China Automotive Systems, Inc. (NASDAQ:CAAS) , which manufactures and sells automotive systems and components, could be an interesting play for investors. That is because, not only does the stock have decent short-term momentum, but it is seeing solid activity on the earnings estimate revision front as well.

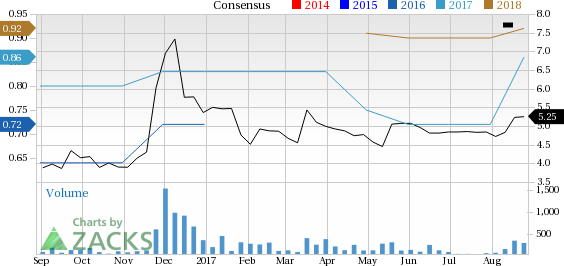

These positive earnings estimate revisions suggest that analysts are becoming more optimistic on CAAS’s earnings for the coming quarter and year. In fact, consensus estimates have moved sharply higher for both of these time frames over the past four weeks, suggesting that China Automotive could be a solid choice for investors.

Current Quarter Estimates for CAAS

In the past 30 days, one estimate has gone higher for China Automotive while none have gone lower in the same time period. The trend has been pretty favorable too, with estimates increasing from 13 cents a share 30 days ago, to 17 cents today, a move of 30.8%.

Current Year Estimates for CAAS

Meanwhile, China Automotive’s current year figures are also looking quite promising, with one estimate moving higher in the past month, compared to none lower. The consensus estimate trend has also seen a boost for this time frame, increasing from 72 cents per share 30 days ago to 86 cents per share today, a move of 19.4%.

China Automotive Systems, Inc. Price and Consensus

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

China Automotive Systems, Inc. (CAAS): Free Stock Analysis Report

Original post