rate.

Using faulty assumptions is the lynchpin to the inability to meet future obligations. By over-estimating returns, it has artificially inflated future pension values and reduced the required contribution amounts by individuals and governments paying into the pension system.

It is the same problem for the average American who plans on getting 6-8% return a year on their 401k plan, so why save money. Which explains why 8-out-of-10 American’s are woefully underfunded for retirement.

As shown in the long-term, total return, inflation adjusted chart of the S&P 500 below, the difference between actual and compounded (7% average annual rate) returns are two very different things. The market does NOT return an AVERAGE rate each year and one negative return compounds the future shortfall.

This is the problem that pension funds have run into and refuse to understand.

Pensions STILL have annual investment return assumptions ranging between 7–8% even after years of underperformance.

However, the reason assumptions remain high is simple. If these rates were lowered 1–2 percentage points, the required pension contributions from salaries, or via taxation, would increase dramatically. For each point reduction in the assumed rate of return would require roughly a 10% increase in contributions.

For example, if a pension program reduced its investment return rate assumption from 8% to 7%, a person contributing $100 per month to their pension would be required to contribute $110. Since, for many plan participants, particularly unionized workers, increases in contributions are a hard thing to obtain. Therefore, pension managers are pushed to sustain better-than-market return assumptions which requires them to take on more risk.

But therein lies the problem.

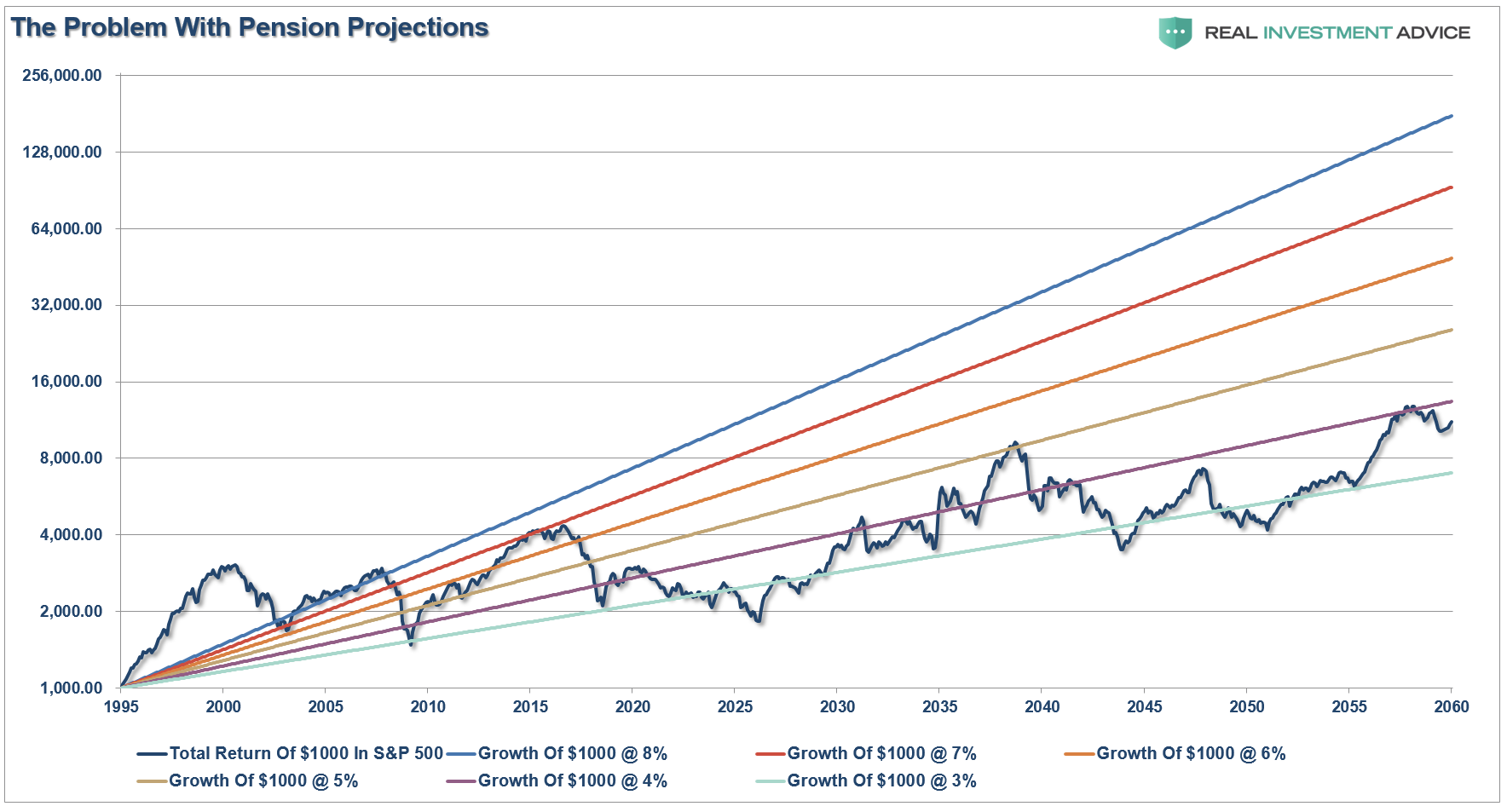

The chart below is the S&P 500 TOTAL return from 1995 to present. I have then projected for using variable rates of market returns with cycling bull and bear markets, out to 2060. I have then run projections of 8%, 7%, 6%, 5% and 4% average rates of return from 1995 out to 2060. (I have made some estimates for slightly lower forward returns due to demographic issues.)

Given real world return assumptions going forward pension funds SHOULD lower their return estimates to roughly 3-4% in order to potentially meet future obligations and regain some solvency.

But we won’t get there.

- This would require a 40% increase in contributions by plan participants which they simply can not afford.

- Given that many plan participants will retire LONG before 2060 there simply isn’t enough time to solve the issues, and;

- The next bear market, as shown, will devastate the plans abilities to meet future obligations without massive reforms immediately.

In a recent note by my friend John Mauldin, he discussed an email Rob Arnott, of Research Affiliates, sent regarding this specific issue.

“Quoting from his letter (in which he assumes the typical 60% equities/40% bonds ratio that most pension funds use), here’s the math:

40% Bonds. Yield is 2% for the US aggregate bond market.

60% Stocks. Our base case is 5.4% for US stocks, but we think valuations are too high, so we trim this to 3.3% for the coming decade.Here’s our logic:

- The yield is 2%.

- Earnings growth over the past century has been 4.5%, of which 3.1% was inflation (real growth of 1.4% … far less than most people realize).

- Inflation expectations are about 2%, so perhaps we should trim this forecast by 1.1%.

- This gives us a base-case of 5.4%.

- Valuation multiples are stretched, with the stock market priced at 25 times the 10-year average earnings, against a historical norm of 16.8x. If we’re back to historical norms in 10 years, that costs us another 4.2%. Since valuation multiples could (a) return to historical norms, or (b) remain at today’s lofty multiples, let’s split the difference, and trim our return expectations another 2.1%.

- This gives us a likely outcome of 3.3% from stocks.

If our logic is sound, we earn 0.8% from our bonds (40% allocation x 2% return) and 2% to 3.2% from our stocks (60% x 3.3%, or 60% x 5.4%). Add up the return from stocks and the return from bonds, and we get 2.8% to 4% from our balanced portfolio.

Bottom line … US public service pensions are toast. One of three constituencies gets nailed:

- The taxpayer (keeping in mind that the affluent are mobile!),

- The current and/or future pensioners (keep in mind that private-sector pensions are now far less generous than public pensions … there’s an inequity here!), or;

- The public services that are on offer to our citizenry, net of sunk costs from servicing past generations.

Most likely, it’ll be a blend of the three.”

Exactly right, and the chart above of projected stock market returns agrees with that assumption.

But, we are running out of time.

Currently, 75.4 million Baby Boomers in America—about 26% of the U.S. population—have reached or will reach retirement age between 2011 and 2030. And many of them are public-sector employees. In a 2015 study of public-sector organizations, nearly half of the responding organizations stated that they could lose 20% or more of their employees to retirement within the next five years. Local governments are particularly vulnerable: a full 37% of local-government employees were at least 50 years of age in 2015.

It is no surprise that public pension funds are completely overwhelmed, but they still have not come to the realization that markets do not compound at an annual return of 8% annually. This has led to a continued degradation of funding levels as liabilities continue to pile up.

A bear market is coming which will be the match that lights the fuse.

If the numbers above are right, the unfunded obligations of approximately $4-$5.6 trillion, depending on the estimates, would have to be set aside today such that the principal and interest would cover the program’s shortfall between tax revenues and payouts over the next 75 years.

Again, that ain’t gonna happen.

Which means that when the next major bear market comes growling, the real crisis won’t be secluded to just subprime auto loans, student loans, and commercial real estate. The real crisis comes when there is a “run on pensions” when “fear” prevails benefits will be lost entirely.

It’s an unsolvable problem. It will happen. And it will devastate many Americans.

It is just a function of time.

As George Will recently wrote:

The problems of state and local pensions are cumulatively huge. The problems of Social Security and Medicare are each huge, but in 2016 neither candidate addressed them, and today’s White House chief of staff vows that the administration will not ‘meddle’ with either program. Demography, however, is destiny for entitlements, so arithmetic will do the meddling.

Whatever amount you are saving for retirement is probably not enough.