Last week, Great Britain voted to leave the European Union. Markets across the world panicked.

But if you think this is as bad as it will get... buddy, you ain’t seen nothin’ yet!

Bad as things could get, panics create incredible buying opportunities once they hit a certain level. Personally, I’d look to buy when the S&P 500 gets to the 1,875 to 1,880 level that it likes to scrape its belly on... But that’s just me.

There are clues of much bigger moves afoot if you know where to look. The babbling heads on TV will be the last to know.

Of course, no matter the opportunity, there is always a danger of the whole shebang going Ker-Blooie!

I’m talking about a full-blown global recession. And that case is being made in bonds right now.

Listen to Bonds

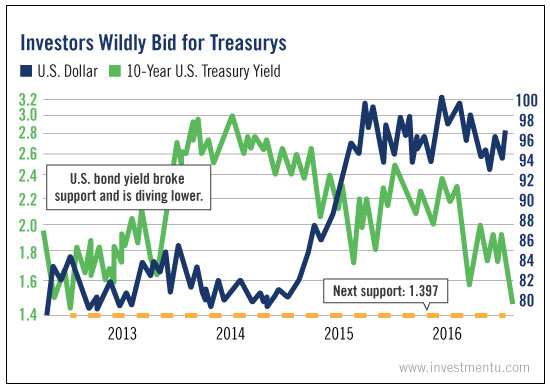

Bonds are an important place to look when the system looks fragile. And this chart tells us all we need to know about bond yields and the dollar:

The yield of the 10-year Treasury note broke below support this week. This tells us that investors are bidding wildly for Treasurys. As the bid (price) goes up, yields go down. And as you can see from this chart, 2012 was the last time yields got this low.

Extreme levels of support in bond yields are going to be tested. If those break, we are in uncharted territory.

Anything can happen.

Meanwhile, the U.S. dollar is going higher. It will probably jump by about 5% - maybe as soon as Q1 of 2017. That’s a big move in currencies.

The dollar will continue to rally - even though the next move for the Fed is “cut.”

That’s right: The rate hike the Fed has loudly been talking about for months is not coming.

Fed Chair Janet Yellen has a knife. Watch her slice and dice.

Debt Crisis Carnage

So why did yields plunge back in 2012? Simply put, there was a debt crisis in Europe. Greece defaulted on its bonds, and several other eurozone states were also unable to pay their debts.

Boy, there were a lot of brown-stained trousers at European banks! The financial system was coming apart at the seams.

In turn, European investors panicked. They sent money to the U.S. by the Airbus-load, in particular buying U.S. Treasurys for safety. The yield on the 10-year note slid as low as 1.397, closing at 1.406 on July 25, 2012.

That was its lowest close ever!

But the bankers didn’t learn a thing. Instead, the European Central Bank papered over the crisis. It slashed interest rates and handed out ultra-cheap loans of more than 1 trillion euros. Yeah, trillion with a T.

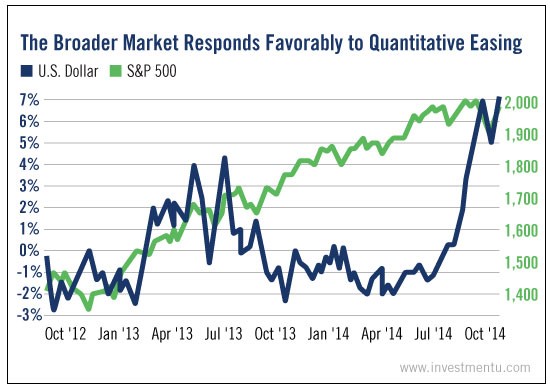

Europe went into recession, which put a drag on the U.S. economy. In September of 2012, the Fed announced a third round of quantitative easing (QE3). Our central bank spent close to $40 billion per month buying mortgage-backed securities. That continued until October 2014.

Holy moly, that’s a load of cash stuffed into bankers’ pockets.

Remember that? Good times, good times. If nothing else, it sure inflated stock prices.

You Brexit, You Bought It

Now, here we are again.

The United Kingdom voted to “Brexit” the European Union. I gave a long explanation at Energy & Resources Digest on what this means. In a weak-growth, high-debt global economy - which is what we have - something like Brexit is enough to start a financial panic.

Again, Europeans are buying treasurys. Again, yields are plunging.

What do you think comes next?

There’s an old saying: “Credit markets are smarter than stock markets.”

It’s not just Europeans buying the bonds that worries me. Economic alarms are flashing here in the U.S.

For example...

- A huge jobs number miss in May. Only 38,000 jobs were added, and sharp downward revisions to previous months’ figures were made.

- Industrial production was down in six of the past eight months.

- Core capital goods orders fell in four of the past six months. The annualized pace is a drop of 8.8%.

Four-fifths of economists surveyed by Reuters expect at least one rate hike (potentially two) this year. That chart of bond yields says those economists are full of you-know-what.

Meanwhile, debt in the nonfinancial sector relative to GDP just hit a record high of 250%. To give you some perspective, at the peak of the last cycle, it sat at 240%.

If the Fed raises rates, many companies won’t be able to pay their debts. Heck, many energy companies can’t even pay their debts now.

What can the Fed do, then? How can it stop a debt implosion? How can it grease the squeaky wheels of the banks in an election year?

The Fed will cut rates. Heck, it might even have to throw money at the market in another round of quantitative easing.

Yellen doesn’t want to cut rates. But her hand will be forced.

How to Play This

Here’s another question for you. What went up 43.47% during the last round of quantitative easing? The answer: The S&P 500.

Yep, the S&P 500 took off like a money-printing rocket.

I threw the U.S. dollar on that chart because it acted counterintuitively. At first, the U.S. dollar lagged - which is no surprise, since the Fed was creating boxcars of money...

But toward the end of QE3, the dollar rallied sharply.

That was a surprise. Then again, maybe the currency markets could see the end was in sight.

To be sure, history doesn’t repeat. But it often rhymes. A difference this time is that gold is seen as a safe haven and a value play by global investors.

Gold also is coming out of a 4 1/2-year-long bear market. The metal is cyclical. A time of easy money combined with a bullish upcycle could be very bullish indeed.

None of this is certain. I’m talking about expectations here. But the credit markets expect the Fed to cut interest rates. I’m not going to argue with that. Especially when there are great ways to make money.